Economics Notes for Chapter 2 National Income Accounting Class 12 - FREE PDF Download

FAQs on National Income Accounting Class 12 Economics Chapter 2 CBSE Notes - 2025-26

1. What is a quick summary of National Income for Class 12 revision?

For a quick revision, remember that National Income (specifically NNP at Factor Cost) is the total monetary value of all final goods and services produced by a country's normal residents during a financial year. It represents the sum of all factor incomes—wages, rent, interest, and profit—earned within and outside the country's domestic territory.

2. How can I quickly revise the three methods of calculating National Income?

To quickly revise the calculation methods, focus on their core components:

- Value Added (Product) Method: Sums up the gross value added by all producing enterprises in the economy. Key formula: GDPMP = GVAMP.

- Income Method: Sums up all factor incomes paid out by producing units. Key formula: NDPFC = Compensation of Employees + Operating Surplus + Mixed Income.

- Expenditure Method: Sums up all final expenditures on goods and services. Key formula: GDPMP = C + I + G + (X-M).

3. What is the core difference between GDP and GNP to remember for revision?

The core difference to remember is their geographical scope. Gross Domestic Product (GDP) measures the value of goods and services produced within the domestic territory of a country. Gross National Product (GNP) measures the value produced by the country's normal residents, regardless of where they are located. The key concept connecting them is Net Factor Income from Abroad (NFIA). Formula: GNP = GDP + NFIA.

4. For revision, what is the key concept to distinguish between Final Goods and Intermediate Goods?

The key concept is the end use of the good. Final Goods are those that have crossed the production boundary and are ready for final consumption or investment (e.g., a car bought by a household). Intermediate Goods are used as raw materials for producing other goods and are still within the production boundary (e.g., steel used to make the car). This distinction is crucial to avoid the problem of double counting.

5. How can I quickly recall the relationship between Market Price (MP) and Factor Cost (FC)?

To quickly recall the relationship, remember that taxes and subsidies create the difference. Market Price (MP) is what a consumer pays, which includes taxes. Factor Cost (FC) is the cost of production factors. The bridge between them is Net Indirect Taxes (NIT), which is Indirect Taxes minus Subsidies. So, the key relationship is: Market Price = Factor Cost + NIT.

6. Why is distinguishing between 'stock' and 'flow' variables a key concept in this chapter?

Distinguishing between these concepts is key because National Income itself is a flow variable. A stock is a quantity measured at a specific point in time (e.g., wealth or capital on Dec 31st). A flow is a quantity measured over a period of time (e.g., annual income or monthly expenditure). Understanding this helps clarify that we are measuring economic activity over an entire year, not just on a single day.

7. For a quick revision, what is the main purpose of calculating Real GDP vs. Nominal GDP?

The main purpose is to isolate the effect of price changes on economic output. Nominal GDP is calculated using current year prices and can increase due to either higher production or higher prices (inflation). Real GDP is calculated using constant base-year prices, so it only changes when the actual quantity of goods and services produced changes. Therefore, Real GDP is a truer indicator of economic growth.

8. What is the concept of 'double counting' and the key principle to avoid it?

The problem of 'double counting' is the error of counting the value of a single product more than once when calculating national income. This happens if we include the value of intermediate goods. The key principle to avoid this is the Value Added Method, where we only sum up the value added at each stage of production, not the total value of output at each stage.

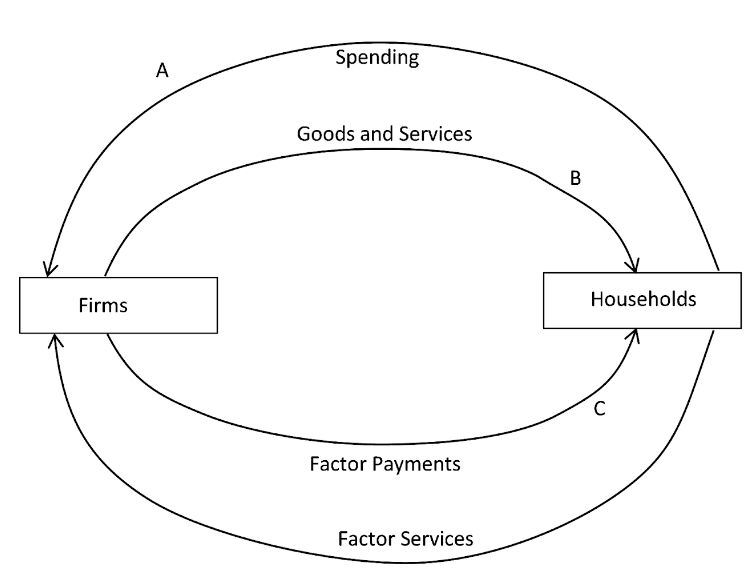

9. What is a quick summary of the Circular Flow of Income in a simple two-sector economy?

In a simple two-sector economy (households and firms), the circular flow shows a continuous movement of money and goods. Households provide factor services (land, labour, capital) to firms and receive factor incomes (rent, wages, interest). Firms use these factors to produce goods and services, which they sell to households, receiving consumption expenditure in return. This creates a circular flow of income and expenditure.

10. What are the key limitations of using GDP as a welfare indicator that I should remember?

For a complete revision, remember these key limitations of GDP as a measure of social welfare:

- Distribution of Income: GDP doesn't show how income is distributed; high GDP can coexist with high inequality.

- Non-Monetary Exchanges: It excludes non-market transactions, like services of a homemaker or barter systems.

- Externalities: It ignores negative effects like pollution or positive effects like public parks, which impact welfare.

- Composition of GDP: It doesn't distinguish between production of welfare-enhancing goods (like schools) and harmful goods (like cigarettes).