NCERT Solutions for Accounts Class 11 (Financial Accounting - Part I and Part II) - FREE PDF Download

FAQs on NCERT Solutions for Class 11 Accountancy 2024-25

1. Distinguish Between Accounting and Accountancy in Class 11 Accountancy NCERT Solutions.

This is one of the most fundamental questions that must be answered so that students aiming to gain knowledge about the subject can understand the difference between the two disciplines. Following are 2 critical points as per the Class 11 Accountancy NCERT Solutions pdf that help to differentiate between the two ideas.

Accounting | Accountancy |

1) Accounting refers to a process of recording, maintaining, and analysing financial transactions. 2) Accounting is a part of Accountancy. | 1) Accountancy refers to the services carried on by an accountant which includes interpreting, analysing, and communicating financial details. 2) Accountancy is a wider concept and includes accounting. |

2. How is the Total Amount of Working Capital and Liabilities Calculated in Class 11 Accountancy NCERT Solutions?

Working capital is the amount allocated to successfully initiate and complete the operations of a listed business organisation. Working Capital of a company refers to the cash and short-term cash equivalents which is used for its everyday expenditure. Liabilities refer to the sum of loans, accounts payable, short, and long-term liabilities taken by the company. In order to efficiently manage the day-to-day operations of a company it is essential that the financial management team strategically allocate the budget and working capital of the firm. The Working capital and liabilities concerned can be identified by applying the below mentioned formulas.

Working Capital = Assets - Liabilities

Liabilities = Assets - Capital

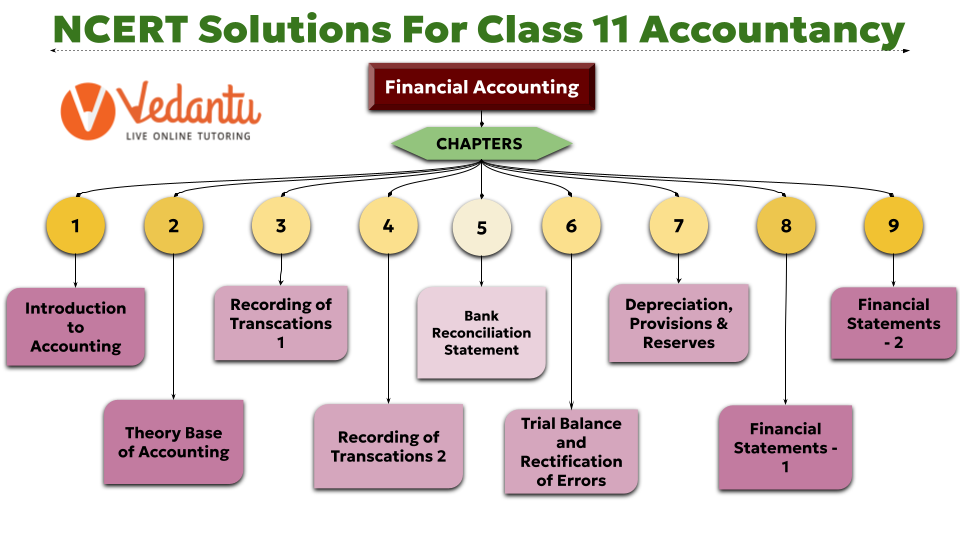

3. What are the chapters in Class 11 Accountancy NCERT Solutions?

There are 15 chapters in the accountancy textbook for Class 11 prescribed by the NCERT. The textbook aims at giving an introduction to all the topics that would be helpful for the students in the future and give them enough practice and extra questions as well. The textbook has enough examples explaining each concept as well. To score good marks, students can also refer to the solutions PDF for CLass 11 Accountancy by Vedantu.

4. What do the two parts of the accountancy textbook cover in NCERT Solutions Class 11 Accountancy?

The NCERT Solutions Class 11 Accountancy is divided into two parts so that the syllabus is consolidated better. Being an introduction to a lot of topics the syllabus may seem extensive. The first part of the textbook covers basic introduction topics like bank reconciliation statements, theory, depreciation, bills of exchange etc. The second part covers topics discussing practical knowledge about how financial statements are formed.

5. What is Depreciation in NCERT Solutions Class 11 Accountancy?

Depreciation occurs when the value of an asset decreases over time. The asset can be fixed assets or goods. These assets include machinery, cars, property etc. This needs to be calculated as it can affect the overall balance sheet of the company or firm at the end of the year. The depreciation occurs due to the wear and tear that may have occurred to the asset over time. It tells us the true financial value of the firm.

6. How can I prepare from the solutions PDF for the final exam for Accounts Solutions Class 11?

The PDF provides an in-depth explanation of all the topics that are covered in the textbook in an easier language so that students of all calibre can understand. It provides solutions to all the questions in both parts one and two of accountancy. The students can refer to these if they need to understand any question. The PDF also has enough questions for the students to practice and revise from.

7. What is the importance of studying Accounts Solutions Class 11?

Studying Class 11 Accountancy is important because it teaches skills like recording transactions, preparing financial statements, and understanding business finances. It helps manage personal and business finances effectively and prepares students for careers in commerce and finance.

8. How can Accounts Solutions Class 11 help in understanding financial statements?

NCERT Solutions provides clear explanations and examples that simplify complex financial statements. By practising these solutions, students can learn how to interpret income statements, balance sheets, and cash flow statements effectively.

9. Why is it essential to practice NCERT Accounts Solutions Class 11 for partnership firms?

Practicing NCERT Solutions for partnership firms helps students understand how partnerships work, distribute profits among partners, and handle legal aspects. It teaches partnership accounting basics, which are crucial for business management.

10. How do NCERT Solutions For Accounts Solutions Class 11 prepare for exams?

NCERT Solutions covers all topics thoroughly and provides practice questions similar to exam formats. Solving these questions helps students understand concepts better, improve problem-solving skills, and boost confidence for exams.

11. Can NCERT Solutions For Accounts Solutions Class 11 improve problem-solving skills in accountancy?

Yes, NCERT Solutions requires students to apply accounting principles to solve problems. By practising these solutions, students learn to analyze financial transactions, calculate profits, and interpret financial data accurately, improving their problem-solving abilities.

12. What are the benefits of using NCERT Solutions For Class 11 Accountancy for financial accounting?

NCERT Solutions for financial accounting explains basic financial concepts clearly, such as recording transactions, preparing balance sheets, and understanding cash flow. These solutions provide practical insights into financial management, useful for personal financial planning and careers in accounting and finance.

13. How can NCERT Solutions for Class 11 Accountancy benefit future career prospects?

Studying NCERT Solutions builds a strong foundation in accounting principles, which are essential for careers in finance, commerce, or entrepreneurship. It prepares students to understand financial statements, analyse business operations, and make informed financial decisions, enhancing their job prospects and career growth.