What is National Debt?

The national debt has long been a contention in US domestic affairs. Given the amount of fiscal stimulus pushed into the US economy in recent years, it is easy to see why many people are paying careful attention to this topic. Unfortunately, how the debt amount is communicated to the general public is frequently opaque. The United States' national debt measures how much the government owes its creditors. Since the government virtually always spends more than it receives in taxes and other revenue, the national debt continues to climb.

Most of the country's debt is issued as treasury or government bonds. Some believe excessive government debt levels will influence economic stability, with repercussions for currency strength in trade, economic growth, and unemployment. Others argue that the national debt is manageable and that citizens should stop worrying.

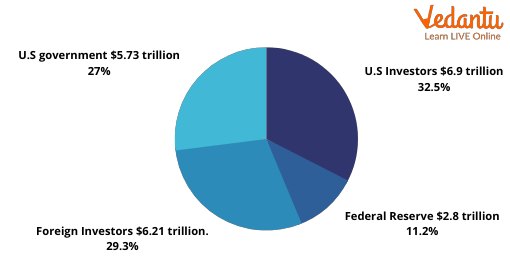

National Debt Pie Chart

Government Debts

A country's central government's entire outstanding debt (bonds and other securities) is represented by public debt, often known as government debt. It's typically expressed as a proportion of GDP (GDP). While internal debt shows the government's responsibilities to domestic lenders, external debt shows its commitments to lenders outside the nation. A government's public debt is an important source of funds for funding public expenditures and closing budgetary shortfalls. The public debt ratio to GDP is frequently used to gauge a government's capacity to pay off future obligations.

What is Government Debt?

The gross government debt (also known as public debt or sovereign debt) of a country is the financial liabilities of the government sector. Government debt changes throughout time reflect mostly borrowing from previous government deficits. A government incurs a deficit when its expenditures surpass its revenues. Government debt may be owed to both domestic and foreign populations. If money is due to foreign people, it is included in the country's external debt.

In 2020, the global value of government debt was USD 87.4 trillion, or 99% of gross domestic output (GDP). Government debt accounted for about 40% of total debt (including corporate and family debt), the largest proportion since the 1960s. The surge in government debt since 2007 is mostly due to the 2007-2008 global financial crisis and the COVID-19 pandemic.

Government Debt Measurement

The gross debt of the general government sector in the form of obligations that are debt instruments is commonly quantified as government debt. A debt instrument is a financial claim that requires the debtor to pay interest and/or principal to the creditor in the future. Debt securities (such as bonds and bills), loans, and government employee pension liabilities are some examples.

The general government includes central, state, provincial, regional, and local governments and social security funds. International comparisons typically concentrate on general government debt because the level of government responsible for programs (for example, health care) varies across countries. According to the Government Finance Statistics Manual 2014 (GFSM), which outlines suggested methodologies for compiling debt statistics to ensure global comparability, the debt of public corporations (such as post offices that offer goods or services on a market basis) is not included in general government debt.

A country's general government debt-to-GDP ratio indicates its debt burden since GDP indicates the value of goods and services produced by an economy over a given period (usually a year). Furthermore, measuring debt as a proportion of GDP allows for comparisons between countries of varying sizes. The OECD considers the general government debt-to-GDP ratio to be an important measure of the sustainability of government finance.

An Overview of US Debt

Since this nation's economic foundation, debt has been a feature of its operations. The national debt did, however, dramatically increase under the administration of President Ronald Reagan, and following administrations have maintained this increasing trend. The U.S. has only temporarily experienced a major decline in debt levels during the height of the economic markets in the late 1990s.

From a public policy perspective, the public normally accepts the issuing of debt as long as the revenues are utilised to boost economic growth to ensure the nation's long-term prosperity. However, the use of debt suffers greatly when money is obtained only for public consumption, such as when Medicare, Social Security, and Medicaid funds are used. Current and future generations benefit when debt is utilised to finance economic growth. Debt used to finance spending, however, only benefits the current generation.

US Debt

Analysis of the National Debt

Debt must be quantified accurately to communicate the long-term impact it poses since it is so essential to economic growth. Unfortunately, comparing the nation's national debt to its gross domestic product (GDP) is not the most effective method. Here are three reasons why this method of determining debt should not be used.

Paying Off the National Debt

Although there is a correlation between the two, the national debt must be paid back through tax revenue, not GDP. Using a method that focuses on the national debt per capita basis provides a far better picture of the country's debt situation.

For example, if people are told that their debt per capita is reaching $90,000, they are more likely to understand the gravity of the situation. However, if they are told that the national debt is approaching 122.5% of GDP, the gravity of the crisis will be misrepresented.

Comparing the national debt to GDP is analogous to comparing one's debt to the value of the goods or services produced by one's employer in a given year. This is not how one would create their budget or how the federal government should analyse its budgetary operations.

The National Debt Has an Impact on Everyone

Given that the national debt has lately expanded faster than the American population, it is reasonable to question how this expanding debt impacts ordinary people. While it may not be clear, national debt levels have at least five direct consequences for people.

First, as the national debt per capita grows, the government may default on its debt payment obligations, requiring the Treasury Department to boost the return on newly issued securities to attract new investors. Because more tax income must be paid out as interest on the national debt, the tax revenue available for other public services is reduced. As financing for economic development projects becomes more onerous, this change in spending will cause individuals to have a poorer quality of living over time.

Second, when the yield on government securities rises, firms in the United States will be perceived as riskier, necessitating an increase in the yield on freshly issued bonds. As a result, firms will have to raise the prices of their goods and services to cover the increasing cost of debt servicing. This will drive individuals to pay more for products and services over time, resulting in inflation.

Third, if the yield on government securities rises, so will the cost of borrowing money to buy a house because the cost of money in the mortgage lending market is closely related to the Federal Reserve's short-term interest rates and the yield on treasury securities. Given this established interdependence, an increase in interest rates will cause home prices to fall because prospective home buyers will no longer be able to qualify for a large mortgage loan because they will have to pay more of their money to cover the interest expense on the loan they receive. As a result, property values will continue to fall, reducing the net worth of all homeowners.

Fourth, because the yield on US Treasury securities is now regarded as a risk-free rate of return, riskier assets such as corporate debt and equity investments would lose appeal when the yield on these securities rises. This issue is a direct outcome of the fact that it will be increasingly difficult for companies to produce enough pre-tax revenue to give a high enough risk premium on their bonds and stock dividends to justify investing in their firm. This issue is known as the crowding out effect, which tends to stimulate the government's development while simultaneously reducing the size of the private sector.

Fifth, and probably most crucially, as a country's danger of defaulting on its debt payment obligations rises, so does its social, economic, and political influence. As a result, the national debt becomes a national security concern.

Conclusion

The national debt is one of the most serious public policy challenges. When handled correctly, debt may be used to promote a country's long-term growth and prosperity. However, the national debt must be evaluated appropriately, for example, by comparing the amount of interest paid to other public expenses or by comparing debt levels per capita basis.

FAQs on Understanding National Debt: Causes and Effects

1. What is national debt in the context of Class 12 Economics?

National debt, also known as public debt, represents the total amount of money that a country's central government has borrowed over time and has not yet repaid. It is the cumulative sum of all past government deficits. This debt is incurred to finance public expenditure when tax revenues and other incomes are insufficient.

2. What are the primary causes for the accumulation of a country's national debt?

The national debt of a country primarily accumulates due to the following reasons:

- Persistent Budget Deficits: When government expenditure consistently exceeds its revenue, it borrows to cover the shortfall, adding to the debt each year.

- Developmental Activities: Governments borrow heavily to fund large-scale infrastructure projects like highways, ports, and power plants to boost economic growth.

- Social Welfare Programs: Expenses on subsidies, healthcare, education, and social security schemes often contribute to borrowing.

- Low Tax Revenue: A low tax-to-GDP ratio or inefficient tax collection can lead to a revenue shortfall, forcing the government to borrow.

- Unforeseen Events: Crises such as wars, natural disasters, or economic recessions require significant unbudgeted spending, which is often financed through debt.

3. What are the main effects of a high national debt on an economy?

A high national debt can have several significant effects on an economy:

- Higher Interest Payments: A large portion of government revenue is used to pay interest on the debt, leaving less money for essential public services.

- Crowding Out Effect: Government borrowing can increase interest rates, making it more expensive for private businesses to borrow and invest, thus 'crowding them out' of the market.

- Inflationary Pressure: If the government finances its deficit by borrowing from the central bank (deficit financing), it can lead to an increase in the money supply and cause inflation.

- Burden on Future Generations: The current generation benefits from debt-financed spending, but future generations are burdened with the responsibility of repaying the principal and interest.

4. How is national debt different from a fiscal deficit?

The key difference between national debt and a fiscal deficit lies in their nature as 'stock' and 'flow' variables. A fiscal deficit is a flow concept, representing the shortfall in government income compared to its spending for a single financial year. In contrast, national debt is a stock concept, representing the total accumulated and outstanding borrowings of the government up to a specific point in time. Essentially, the deficits of many years add up to become the total national debt. For more details, you can explore the concepts in the notes on Government Budget and The Economy.

5. Can you provide a simple example of how national debt accumulates?

Imagine a government has a total revenue of ₹100 crore in a year but its total expenditure is ₹120 crore. To cover the shortfall, it incurs a fiscal deficit of ₹20 crore and borrows this amount. This ₹20 crore is added to the country's national debt. If the country already had an existing debt of ₹500 crore, the new total national debt at the end of the year would be ₹520 crore. This process, repeated over many years, causes the national debt to accumulate.

6. Is all national debt considered harmful to a country's economy?

Not necessarily. The impact of national debt depends on how the borrowed funds are used. If the government borrows to invest in productive assets like infrastructure, education, and technology, it can boost the country's long-term economic growth and productive capacity. This is often seen as beneficial debt. However, if the debt is used to finance non-productive consumption expenditure or just to pay off old loans, it can become a burden without creating future income, making it harmful to the economy.

7. Why is the debt-to-GDP ratio more important than the absolute value of the national debt?

The debt-to-GDP ratio is a more meaningful indicator of a country's financial health than the absolute debt figure. It compares the total national debt to the country's total economic output (Gross Domestic Product). A high ratio suggests that a country might not be producing enough to repay its debts. For example, a debt of $1 trillion is a much larger problem for a country with a GDP of $1 trillion (100% ratio) than for a country with a GDP of $20 trillion (5% ratio), as the latter has a much stronger capacity to service its debt.

8. What is the difference between internal debt and external debt?

National debt is composed of two main types:

- Internal Debt: This is the portion of the government's debt that is owed to its own citizens, banks, and institutions within the country. It is denominated in the domestic currency.

- External Debt: This is the portion of the debt owed to foreign creditors, which can include foreign governments, international organisations (like the World Bank or IMF), and foreign private investors. It is often denominated in foreign currencies.

9. How can a large and persistent fiscal deficit lead to a 'debt trap'?

A 'debt trap' is a vicious cycle where a country is forced to borrow more money just to pay the interest on its existing loans. This happens when the government's debt grows so large that the interest payments consume a significant portion of its revenue. To meet these interest obligations and other expenses, the government takes on new loans, which further increases the total debt and future interest payments. This situation can lead to a sovereign debt crisis if unchecked. Understanding the Primary Deficit is key to analysing this risk, as it shows the borrowing requirement of the government, excluding interest payments.

10. What are some specific factors that have contributed to India's national debt?

Several specific factors have contributed to India's national debt over the years, in line with the country's economic priorities and challenges. Key contributors include:

- High Fiscal Deficit: Historically, government expenditure has often surpassed revenue, leading to consistent borrowing as seen during the economic reforms of 1991.

- Subsidies: Significant government spending on subsidies for food, fuel, and fertilisers to support vulnerable populations.

- Infrastructure Development: Massive investments in projects like roads, railways, and energy to fuel economic growth.

- Defence Expenditure: Consistently high spending on national security.

- Interest Payments: A substantial part of the budget is allocated to paying interest on past borrowings, contributing to the cycle of debt.