Financial Management

One of the essential requirements for starting any business is financing. Furthermore, throughout a company's existence and even after it is sold or wound up, a sufficient collection of funds and effective financial management are needed. Therefore, at every stage of the business lifecycle, funds must be managed and regulated. Features of Financial management involve planning, organising, directing, and controlling the business's financial activities, such as procurement and utilisation of funds.

Financial Planning

Functions of Financial Management

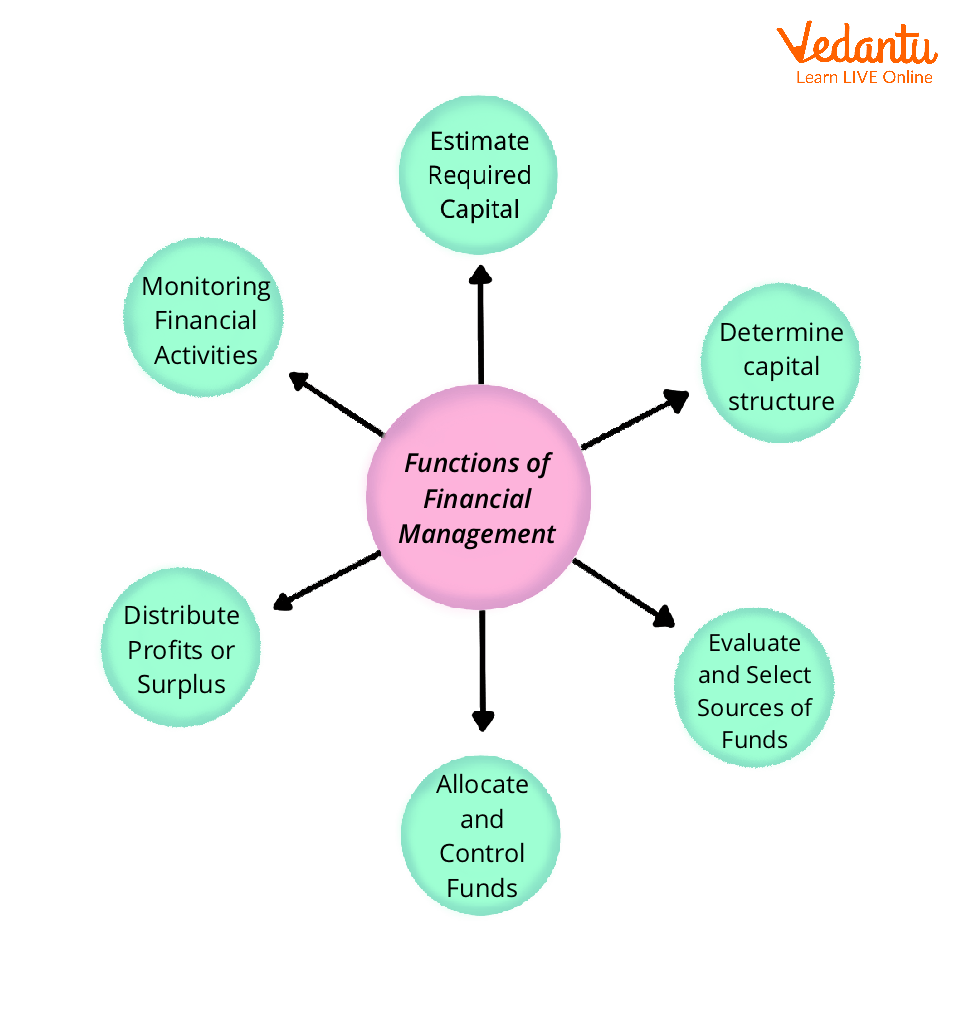

Financial management is essential for properly and efficiently managing financial resources. Financial management functions ensure that the appropriate amount of funds is available when needed for a business. These functions range from the acquisition of funds to their proper and effective utilisation. So, here are various functions of Financial Management:

Functions of Financial Management

Determine the Capital Requirement: The first function of a financial manager is to estimate the total capital required by the business to fulfil its mission and objectives. The amount of capital required is determined by several factors, including the size of the business, expected profits, company programmes, and policies.

Establish the Capital Structure: After estimating the required capital, the structure must be determined. Short-term and long-term equity is used in the structure. It will also determine how much capital the company must own and how much must be raised from outside sources, such as IPOs (Initial Public Offerings), and so on.

Determine the Funding Sources: The next financial management function is to determine where the capital will come from. The company may decide to take out bank loans, approach investors for capital in exchange for equity, or hold an IPO to raise funds from the public in exchange for shares. The source of funds is chosen and ranked based on the benefits and limitations of each source.

Fund Investment: Another function of financial management is deciding how to allocate funds to profitable ventures. The financial manager must calculate the risk and expected return for each investment. The investment methods must also be chosen so that there is minimal loss of funds and maximum profit optimisation.

Implement Financial Controls: Controls can take the form of financial forecasting, cost analysis, ratio analysis, profit distribution methods, and so on. This information can assist the financial manager in making future financial decisions for the company.

Mergers and Acquisitions: They both are one method of business growth. Buying new or existing businesses that align with the buyer company's mission and goals is referred to as an acquisition. A merger occurs when two current companies combine to form a new company. One of the responsibilities of a financial manager is to assist in the merger and acquisition decision by carefully examining the financials and securities of each company.

Work on Capital Budgeting: Capital budgeting refers to decisions made regarding the purchase of assets, the construction of new facilities, and the investment in stocks or bonds. Prior to making a significant capital investment, organisations must first identify opportunities and challenges.

Roles of Financial Management

Financial Planning: The planning of financial activities and resources in the organisation plays a critical role in financial management. To that end, they use available data to understand the establishment's needs and priorities, as well as the overall economic situation, and create plans and budgets for the same.

Utilising and Allocating Financial Resources: Financial management makes sure that all of an organisation's financial resources are utilised, invested, and managed profitably, sustainably, and feasibly over the long term. Due to the intense competition that exists among businesses, finance directors must make sure that the money they own is being used as efficiently as possible.

Financial Reporting: Financial management keeps track of all relevant financial reports for the company and uses this information as a database for forecasting and planning financial activities. For all organisations, reporting is a crucial task. It provides information about the company's performance and financial position. This is typically carried out on a quarterly or annual basis.

Management of Risk: A company that practises sound financial management is best prepared to anticipate risks, implement mitigation strategies, and deal with emergencies and unforeseen risks. There are risks in every business. For example, sales can suddenly decline due to market conditions, taxes could be made heavier by government policies etc., or internal problems like equipment failures cause problems for businesses. Depending on how serious they are, risks must be identified, evaluated, and action plans must be developed.

Mean of Financial Management Types

The mean of financial management types are as follows:

Strategic Financial Management: It refers to the management of a company's finances with the intention of success, i.e., the achievement of the company's long-term goals and objectives and the long-term maximisation of shareholder value.

The goal of strategic financial management is to generate long-term business profits.

For stakeholders, it aims to maximise return on investment.

A strategic financial plan prioritises long-term gain.

Every company, sector, and industry has a different approach to strategic financial planning.

Tactical Financial Management: In a business setting, tactical management allows a manager to select the best tactics or methods for each situation that arises, rather than following a specific standard procedure.

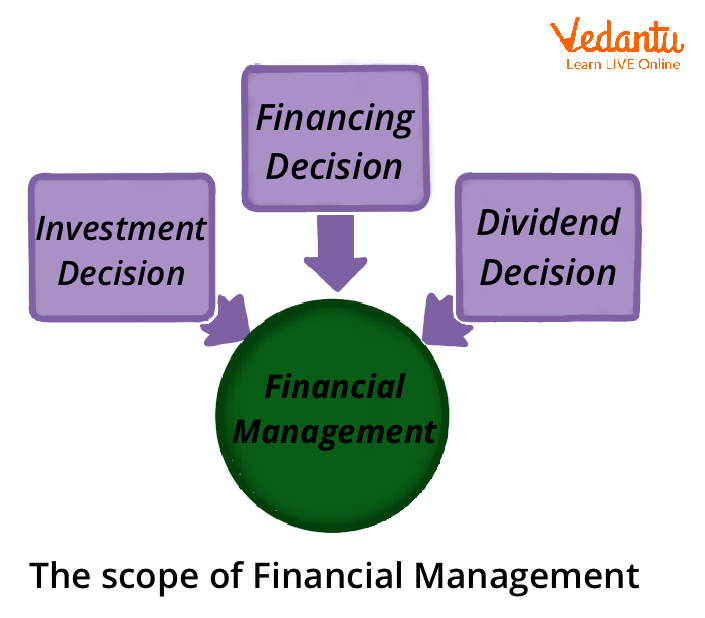

How different types of financial management decisions are made largely determines how well an organisation's financial report is prepared. Let's look at the three categories of financial management decisions:

Scope of Financial Management

Financing Decision: The amount of money to be raised from various long-term sources of funding, such as equity shares, preference shares, debentures, bank loans, etc., is the subject of this financial decision, referred to as a financing decision. In other words, it refers to the company's "capital structure." There are two ways from which finance can be sourced.

Borrowed Fund: It includes Retained Earnings, Bonus, and Share Capital.

Owner’s Fund: It includes Loans, Bonds, and Debentures.

Investing Decision: Investment decisions are those made in regard to how the company's funds are allocated among various assets. Long-term or short-term investment decisions are both possible. Capital budgeting decisions are long-term investment choices that involve large sums of money and are not reversible except at a high cost. Working capital decisions are short-term investment decisions that have an impact on how a business operates on a daily basis. It also includes choices regarding the quantities of cash, inventory, and receivables.

Dividend Decision: Dividend decision is a term used to describe a financial choice regarding how much of a company's profit should be retained for future needs versus distributed to shareholders as a dividend.

The portion of the profit that is distributed to shareholders is referred to as a dividend. The overall goal of maximising shareholder wealth should be considered when making the dividend decision.

Factors Affecting Financial Decision

Cost: The allocation of funds and cost-cutting are the main factors in financing decisions. The costs of obtaining funding from various sources vary. A wise financial manager would typically choose the cheapest source. It is best to choose the source with the lowest cost.

Risk: The risk associated with various sources varies. The finance manager weighs the risk against the cost and prefers securities with a low-risk factor. The risk associated with borrowed funds is greater than the risk associated with equity funds. One of the most important aspects of financing decisions is risk assessment.

Floatation Fees: The higher the floatation fee, the less appealing the source. It refers to the costs associated with the issuance of securities, such as broker commissions, underwriter fees, prospectus expenses, and so on. The higher a source's floatation cost, the less attractive it appears to management.

Market Condition: The market condition is very important for financing decisions. During a boom period, the issue of equity is common, but during a depression, a firm must use debt. These choices are an important part of the financing process.

Tax Rate: Because interest is a deductible expense, the tax rate influences the cost of debt. Because interest is a tax-deductible expense, a higher tax rate reduces the relative cost of debt and increases its attractiveness relative to equity. Debt financing becomes more appealing as the tax rate rises.

Case Study

1. XYZ ltd. is manufacturing automobile parts in its factory. The demand for its automobile parts is increasing, so they are planning to set up a new automobile factory. After evaluation, it will require about Rs 7,000 crores to set up and about crores of working capital to start the new factory.

What are the roles and goals of financial management for this business?

Ans: The roles of financial management for this business will be:

Deciding how much capital the company intends to invest.

Current asset quantity and its division into cash, inventory, and receivables.

The fund is to be required for short-term and long-term financing.

Deciding on fixed capital debt to equity ratio.

The primary goal of the finance manager will be:

To maximise equity shareholders' wealth.

To increase the value of the company over time by developing and implementing financial plans.

Finding opportunities to invest, buy a rival company, or create new products can all contribute to maximising profit.

Conclusion

Because of the importance of finance in business, financial management is always a trending topic in the business world. The goal of forming a company is to make a profit while also operating for many years. However, it is the financial manager's responsibility to ensure that the company's finances are used appropriately.

FAQs on Financial Management Functions: Overview

1. What are the 4 finance functions?

The four main finance functions include:

- Investment decisions

- Financing decisions

- Dividend decisions

- Liquidity management

2. What are the 4 C's of financial management?

The 4 C's of financial management are:

- Cost

- Capital

- Control

- Cash

3. What are the three basic functions of a finance manager?

A finance manager's three basic functions are:

- Planning financial activities

- Controlling financial resources

- Decision-making for investments and funding

4. What are the functional areas of financial management?

The main functional areas of financial management include:

- Capital budgeting

- Capital structure

- Working capital management

- Risk management

5. How does financial management help businesses?

Financial management helps businesses by organizing how money is raised, spent, and saved. It ensures

- proper cash flow

- smart investments

- efficient use of resources

6. What is liquidity management in financial management?

Liquidity management ensures a company has enough cash and assets to pay short-term debts. It is a key function of financial management, helping the business avoid financial distress and run operations smoothly without interruption.

7. Why is capital budgeting important in finance functions?

Capital budgeting is important because it helps businesses decide which long-term projects to invest in. Using financial management tools, companies evaluate expected returns and risks, making sure money is spent on the most valuable opportunities.

8. How does financial control affect an organization's success?

Financial control means monitoring spending and comparing it with budgets. This financial management function helps organizations reduce unnecessary expenses, detect problems early, and make adjustments to meet financial goals, leading to greater success and stability.

9. What is working capital management in financial management?

Working capital management involves balancing a company’s short-term assets and liabilities. Good financial management ensures enough cash for daily operations, timely payments, and healthy supplier relationships, while still earning a return on surplus funds.

10. Why are investment decisions important in financial management?

Investment decisions determine how resources are allocated to assets or projects. Through financial management, organizations aim to choose options that maximize returns and minimize risks, supporting long-term business growth and shareholder value.

11. What role does risk management play in financial management?

Risk management is a function of financial management that identifies and reduces possible financial losses. It involves analyzing uncertainties, using insurance, or diversifying investments to protect a company’s assets and financial health.