Introduction to Business Organisation

A business organisation is an entity created with the intention of conducting a business. These organisations are operated on legal systems that control contracts, exchanges of goods and services, ownership rights, and incorporation.

Managing and planning various activities is a concern of the business organisation system. In order to generate goods and services, resources like labour, equipment, capital, and money must be accumulated and coordinated. The business organisation works to manage and regulate all of these production factors.

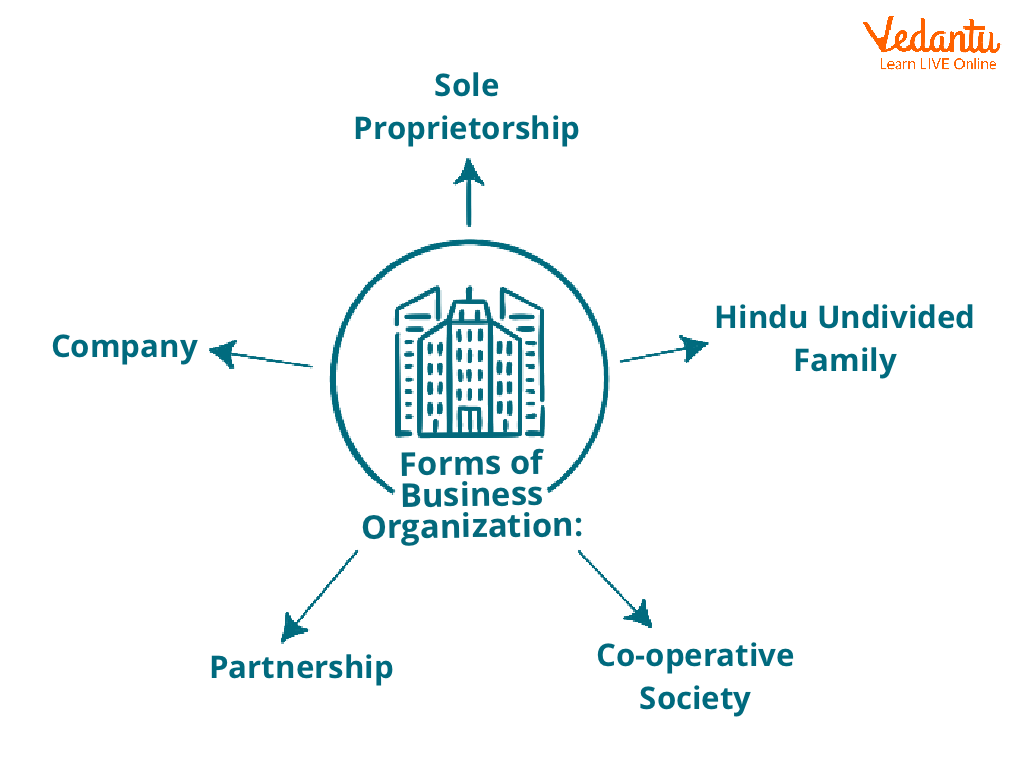

Forms of Business Organisations

Forms of Business Organisation

1. Sole Proprietorship

A sole proprietorship is a form of business in which one individual is in charge of the entire business. The owner of a firm controls every aspect of how it is run and is responsible for all financial obligations and debts.

A sole proprietorship is the least expensive option and relatively simple to set up. It is not governed by a separate law and can easily be formed with only the proper licensing required to operate a business and the registration of the business name.

Merits of Sole Proprietorship

The benefits of being a sole proprietor are numerous. The following are a few of the significant ones:

A sole proprietor has a great deal of freedom in doing business. This results in quick and inexpensive decision-making.

A sole proprietorship can be easily formed or closed, as there are only a few legal requirements.

The capital requirement to set up a sole proprietorship is generally low and least among all forms of business.

Demerits of Sole Proprietorship

Despite its many benefits, the sole proprietorship business structure has limitations. The following are some significant demerits of a sole proprietorship business structure:

The resources of a sole proprietor are limited to his savings and the money he can borrow from others. The lack of resources is one of the key causes of the business's typically limited size and lack of significant growth.

A significant demerit of the sole proprietorship is the unlimited liability of the sole proprietor. In the event of business failure, the owner has to bear a heavy financial burden.

2. Partnership

A partnership is when two or more people work together to conduct a business. Each partner contributes their fair share of money, assets, labour, and experience and expects to earn money from the firm.

There are different types of partnership firms, including general partnership, limited partnership, LLP partnership, and limited liability partnership (LLP) firms.

This form of organisation is governed by the Partnership Act, of 1932. A partnership deed is drafted by the partners to establish a partnership firm. This deed contains information like the profit sharing ratio, capital contribution by each partner, the purpose of the partnership, etc. The number of people is limited to a maximum of 10 for banking businesses and 20 for other businesses.

Merits of Partnership

The following are some merits of partnership firms:

One of the major advantages of a partnership firm is increased resources. A prospective partner will bring not only more capital but also expertise and connection, which can help the business.

Compared to sole proprietorship, the decisions taken by the partners would be more balanced.

The legal obligations for forming a partnership are minimal, and the process of registration is relatively easy.

All of the partners in a partnership firm share the risks associated with running the business. As a result, each individual has less stress, anxiety, and pressure.

Demerits of Partnership

Some of the drawbacks of a partnership firm are:

Conflicts could arise because the partnership is operated by a group of people with shared decision-making authority. Disagreements between partners may result from different perspectives on some problems.

Another drawback of this form of business is the unlimited liability of partners. The liability of partners is joint and several, i.e., if one or more partners are unable to pay their part of the debt, the others are liable to repay the full amount.

3. Joint Stock Company

A company is an organisation of people created for the purpose of conducting business activities and has a legal existence separate from that of its members. The statute governing this form of organisation is the Companies Act, 2013.

A company is an artificial person with a separate legal entity and perpetual succession. The company is managed by a Board of Directors and management, whereas shareholders are the owner of the company.

Merits of Joint Stock Company

Some major advantages of a joint stock company are:

Unlike other different forms of ownership, the liability of owners (shareholders) is limited to the extent of shares held by them.

The perpetual existence of the company allows it to take on long-term projects and also serves as a strong incentive for creditors and investors to engage in the company.

The company's large operation would lead to the realisation of economies in purchasing, management, distribution, or selling. The consumer would receive things at a lower cost thanks to these economies.

A significant number of people belong to a company. The company's members share the business risk in different ways. Small investors are encouraged to invest as a result.

Demerits of Joint Stock Company

Some major disadvantages of a joint stock company are:

There are numerous legal formalities and processes necessary for the formation of a company which results in incurring huge costs and time.

In a company structure, salaried employees or executives who have no personal stake in the business are responsible for day-to-day operations. This could result in inefficiencies and lower employee motivation.

Statutory limitations on meetings, voting, audits, and other internal operations of the firm apply. Therefore, due to complex legal requirements, starting and maintaining a business would prove to be difficult and burdensome.

4. Joint Hindu Family Business

It is also known as the Hindu Undivided Family (HUF) business. A business that is owned and managed by the Hindu undivided family is referred to as a Joint Hindu Family business. Birth in a particular family serves as the prerequisite for membership in the business.

The family head, known as Karta, is the oldest member and is in charge of the company. All members have an equal ownership interest in an ancestor's property and are known as co-parceners.

Merits of Joint Hindu Family Business

The following are some benefits of a joint Hindu family business:

Karta has ultimate control over all decisions. As no one can restrict his right to make a decision, this prevents disputes amongst members. Moreover, quick and flexible decision-making results from this.

The business won't be impacted by Karta's death because the next eldest member will step into the role. As a result, operations are not stopped, and business continuity is not in danger.

Demerits of Joint Hindu Family Business

The following are demerits of a joint Hindu family business:

Karta’s dominance may seem unreasonable to other members and may cause conflict among members.

Disputes over ancestral property are common in this form of organisation.

5. Cooperative Society

A cooperative society is a group of people who get together voluntarily for the benefit of their fellow members. They are motivated by the need to defend their financial interests against potential exploitation at the hands of intermediaries who are driven by the desire to make bigger profits.

A cooperative society should be registered under the Cooperative Societies Act

1912.

Merits of Cooperative Society

The following are some merits of a joint Hindu family business:

The cooperative society is governed by the 'one man, one vote' premise. Each member has an equal right to vote, regardless of how much capital they have contributed.

The cooperative society is often supported by the government through low taxes, subsidies, and loan interest rates.

In a cooperative society, each member's liability is limited to the amount of their capital contribution.

Demerits of Cooperative Society

The following are some demerits of a joint Hindu family business:

Due to their inability to afford to pay experienced managers high salaries, cooperative societies struggle to attract and retain them.

Cooperative societies are subject to a number of laws and regulations on the auditing of finances, the submission of accounts, etc. in exchange for the benefits provided by the government, which may negatively affect the operations.

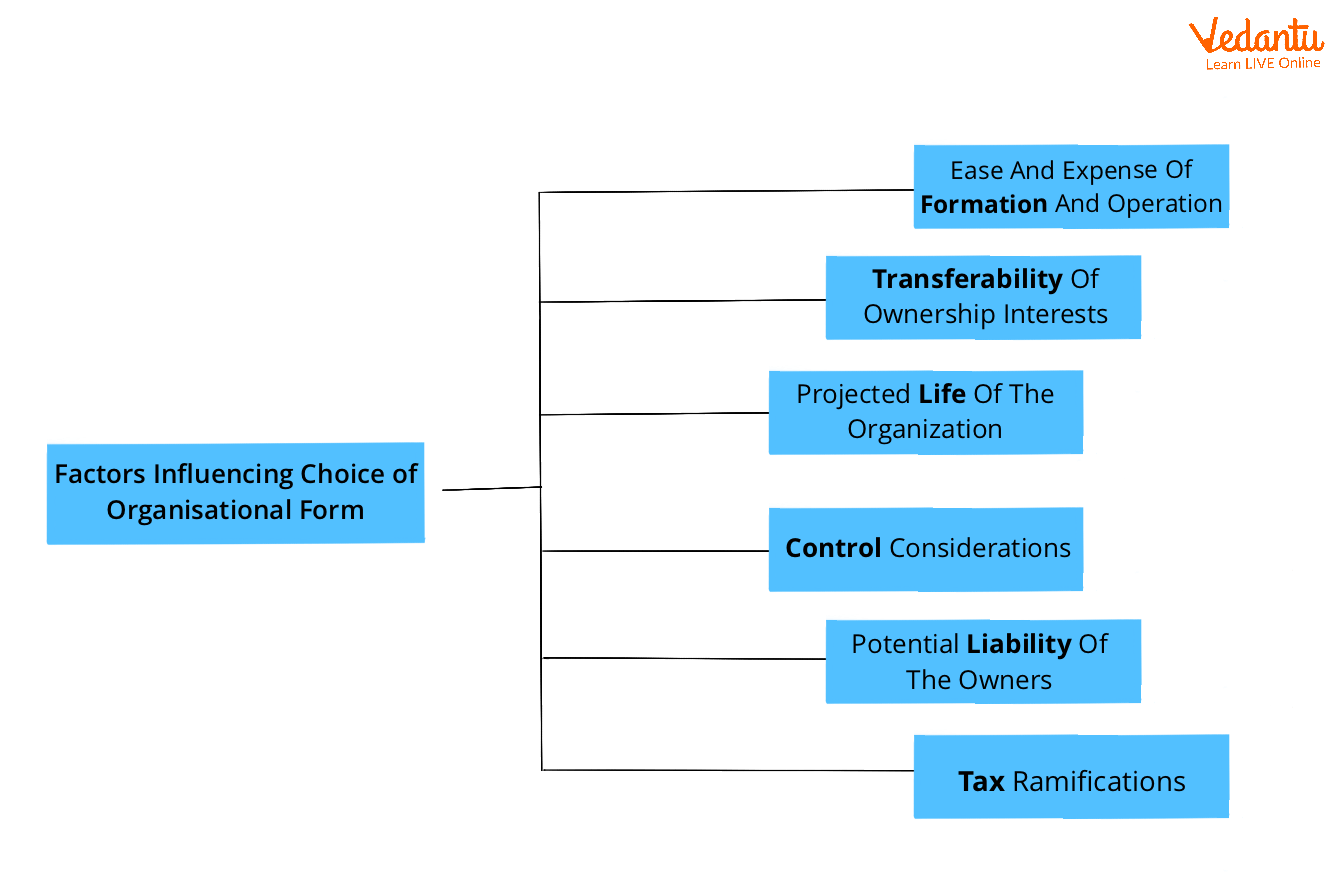

Factors Affecting the Choice of Form of Business Organisation

Factors Affecting the Choice of Form of Business

It is clear from analysing different forms of organisation that each kind has its own benefits and limitations. Therefore, it becomes crucial to keep a few fundamental factors in mind while selecting an acceptable form of organisation. Following are some factors that can help in deciding the form of organisation:

Size and Nature of the Business: Determining the nature and size are important factors. For instance, a manufacturing business producing large quantities of goods would be unsuitable for a sole proprietorship form.

Continuity of Business: How the life of the business is affected by its owner is another factor in determining the form of organisation. A sole proprietorship and partnership are affected by the death of its owners but that is not the case for other forms.

Statutory Obligations: A company has to deal with many statutory obligations, whereas other forms of organisation have relatively fewer statutory obligations.

Liability: Whether liability is a limited liability or unlimited, also affects the choice of form of business.

Capital Requirement: Forms of business such as a company have a relatively huge capital requirement, in comparison to other forms of organisation.

Case Study

Dinesh Sarabhai runs a business producing food items, including sweets and namkeen. He lives in a joint family and has a massive proportion of inherited wealth. This business is run by all the 18 members of the family. His father, Akash is the eldest male family member, so he heads the business. Since Akash makes all of the major decisions, he is liable to all of its creditors. Dinesh’s son Ashok was born a few months ago and he is also a member of the business.

1. Identify the form of business Dinesh is working under and explain any two features of this form of business.

Ans: Dinesh Sarabhai is involved in a Hindu undivided family business. Following are the features of Hindu undivided family business:

Control and Management - Karta oversees and manages all the major operations of a Hindu undivided family business.

Membership by Birth - The way to become a member of the family business is through birth. A child is considered a member of the family business from the moment they are born. No agreement or consent is necessary for membership.

Summary

A business organisation is an entity created with the intention of conducting commercial transactions such as selling and buying. These operate in accordance with an established structure.

It seeks to establish positive working relationships between personnel, tasks, and other resources so that they can cooperate to accomplish shared objectives.

Forms of business organisation are different organisational structures that vary in terms of ownership and management.

Sole proprietorship, partnership, joint Hindu family business, cooperative society, and joint stock company are some major forms of business.

FAQs on Overview of Business Organizations

1. What are the 4 types of business organization?

Four major types of business organization include:

- Sole proprietorships (single-owner businesses),

- Partnerships (owned by two or more partners),

- Corporations (separate legal entities),

- and Limited Liability Companies (LLCs) (which combine features of partnerships and corporations).

2. What are examples of business organisations?

Some common examples of business organisations are a local bakery (sole proprietorship), a law firm (partnership), a large tech company (corporation), and a real estate agency (LLC). Each type follows different legal rules and serves unique business needs.

3. What are the five types of business organisations?

Five common types of business organisations are:

- Sole proprietorship,

- Partnership,

- Corporation,

- Cooperative,

- and Limited Liability Company (LLC).

4. What are business organisations?

Business organisations are legal entities or groups formed to carry out commercial activities. They provide products or services to earn profits and can take different legal forms, each with its own structure, liability, and purpose within the economic system.

5. What is the main purpose of a business organization?

The main purpose of a business organization is to produce goods or provide services for profit. By organizing resources efficiently, business organisations contribute to economic growth and offer jobs, while satisfying consumer needs in the marketplace.

6. How are business organisations structured?

A business organisation is structured by ownership, management, and legal responsibility. Structures include:

- Owner-managed (sole proprietorship),

- Shared management (partnership),

- Board of directors (corporation),

7. What is the difference between a corporation and an LLC?

The main difference is that a corporation is a separate legal entity owned by shareholders, often with stricter regulations, while an LLC offers flexibility and combines features of partnerships and corporations, providing limited liability to its owners.

8. Why do businesses choose different organisational types?

Businesses select different organisational types for reasons such as:

- Liability protection,

- Tax benefits,

- Management preferences,

- and ease of raising capital.

9. What is a partnership in business organisations?

A partnership is a business organisation in which two or more people share ownership and management. Profits, liabilities, and responsibilities are divided according to the partnership agreement, making it a flexible form of business organisation for small businesses.

10. What is a cooperative business organisation?

Cooperative business organisations are owned and operated by members, usually workers or customers, who share profits and decision-making. The main aim is to benefit members rather than maximize profit, and each member often has an equal vote in management.

11. What are the advantages of a sole proprietorship?

A sole proprietorship is easy to set up and fully controlled by the owner.

- Simple tax filing,

- less regulation,

- and direct profit retention