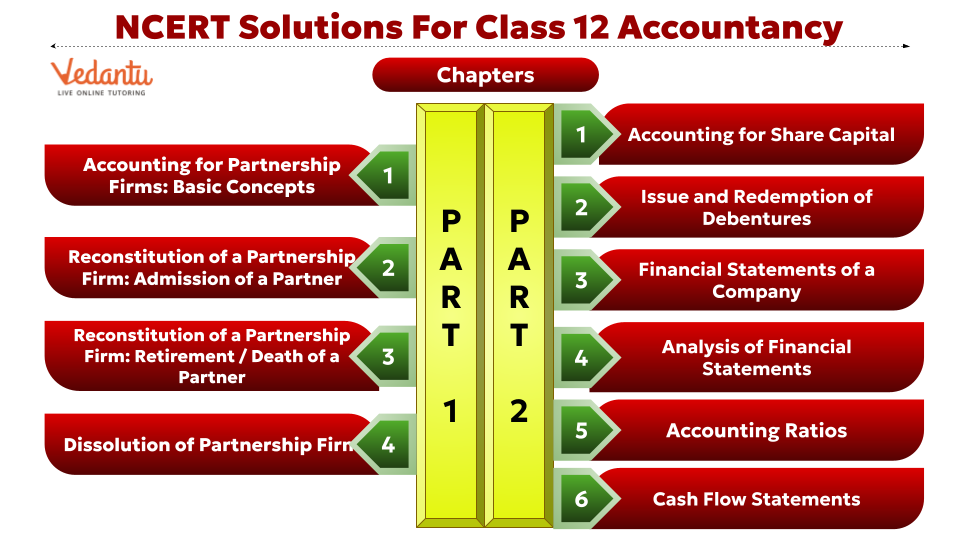

NCERT Class 12 Accountancy Solutions (Accountancy - Part I and II) - FREE PDF Download

NCERT Solutions for Class 12 Accountancy Part 1 & 2

FAQs on NCERT Solutions for Class 12 Accountancy 2024-25

1. How to get 100 marks in Accounts Class 12?

Aim for a perfect score by deeply understanding concepts, not just memorising. Regularly practise solving numerical problems and revise theoretical concepts using NCERT Solutions and past papers to grasp exam patterns.

2. Is Accounts Class 12 accounts paper difficult?

The difficulty depends on your preparation and understanding. With thorough study and practise using resources like NCERT Solutions, you can effectively manage the exam. Focus on mastering each chapter to boost confidence.

3. Is Class 12 Accountancy NCERT Solutions hard?

It can be challenging due to its numerical and conceptual depth. However, consistent effort and using study aids like NCERT Solutions and teacher guidance can help you succeed. Practice problem-solving and grasp fundamental principles to overcome difficulties.

4. Which is the hardest chapter in Class 12 Accountancy NCERT Solutions?

The hardest chapter varies, but topics like cash flow statements or partnership accounting can be challenging due to technical aspects and calculations. Practice and understanding using NCERT Solutions can simplify these chapters.

5. Which topics are deleted from Class 12 Accountancy NCERT Solutions?

As of recent updates, specific topics may be revised or updated, there are no deleted topics but it's essential to consult the latest curriculum or NCERT guidelines for accurate information.

6. How many subjects are there in Class 12 Accountancy NCERT Solutions?

Accountancy typically covers various subjects such as financial accounting, cost accounting, management accounting, and auditing, each focusing on different aspects of financial management and reporting.

7. How many books are there in Class 12 Accountancy NCERT Solutions?

Generally, students use textbooks prescribed by the educational board, accompanied by supplementary study materials like workbooks or guides to enhance understanding and practice.

8. How many hours should I study accountancy class 12?

Allocate sufficient study time based on personal learning pace and workload. Aim for consistent daily or weekly study sessions, focusing on understanding concepts thoroughly rather than just completing hours.

9. What are the branches of accounting?

Branches of accounting include financial accounting, which deals with preparing financial statements; management accounting, focusing on internal decision-making; cost accounting, analysing costs; and auditing, ensuring accuracy in financial records through examination.

10. Are the NCERT Solutions for Accountancy Class 12 Question And Answer available for FREE?

Yes, the NCERT Solutions for Accounts Class 12 are available for free download in PDF format. This allows students to access the solutions anytime and anywhere without any cost. The free availability ensures that all students can take advantage of these resources, regardless of their financial situation.

11. Who prepares the NCERT Solutions for Accountancy Class 12 Question And Answer?

Accounts Class 12 solutions are prepared by experienced teachers and subject experts who are well-versed with the curriculum and exam requirements. They ensure that the solutions are accurate, comprehensive, and easy to understand. Their expertise helps in creating high-quality educational material that benefits students.

12. Can I rely on NCERT Solutions for Accountancy Class 12 Question And Answer for my board exams?

Yes, you can rely on these solutions for your board exams. They are designed to align with the NCERT Accounts Class 12 curriculum and cover all important topics and questions likely to appear in the exams. Using these solutions as a study guide can help you build a solid foundation in accountancy and be well-prepared for your exams.

13. How does the NCERT Solutions Accountancy Class 12 Question And Answer help in understanding difficult topics?

The NCERT Solutions Accounts Class 12 simplifies complex accounting problems by breaking them down into easy-to-understand steps. Each solution is explained in detail, making it easier for students to grasp challenging topics. This approach helps clarify doubts and reinforces learning, enabling students to tackle difficult problems confidently.