What is the Global Financial Crisis?

The Global Financial Crisis of 2008 was the result of a series of events, each with its own trigger, leading to the near-collapse of the banking system. It hit individuals and institutions around the world. The crisis is often called the 'Great Recession’ and did not come overnight. A recession is considered when a country's economy faces negative gross domestic product (GDP) growth, rising unemployment, declining retail sales, and declining income and manufacturing activity for an extended period of time.

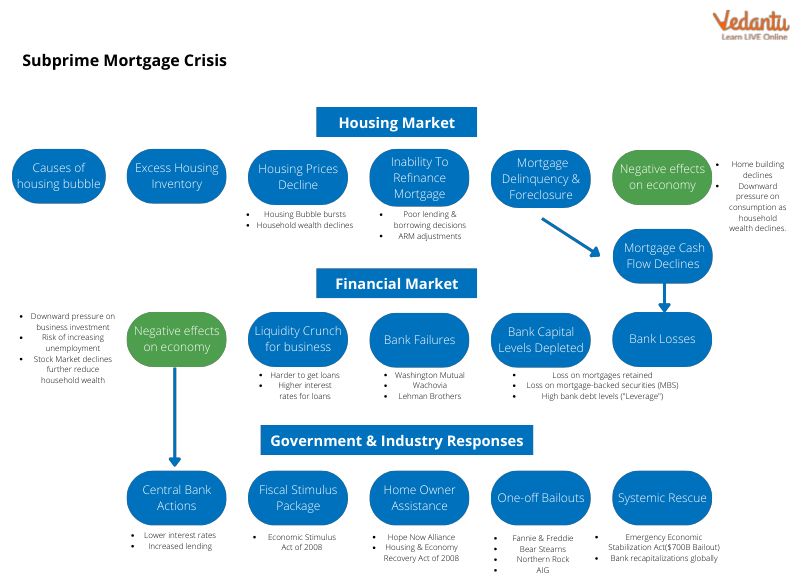

There were many factors that led to the crisis, and its effects continue to this day. It was an epic financial and economic meltdown that cost many ordinary people jobs, life savings, homes, or all three. Looser credit requirements combined with easier money spurred a real estate boom that fueled speculation, boosted home prices, and created a real estate bubble.

Recession

2008 Subprime Crisis: How It All Started?

Back in 2008, interest rates in the US were only 1%, people thought that it was not safe to put their money in the bank, and even the stock market started to fall, so they started looking for assets from which they could get higher returns. That's when real estate housing came into the picture.

The changes in banking laws began in the 1980s that allowed banks to offer mortgages to subprime customers. Consumers took advantage of cheap credit to purchase durable goods such as appliances and houses. People who couldn't get a traditional mortgage were happy to be approved for these interest rate loans. As a result, between 2001 and 2007, the share of subprime mortgages doubled from 6% to 14%.

The demand for mortgages has driven up the demand for homes that home builders were trying to meet. Because of this ease of credit, many people bought homes as an investment to sell as prices continued to rise. Little did many people with variable rate loans know that the interest rate would go from 3 years to its original in 5 years.

These loans were then bundled with high-quality loans and issued as Mortgage Backed Securities (MBS). Banks were able to pass the risk on to investors, so they were happy to approve loans to people who didn't have the proper documentation or a good credit rating. No one worried about the results, but soon reality hit back.

Now Instead of finding a credible solution, they decided to keep raising interest rates. They thought they could recoup their losses by paying regularly or at least charging higher interest rates to those who made a conscious effort to pay. The tax rate increased from 2.25% to 5.25%. Plagued by huge interest rates, defaults only increased. Banks promised safety and security with higher returns, but their actions weren't the same.

When the Fed raised interest rates, the resulting increase in mortgage payments put pressure on borrowers' ability to pay. Property prices soared as supply began to outstrip demand. High-interest rates combined with falling home prices made it very difficult for buyers to pay for their homes. This trapped homeowners who could not afford to buy and sell homes. When the value of derivatives crashed, banks stopped lending to each other. This triggered the financial crisis that led to the Great Recession. And in late 2007, the economy officially plunged into recession.

Causes of the 2008 Global Financial Crisis

The 2008 recession reasons are discussed below.

Relaxation of Lending Standards

Financial deregulation was a major contributor to the 2008 financial crisis. The expectation that house prices will continue to rise led households, especially in the United States, to go into debt recklessly to buy and build homes. Similar expectations for property prices also encouraged developers and households to over-borrow. Many mortgages, especially in the United States, were close to or even exceeded the purchase price of a home.

So, the mixture of free credit score necessities and reasonably priced cash spurred a housing boom, which drove speculation, pushing up housing expenses and developing an actual property bubble. As a result, whilst house expenses commenced to fall, banks and buyers incurred huge losses due to the fact they had borrowed so much.

Financial Instruments

Meanwhile, after the year 2001, investment banks looking for easy profits created collateralized debt obligations from mortgages purchased on the secondary market. Because subprime mortgages were bundled with prime mortgages, investors had no way of understanding the risks associated with the product. The housing bubble that had been building for years finally burst as the CDO market began to warm. As house prices fell, subprime borrowers began defaulting on loans worth more than the house, accelerating the fall in house prices.

Policy Errors and Regulation

Regulations on subprime loans and MBS products were too lax and poorly regulated. Many individual borrowers not only made loans so large that they would be difficult to repay but also overestimated the income of the borrowers and made exaggerated promises by investors about the safety of the MBS products used. There was also an increase in fraudulent activities, such as they were sold. Moreover, as the crisis escalated, many central banks and governments failed to fully appreciate the expansion of non-performing loans during boom times and the multifaceted nature of mortgage losses across the financial system.

Causes of 2008 Financial Crisis

Policy Responses

The policy responses by the central bank are discussed below in detail.

The Central banks lowered interest rates to very low levels, lent large amounts of money to institutions and banks with good assets that could not borrow in financial markets, and purchased a substantial amount of financial securities to support dysfunctional markets and stimulate economic activity.

The Governments increased their spending to stimulate demand and support employees throughout the economy, guaranteed deposits and bank bonds to shore up confidence in financial firms, and purchased ownership stakes in banks and other financial institutions in order to prevent bankruptcies that could have exacerbated panic in the financial markets.

Strengthening supervision of financial companies In response to the crisis, regulators have stepped up their scrutiny of banks and other financial institutions. In addition to many new global regulations, banks now need to assess the risks of lending more accurately and use more resilient funding sources. The Regulators have also become more vigilant about how risks can spread throughout the financial system and are calling for measures to prevent them from spreading.

Case Study:

Answer the following questions.

The global financial recession began in 2007 and hit nearly every country. If its consequences and growth are projected, its adverse and destructive effects. The impact on global and national economies could be partially neutralised. The financial crisis, like all crises, the 2007 recession had its own conditions and indicators that revealed global imbalances. The economy and state of the US financial system, a global rating agency and leader Economic analysts did not pay attention to or believe in the immortality and robustness of the United States.

What is a Financial Recession?

Explain the after-effects of the crisis on the Indian economy.

Ans:

A recession is considered when a country's economy faces negative gross domestic product (GDP) growth, rising unemployment, declining retail sales, and declining income and manufacturing activity for an extended period of time. Recessions are an inevitable part of the business cycle or the predictable rhythm of expansion and contraction in a country's economy.

India at the time was less dependent on the US economy, so it was less exposed to its downsides. However, it was not completely protected from the giant bomb that reduced the entire US financial market to rubble. India's GDP fell from 9% to 7.8% in 2008. About $12 billion worth of investors pulled out of the stock market, seeing a significant drop. Trade and fiscal deficits were also severely affected. However, the Indian government at the time responded swiftly to the crisis.

Summary

The 2007-2008 financial crisis, also known as the subprime mortgage crisis, was a severe liquidity crisis in global financial markets that occurred in the United States as a result of the collapse of the US housing market. It has led to the collapse (or near collapse) of several large investments and commercial banks, mortgage lenders, insurance companies, savings and credit unions, causing the Great Recession. The financial crisis, like all crises, The 2007 recession, had its own conditions and indicators that revealed global imbalances. The economy and state of the US financial system, a global rating agency and leading Economic analysts did not pay attention to or believe in the immortality and robustness of the United States.

FAQs on The 2008 Global Financial Crisis: An Overview

1. What was the 2008 Global Financial Crisis in simple terms?

The 2008 Global Financial Crisis was a severe, worldwide economic crisis that began with the collapse of the U.S. housing market. It led to the failure of major investment banks, a stock market crash, and a deep global recession. Often referred to as the Great Recession, it was the most serious financial crisis since the Great Depression of the 1930s, highlighting how interconnected the world's economies had become.

2. What were the main causes of the 2008 financial crisis?

The primary causes of the 2008 financial crisis were a combination of factors that created a high-risk environment. The key contributors include:

Subprime Mortgage Lending: Banks offered high-risk loans to borrowers with poor credit history, leading to widespread defaults.

Financial Deregulation: Reduced oversight allowed banks to take on excessive risk through complex and opaque financial products.

Mortgage-Backed Securities (MBS): Risky mortgages were bundled together and sold to investors as supposedly safe investments, spreading the risk throughout the financial system.

Housing Bubble: Easy credit led to a surge in housing prices. When the bubble burst, property values plummeted, leaving many homeowners with negative equity.

3. How did the 'subprime mortgage crisis' trigger the global financial collapse?

The subprime mortgage crisis acted as the primary trigger for the global collapse. It started when a large number of borrowers with poor credit (subprime borrowers) began to default on their home loans. Financial institutions had bundled these risky loans into complex assets called Mortgage-Backed Securities (MBS) and sold them to other banks and investors globally. When the defaults occurred, the value of these MBS assets collapsed, causing massive, unexpected losses for financial institutions worldwide. This led to a loss of trust, a freeze in lending (credit crunch), and a chain reaction of failures across the interconnected global financial system.

4. What was the significance of Lehman Brothers' collapse in the 2008 crisis?

The collapse of Lehman Brothers, a major global investment bank, on September 15, 2008, was a pivotal moment in the crisis. Until then, it was widely believed that the U.S. government would bail out any financial institution that was “too big to fail.” When the government allowed Lehman Brothers to go bankrupt, it sent a shockwave of panic through global markets. It shattered confidence, causing inter-bank lending to freeze completely, as no one knew which institution would be next to fail. This event transformed a manageable crisis into a full-blown global financial catastrophe.

5. What were the immediate consequences of the 2008 financial crisis worldwide?

The immediate consequences of the crisis were severe and widespread, impacting economies across the globe. Key effects included:

A global recession, with many countries experiencing negative GDP growth.

Massive government bailouts of banks and financial institutions to prevent total collapse.

A sharp rise in unemployment rates as businesses failed or downsized.

A significant drop in international trade and investment.

The loss of trillions of dollars in personal savings, pensions, and investments.

6. How did the 2008 Global Financial Crisis affect the Indian economy?

While India's well-regulated banking sector helped cushion the direct impact, the crisis still affected its economy significantly. The main effects included a sharp outflow of foreign institutional investment (FII), leading to a stock market crash and a depreciation of the Indian Rupee. Exports slowed down due to the recession in Western countries, and Indian companies found it harder to access international credit. However, strong domestic demand and timely policy interventions by the government and RBI helped India recover faster than many other nations.

7. What is the difference between a recession and a depression, especially regarding the 2008 crisis?

A recession is a significant, widespread, and prolonged downturn in economic activity, typically defined as two consecutive quarters of falling GDP. A depression is a much more severe and long-lasting recession, characterised by a substantial fall in GDP (over 10%) and extremely high unemployment over several years. The 2008 crisis triggered the 'Great Recession' because, while it was the deepest economic downturn since the 1930s, it did not reach the extreme duration or depth of the Great Depression.

8. What key lessons were learned from the 2008 crisis to prevent a future collapse?

The 2008 crisis prompted significant reforms and taught crucial lessons about the modern financial system. Key takeaways included:

Stricter Financial Regulation: The crisis proved that deregulation can lead to excessive risk-taking. New laws, like the Dodd-Frank Act in the U.S., were introduced to increase oversight.

Systemic Risk Management: Regulators now understand that the failure of large, interconnected firms (systemically important institutions) can bring down the entire system, requiring special monitoring.

Need for Transparency: Complex financial products like MBS made it impossible to assess risk, highlighting the need for greater transparency.

Global Cooperation: As the crisis was global, it showed that coordinated international responses are essential to manage financial panics effectively.