Class 12 Economics Chapter 4 Questions and Answers - Free PDF Download

Understanding how businesses work in perfect competition can be interesting! Economics Class 12 Chapter 4 questions and answers help you learn these important concepts easily. This chapter explores how firms make decisions when they face many competitors in the market.

Class 12 Economics Chapter 4 solutions make complex topics simple for students like you. These step-by-step answers help you prepare for board exams and understand concepts clearly.

Vedantu's expert solutions boost your confidence and improve your exam performance significantly. You'll learn about profit maximization, market structures, and firm behavior through easy explanations. Download the NCERT Solutions PDF for free and start your Economics preparation today!

1. What are the characteristics of a perfectly competitive market?

Ans: Perfect Competition: A market wherein we find perfect competition between a large number of buyers and sellers of a homogeneous product and the price of the product is determined by the industry is called perfect competition market. There is one fee that remains in the marketplace and all the corporations sell the product on the fixed fee.

Features of perfectly competitive marketplace

a. Free and Perfect Competition:

In a great marketplace, there are no tests either on the buyers or sellers. they're unfastened to shop for or to promote to any person. It means there are not any monopolies.

b. Cheap and Efficient Transport and Communication:

Uniform rate for the commodity might not be viable if the modifications inside the prices are not speedy adjusted or the commodity can't be speedy transported. Thus, cheap and efficient means of shipping and conversation are a need in a superbly aggressive market.

c. Wide Extent:

Sometimes a wide market is regarded as the same thing as the perfect market. When we consider a wider market, the commodity should have permanent as well as universal demand. The products should be portable and the means of transport as well as communication should be quick enough to speed up the process. There ought to be peace and protection and substantial division of labor.

d. Large Number of Firms:

In this market, a product is produced as well as sold with the aid of massive wide variety of firms. considering that there are big wide variety of corporations, therefore every company is providing handiest a small a part of the overall supply within the market, accordingly no person firm has any marketplace electricity. It means that no firm can impact the charge of the product; rather , each have to take delivery of the price set with the aid of the forces of marketplace demand and supply. The companies are fee-talkers as opposed to price-makers.

e. Large Number of Buyers:

In a wonderfully competitive marketplace, there are big numbers of consumers each worrying a small a part of the total market deliver of the product. As a result, no unmarried buyer is in a position to persuade the market charge determined with the aid of the forces of market demand and supply

f. Homogeneous Product:

In a perfectly aggressive market, all of the companies produce and supply the same merchandise. It way that the goods of all the firms are ideal substitutes of each different in terms of amount, great, coloration, length, capabilities, and many others. because of the homogenous nature of products, existence of uniform fee is assured.

g. Free entry and Exit:

In a superbly competitive market, there aren't any regulations at the entry of new companies into the marketplace or at the go out of current firms from the marketplace. If there are abnormal income, new firms will enter the marketplace and if there are abnormal losses, a few present companies will exit the marketplace.

h. Perfect knowledge Among Buyers and Sellers

In a wonderfully aggressive marketplace, the firms and the shoppers own ideal statistics about the marketplace. It implies that no customer or firm is ignorant about the charge winning inside the marketplace. The implication of this option is if any character company is charging better (or decrease) charge for a homogeneous product, the buyers will shift their buy to different companies (or shift their purchase from the company to other corporations promoting at decrease price).

i. Perfect Mobility of Factors of Production:

In a perfectly aggressive marketplace, the factors of production whether or not geographically or occupationally are completely cellular main to component-rate equalization throughout the marketplace.

j. No Promotional and Selling Costs:

There are not any commercials and promotional costs incurred by way of the companies. The selling expenses beneath a perfectly competitive marketplace are zero.

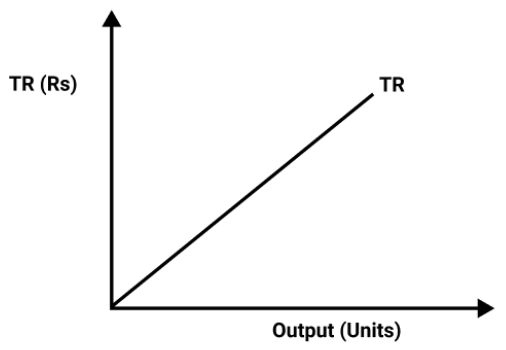

2. How are the total revenue of a firm, market price and the quantity sold by that firm related to each other?

Ans: Total revenue is said to be defined as the total sales proceeds of a producer by selling corresponding levels of output or sum total of revenue receipts from the sale of a given quantity of commodity. In other words, it can be defined as price times the quantity of output sold.

Total Revenue = Market Price x Quantity of output sold

TR = P×Q

Hence, TR = PQ

In a perfectly competitive market, the marketplace price is given, i.e., a company can act as a price taker and cannot have an effect on the rate. subsequently, a specific firm can have an impact on its TR by altering the amount.

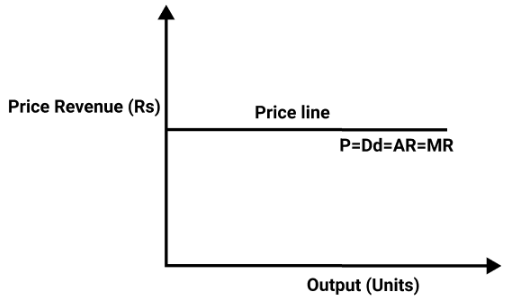

3. What is the price line?

Ans: Rate line is the graphical representation of the connection between output and rate, with x-axis denoting the output and y-axis denoting the price.In other words, the price line shows the relationship between the market price and a firm’s output level. The vertical height of the price line is equal to the market charge. For a wonderfully competitive firm, rate line and call for curve are the same.

(Image will be uploaded soon)

4. Why is the total revenue curve of a price-taking firm an upward-sloping straight line? Why does the curve pass through the origin?

Ans: The total revenue curve for a company in a perfectly competitive marketplace is an upward sloping curve due to the fact the rate or AR remains steady and MR is also same to AR. Therefore, TR can handiest be prompted through altering the output offered, because the charge stays constant. The growth in TR is within the identical proportion because the boom in the output sold.

The curve passes via the beginning, which means that no matter what the price level is, if the output bought is 0, TR may also be 0.

5. What is the relation between market price and average revenue of a price taking firm?

Ans: Average revenue is described as the sales consistent with unit of the output sold. it is expressed because the ratio among general sales and the output bought.

AR= TR/O

We know that,

TR= P * Q

AR=P * Q \ Q

AR = P

For this reason, the marketplace fee and the common sales are the equal for an excellent competitive firm.

6. What is the relation between market price and marginal revenue of a price-taking firm?

Ans: Marginal sales is described as the trade in the overall revenue that occurs because of the sale of 1 extra unit of output. it is calculated as

Where,

MRn = Marginal revenue due to nth unit of output

TRn = Total revenue due to n units of output

TRn-1 = Total revenue due to (n – 1) units of output

Suppose that the market price is P

MRn = TRn – TRn-1

= PQn – P(Qn-1)

MR = PQn – PQn + P

MR = P. Thus, for an excellent competitive company, marginal sales is equal to the marketplace charge according to unit of output. As a end result that revenue from every extra unit (MR) is same to price or average revenue.

7. What conditions must hold if a profit-maximizing firm produce positive output in a competitive market?

Ans: Whilst charge stays constant companies can sell any quantity of output at the fee constant by way of the market. AR stays equal in any respect levels of output and additionally revenue from every additional unit (MR) is identical to AR. the following 3 conditions must maintain if a income maximizing company produces high quality degree of output (say equilibrium output Q*) in a aggressive marketplace:

(i) MR must be equal to MC at Q*.

(ii) MC should be upward sloping or rising at Q*.

(iii) In short run-Price must be greater than or equal to AVC .i.e. P > AVC at Q*.

In long run - Price must be greater than or equal to LAC.

8. Can there be a positive level of output that a profit-maximizing firm produces in a competitive market at which market price is not equal to marginal cost? Give an explanation.

Ans: There is no positive level of output that a firm generates at which price is not equal to MC. Let us understand the following two cases where price is not equal to MC.

(Image will be uploaded soon)

Case A: If P > MC

At output Oq1, price is, while the MC is Lq1. So, Oq1 isn't the income maximizing output. that is because of the truth that the firm can grow its profit degree via increasing its output too.

Case B: If P < MC

At output Oq3 price is Hq3 and MC is Gq3. So, Oq3 isn't always the income maximizing output. That is due to the fact the firm can growth its income through lowering its output degree to. Hence the earnings maximizing factor must be same as MC and it can not be extra or lesser than MC.

9. Will a profit-maximizing firm in a competitive market ever produce a positive level of output in the range where the marginal cost is falling? Give an explanation.

Ans: No, It isn't always feasible for any perfect aggressive company to provide a advantageous stage of output in a selection where MC is falling. that is because, in line with one of the situations of income maximization, MC curve need to be upward sloping or the slope of MC curve have to be superb at the equilibrium stage of output.

Allow us to take an example: At point Z price is identical to MC, however MC is falling and is negatively sloped. For any degree of output greater than Oq0, the firm is facing fee > MC, which implies that the income may be maximized via growing the output level further.

(Image will be uploaded soon)

Therefore, the factor 'E’ is the equilibrium point, where an earnings maximizing company could operate and produce gadgets of output and its earnings will be maximized.

10. Will a profit-maximizing firm in a competitive market produce a positive level of output in the short run if the market price is less than the minimum of AVC ?

Ans: No, it is not feasible for a company to supply a nice level of output within the brief run if the charge is much less than the minimal of AVC. this is because as soon because the market rate falls underneath the minimum of SAVC, which implies that the company is not able to cowl it’s fixed in addition to variable fees, and as a result it's going to stop production. consequently, allow us to recognize by using taking an instance:

(Image will be uploaded soon)

At the point K, price charged by the firm is ON and output sold is Oq1, and the firm generates TR.

TR = P * Q

= OP * Oq1

= area (rectangleOq1LP)

And incurs the variable cost of TVC

TVC = SAVC * Quantity of output

= ON * Oq1

= area (rectangle Oq1KN

Profit earned by the firm = TR – TC = TR – (TVC + TFC)

= TR – TVC - TFC

If the firm is not producing anything then at zero level of output, the firm’s TR and TVC will be zero level of output, the profit earned by the firm is

Profit = II1 = TR - TVC- TFC

II1 = - TFC

Now if it produces level of output, then the profit earned will be

II2 = TR – TVC - TFC

= area (rectangle Oq1LP) - area (rectangle Oq1KN) - TFC

Or, II2 = - area (rectangle PLKN) - TFC

This implies this is more than II2. The company incurs extra loss if it produces Oq1 degree of output than the loss related to 0 degree of output. as a consequence, the firm will stop manufacturing on every occasion P < SAVC and therefore at income maximizing level of output, the fee must be extra than or identical to SAVC inside the short run.

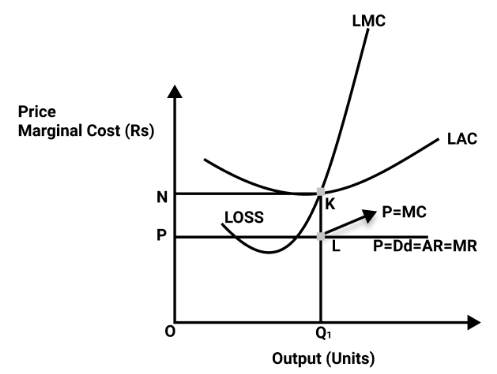

11. Will a profit-maximizing firm in a competitive market produce a positive level of output in the long run if the market price is less than the minimum of AC? Give an explanation.

Ans: No, it isn't always possible for a company to provide a high quality degree of output in the end if the marketplace price falls quickly to the minimum of AC. This is because, in the long run, there's free access and go out of companies and all corporations earn ordinary profit. Therefore, any firm making losses in the long term will forestall production. let us recognize this concept via an instance

At Oq1 Level of output,

Price charged by the firm = OP.

Revenue generated by the firm (TR)= P * Q

= OP * Oq1

= area (rectangle Oq1LP)

Cost of producing Oq1 level of output (TC) = Quantity of output

= ON * Oq1

TC = area ( rectangle Oq1KN ) Profit earned by the firm

= TR – TC

= area (rectangle Oq1LP) - area (rectangle Oq1KN)

= - area (rectangle NKLP)

Accordingly, the loss incurred by the firm is equal to the area of the rectangle NKLP.

In the long run, all corporations earn 0 economic profit, and if any firm earns loss or terrible profit, then the firm will shut down its production. accordingly, if the firm earns loss, i.e. if rate is lesser than LAC at any stage of output, it'll no longer be the income maximizing output stage of the firm

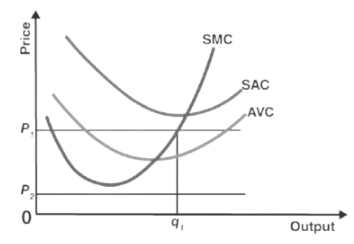

12. What is the supply curve of a firm in the short run?

Ans: Let's create a short-run supply curve for an organisation. This derivation will be divided into two parts. When the market cost price is greater than or equal to the minimal AVC, establish the enterprise's profit-maximizing output degree. When the market cost is less than the minimum AVC, we can now establish the enterprise's profit-maximizing output degree.

Case 1: The price exceeds or equals the minimal AVC.

Assume the market cost price is p1, which is higher than the AVC minimum. On the increasing half of the SMC curve, we equalise p1 with SMC, resulting in the output degree q1. It's also worth noting that the AVC in q1 does not exceed the market cost price, p1. As a result, at q1, all three conditions in section 3 are met. As a result, when the market cost price is p1, the short-run output degree of the firm is q1.

Case 2: The price is lower than the AVC minimum.

Assume the market cost price is p2, which is lower than the AVC minimum. If a profit-maximizing firm produces a positive production in the near run, the market cost price, p2, must be higher than or equal to the AVC at that output level. The AVC clearly outperforms p2 in the image. In other words, the company is unable to produce a profit. As a result, if the market price is p2, the firm will produce no output.

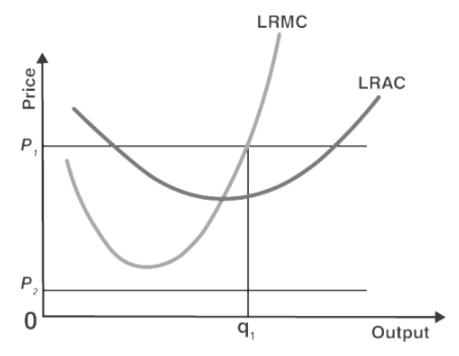

13. What is the supply curve of a firm in the long run?

Ans: Let's create a long-run supply curve for a company. We divide the derivation into two sections when dividing the short-run curve. When the market cost price is larger than or equal to the minimal (long-run) AC, we first determine the enterprise's profit-maximizing production degree.

When the market cost price is less than the minimal (long-run) AC, we determine the enterprise's profit-maximizing output degree.

Case 1: A price that is greater than or equal to the LRAC minimum

Assume the market cost price is p1, which is higher than the LRAC minimum. We obtain the output degree q1 by equating p1 with LRMC on the ascending part of the LRMC curve.

It's also worth noting that the LRAC at q1 does not exceed the p1 market cost pricing. As a result, at q1, all three conditions in section 3 are met. As a result, when the market cost price is p1, the enterprise's supplies are equal to q1 in the long term.

Case 2: Price Below the LRAC Minimum

Assume the market cost price is p2, which is lower than the LRAC minimum. If a profit-maximizing firm produces a positive production over time, the market cost price, p2, must be larger than or equal to the LRAC at that output level.

In other words, the company is unable to produce a profit. As a result, when the market cost price is p2, the firm produces nothing. We can draw an important conclusion by combining instances 1 and 2.

The increasing component of the LRMC curve from and above the minimum LRAC, as well as the zero production for all cost prices less than the minimum LRAC, is an enterprise's long-run supply curve.

14. How does technological progress affect the supply curve of a firm?

Ans: The supply curve of a company is a wonderful feature of a country of era. that is, if the technology to be had to the firm appreciates, more amount of output may be produced through the firm with the given ranges of capital and exertions. due to such improvements or technological improvements, the company will revel in decrease cost of manufacturing, that allows you to result in downward shift (to the right) of the MC curve. this may similarly cause rightward shift of the firm's supply curve. accordingly, because of the appreciation and development of production strategies, the company will produce more and more output a good way to be provided at a given marketplace fee. it may reason fall to the marginal price additionally.

15: How does the imposition of a unit tax affect the supply curve of a firm?

Ans: A unit tax is the tax imposed by using the government on according to unit of the output bought. because of the imposition of unit tax, the value of production according to unit of output will increase, which ultimately increases the marginal cost? therefore, the LMC curve will shift leftward upward and because the deliver curve is a portion of LMC, so the deliver curve may even shift leftward upward.

Let us apprehend the impact of imposition of unit tax via an instance. assume that a company is facing the rate OP1. LAC1 and LMC1 are the long term average value curve and long term marginal price curve respectively. also anticipate that the authorities has imposed a unit tax of Rs in line with unit of output produced. Now, this could increase the firm's LAC and LMC, because the firm desires to pay Rs ok extra on every output produced. LMC1 and LAC1 will shift leftward upwards to LMC2 and LAC2. The significance of shift is equal to Rs k. as the deliver curve is part of LMC, it's going to additionally shift leftward from S1 to S2, because of the imposition of the tax. consequently, the firm will now supply lesser devices of output.

(Image will be uploaded soon)

16. How does an increase in the price of an input affect the supply curve of a firm?

Ans: A boom inside the price of an enter increases the cost of manufacturing, which in turn increases the marginal fee of the company. consequently, the MC curve will shift upward to the left. As a result, the supply curve will even shift leftward upward. therefore, an increase in the enter rate negatively impacts the deliver of the company.

17. How does an increase in the number of firms in a market affect the market supply curve?

Ans: The marketplace deliver curve is a horizontal summation of all the supply curves of man or woman companies in the market. If the wide variety of firms in a market will increase, then the marketplace deliver curve will shift rightward as there might be greater variety of firms imparting extra output. boom in variety of producers will reason increase in deliver.

18. What does the price elasticity of supply mean? How do we measure it?

Ans: Price elasticity of supply (es) or PES is defined as the degree of the responsiveness of quantity supplied, to the change in price for a specific commodity.

It is only expressed in numerical form as:

Price elasticity of supply (es)

Es = Percentage change in quantity supplied / Percentage change in price.

19. Calculate the total revenue, marginal revenue and average revenue schedules in the following table. Market price of each unit of the good is Rs 10.

Quantity sold | TR | MR | AR |

0 | |||

1 | |||

2 | |||

3 | |||

4 | |||

5 | |||

6 |

Ans:

Quantity sold | TR = P * Q | MR=TRn-TRn-1 | AR = TR / Q |

0 | - | - | - |

1 | 10 * 1 = 10 | 10 – 0 =10 | 10 |

2 | 10 * 2 = 20 | 20 – 10=10 | 10 |

3 | 10 * 3 = 30 | 30 – 20=10 | 10 |

4 | 10 * 4 = 40 | 40 – 30=10 | 10 |

5 | 10 * 5 = 50 | 50 – 40=10 | 10 |

6 | 10 * 6 = 60 | 60 – 50=10 | 10 |

20. The following table shows the total revenue and total cost schedules of a competitive firm. Calculate the profit at each output level. Determine also the market price of the good.

Quantity Sold | TR | TC | Profit |

0 | 0 | 5 | |

1 | 5 | 7 | |

2 | 10 | 10 | |

3 | 15 | 12 | |

4 | 20 | 15 | |

5 | 25 | 23 | |

6 | 30 | 33 | |

7 | 35 | 40 |

Ans:

Quantity sold | TR | TC | Profit | AR = TR / Q |

0 | 0 | 5 | 0 – 5 = - 5 | - |

1 | 5 | 7 | 5 – 7 = -2 | 5/1 = 5 |

2 | 10 | 10 | 10 – 10 = 0 | 10/2 = 5 |

3 | 15 | 12 | 15 – 12 = 3 | 15/3 = 5 |

4 | 20 | 15 | 20 – 15 = 5 | 20/4 = 5 |

5 | 25 | 23 | 25 – 23 = 2 | 25/5 = 5 |

6 | 30 | 33 | 30 – 33 = -3 | 30/6 = 5 |

7 | 35 | 40 | 35 – 40 = -5 | 35/7 = 5 |

21. The following table shows the total cost schedule of a competitive firm. It is given that the price of the good is Rs 10. Calculate the profit at each output level. Find the profit maximizing the level of output.

Quantity Sold | TC |

0 | 5 |

1 | 15 |

2 | 22 |

3 | 27 |

4 | 31 |

5 | 38 |

6 | 49 |

7 | 63 |

8 | 81 |

9 | 101 |

10 | 123 |

Ans:

Quantity Sold | Price | TC | TR = P * Q | Profit = TR - TC |

0 | 10 | 5 | 10 * 0 = 0 | 0 – 5 = -5 |

1 | 10 | 15 | 10 * 1 = 10 | 10 - 15 = -5 |

2 | 10 | 22 | 10 * 2 = 20 | 20 - 22 = -2 |

3 | 10 | 27 | 10 * 3 = 30 | 30 - 27 = 3 |

4 | 10 | 31 | 10 * 4 = 40 | 40 - 31 = 9 |

5 | 10 | 38 | 10 * 5 = 50 | 50 - 38 = 12 |

6 | 10 | 49 | 10 * 6 = 60 | 60 - 49 = 11 |

7 | 10 | 63 | 10 * 7 = 70 | 70 - 63 = 7 |

8 | 10 | 81 | 10 * 8 = 80 | 80 - 81 = -1 |

9 | 10 | 101 | 10 * 9 = 90 | 90 - 101 = -11 |

10 | 10 | 123 | 10 * 10 = 100 | 100 – 123 = -23 |

Income maximizing output is wherein the distinction between TR and TC is the most. This exists at 5 devices of output, wherein the company is earning profit of 12.

22. Consider a market with two firms. The following table shows supply schedules of two firms: SS1 denotes the supply schedule of firm 1 and SS2 denotes the supply schedule of firm 2. Calculate the market supply schedule.

Price | SS1 (units) | SS2 (units) |

0 | 0 | 0 |

1 | 0 | 0 |

2 | 0 | 0 |

3 | 1 | 1 |

4 | 2 | 2 |

5 | 3 | 3 |

6 | 4 | 4 |

Ans:

Price | SS1 (units) | SS2 (units) | Market Supply = SS1 + SS2 |

0 | 0 | 0 | 0 + 0 = 0 |

1 | 0 | 0 | 0 + 0 = 0 |

2 | 0 | 0 | 0 + 0 = 0 |

3 | 1 | 1 | 1 + 1 = 2 |

4 | 2 | 2 | 2 + 2 = 4 |

5 | 3 | 3 | 3 + 3 = 6 |

6 | 4 | 4 | 4+ 4 = 8 |

23. Consider a market with two firms. In the following table, columns labelled as and give the supply schedules of firm 1 and firm 2 respectively. Compute the market supply schedule.

Price | SS1 (kg) | SS2 (kg) |

0 | 0 | 0 |

1 | 0 | 0 |

2 | 0 | 0 |

3 | 1 | 0 |

4 | 2 | 0.5 |

5 | 3 | 1 |

6 | 4 | 1.5 |

7 | 5 | 2 |

8 | 6 | 2.5 |

Ans:

Price | SS1 (kg) | SS2 (kg) | Market Supply = SS1 + SS2 |

0 | 0 | 0 | 0 + 0 = 0 |

1 | 0 | 0 | 0 + 0 = 0 |

2 | 0 | 0 | 0 + 0 = 0 |

3 | 1 | 0 | 1 + 0 = 0 |

4 | 2 | 0.5 | 2 + 0.5 = 2.5 |

5 | 3 | 1 | 3 + 1 = 4 |

6 | 4 | 1.5 | 4 + 1.5 = 5.5 |

7 | 5 | 2 | 5 + 2 = 7 |

8 | 6 | 2.5 | 6 + 2.5 = 8.5 |

24. There are three identical firms in a market. The following table shows the supply schedule of firm 1. Calculate the market supply schedule.

Price | SS1 (units) |

0 | 0 |

1 | 0 |

2 | 2 |

3 | 4 |

4 | 6 |

5 | 8 |

6 | 10 |

7 | 12 |

8 | 14 |

Ans:

Price | SS1 | SS2 | SS3 | Market Supply = SS1 + SS2 + SS3 |

0 | 0 | 0 | 0 | 0 |

1 | 0 | 0 | 0 | 0 |

2 | 2 | 2 | 2 | 6 |

3 | 4 | 4 | 4 | 12 |

4 | 6 | 6 | 6 | 18 |

5 | 8 | 8 | 8 | 24 |

6 | 10 | 10 | 10 | 30 |

7 | 12 | 12 | 12 | 36 |

8 | 14 | 14 | 14 | 42 |

Thus, from the above solution, we can understand that if the three firms are identical, supply from each firm will also be equal.

25. A firm earns a revenue of Rs 50 when the market price of a good is Rs 10. The market price increased to Rs 15 and the firm now earns revenue of Rs 150. What is the price elasticity of the firm's supply curve?

Ans:

At Market Price, (P1) = Rs 10

Total Revenue, TR1= P1 * Q1 =50

= Q1 = TRI\ P1

Q1 = 50/10

Q1 = 5 units

At Market Price, (P2) = Rs. 15

Total Revenue, TR2 = P2 * Q2 =150

Q2 = TR2/P2

Q2 = 150/15

Q2= 10 (units)

Elasticity of supply, e, = Q \ P * P\ Q

Q =Q2 – Q1

Change in quantity = 10 – 5 = 5 units

Change in price P = P1 - P2 = 15 – 10 = Rs. 5

es = 5 / 5 * 10 / 5

es = 2

Thus, price elasticity of the firm's supply curve is 2.

26. The market price of good changes from Rs 5 to Rs 20. As a result, the quantity supplied by a firm increase by 15 units. The price elasticity of the firm's supply curve is 0.5. Find the initial and final output levels of the firm.

Ans:

Elasticity of Supply, es = 0.5

Initial Price, P1 = Rs 5

Final price, P2 = Rs 20

P =P1 - P2

= 20 - 5

P = 15 (change in price)

Q = 15 (change in quantity)

Q1 = Q + Q

0.5 = 5 / Q1

= 10 units

Initial quantity = 10 units

Final quantity, Q3 = Q + Q1

= 15 + 10

Therefore, Q1 = 25 units

27. At the market price of Rs 10, a firm supplies 4 units of output. The market price increases to Rs 30. The price elasticity of the firm's supply is 1.25. What quantity will the firm supply at the new price?

Ans:

Initial Price, P1 = Rs 10

Initial Output, Q1 = 4 units

Final Price, P2= Rs 30

P = P2 – P1

= Rs 30 – 10 = Rs 20

Elasticity of supply, es = 1.25

es = Q / 20 * 10 / 4

1.25 = Q / 20 * 10 / 4

= 1.25 * 8 = Q

=10 units

Thus, final output supplied, Q2 = Q +Q

Q2 = 10 + 4 = 14 units (quantity at new price)

Microeconomics Chapter 4 Class 12 - Free PDF Download

Microeconomics Class 12 Chapter 4 NCERT Solutions PDF is available for free with just a click. Top-notch solutions and worksheets are available in it assembled by expert instructors. By solving this study material, the student can rest assured regarding this chapter, as it covers all the vital topics. Long answers, numerical and tabular form of solutions are all well scripted making the ideas precise yet clear.

The main objective achieved through this method of learning is concreting the basics of the pupils in economics which will help them in competitive as well as school academic examinations. Having a free PDF ensures access to all students.

NCERT Solutions for Class 12 Microeconomics Chapters

Chapter 4 - The Theory of the Firm Under Perfect Competition

Class 12th Microeconomics Chapter 4 is all about the concepts of perfect competition, profit maximization, revenue, supply schedule, etc. These are basics of economics and NCERT Solutions is the most appropriate choice for a student aspiring to score well above average. With this study material handy, no students need to worry about preparing separate notes for a quick revision before examinations. By doing various types of exercises provided, students themselves can recognize the change in their approach towards the subject. Students can have a taste of the skilled approach to this field which is helpful in the future.

Microeconomics Chapter 4 Class 12 Mark Distribution.

This chapter is one of the areas where students can score best but due to the lack of basics, many find it difficult to get hold of the concept. By revising repeatedly asking questions, students can make sure that they do not miss out on any of the scoring topics. Many topics are repeatedly asked in every examination. Few questions seen to be asked can be found below.

|

Importance of Chapter 4 Microeconomics of Class 12

Solutions to all textbook questions are given with the utmost precision and quality.

Concepts are explained evidently with examples.

The whole study material is organized in such a way that all concepts complement each other. Main headings are emphasized and made clear.

Students are provided with different approaches to the same matter.

NCERT Solutions aim to make the student have a practical approach to the subject. This helps the students to visualize the concepts and to relate it to real-life instances.

Important Study Material Links for Class 12 Economics Chapter 4 - The Theory of The Firm Under Perfect Competition

S.No. | Important Study Materials Links for Class 12 Economics Chapter 4 |

1. | Class 12 The Theory of The Firm Under Perfect Competition Revision Notes |

2. | Class 12 The Theory of The Firm Under Perfect Competition Important Questions |

NCERT Solutions for Class 12 Macro Economics - Chapter-wise List

Given below are the chapter-wise NCERT Solutions for Class 12 Macro Economics. These solutions are provided by the Macro Economics experts at Vedantu in a detailed manner. Go through these chapter-wise solutions to be thoroughly familiar with the concepts.

S.No. | NCERT Solutions Class 12 Macro Economics Chapter-wise List |

1 | |

2 | |

3 | |

4 | Chapter 4 - Determination of Income and Employment Solutions |

5 | |

6 |

NCERT Solutions for Class 12 Micro Economics - Chapter-wise List

Given below are the chapter-wise NCERT Solutions for Class 12 Micro Economics. These solutions are provided by the Micro Economics experts at Vedantu in a detailed manner. Go through these chapter-wise solutions to be thoroughly familiar with the concepts.

S.No. | Chapter Wise NCERT Solutions for Class 12 Micro Economics |

1 | |

2 | |

3 | |

4 |

Additional NCERT Books for Class 12 Economics

The NCERT Books for Class 12 Economics provide a comprehensive understanding of key economic theories and concepts. These textbooks are essential resources for students preparing for their board exams, covering both microeconomics and macroeconomics in detail.

S.No. | Other NCERT Books for Class 12 Economics |

1 | |

2 |

Related Links for NCERT Solutions Class 12 Economics

These links offer direct access to detailed NCERT Solutions for Class 12 Economics. Covering both microeconomics and macroeconomics, these solutions help students understand key concepts and prepare effectively for exams.

S.No. | Related NCERT Solutions for Class 12 Economics |

1 | |

2 |

Important Related Links for CBSE Class 12 Economics

S.No | Important Resources Links for Class 12 Economics |

1 | |

2 | |

3 | |

4 | |

5 |

FAQs on NCERT Solutions For Class 12 Economics Chapter 4 The Theory Of The Firm Under Perfect Competition - 2025-26

1. Where can I find the correct, step-by-step NCERT Solutions for Class 12 Economics Chapter 4?

You can find reliable and detailed NCERT Solutions for Class 12 Economics Chapter 4, 'The Theory of The Firm Under Perfect Competition', on Vedantu. These solutions are prepared by subject experts to provide clear, step-by-step methods for every textbook question, fully aligned with the 2025-26 CBSE syllabus.

2. How do these NCERT solutions help with solving the numerical problems in this chapter?

The NCERT solutions for this chapter offer a complete breakdown of all numericals. They explain how to calculate a firm's Total Revenue (TR), Average Revenue (AR), and Marginal Revenue (MR). Each step is shown clearly, helping you understand the formulas and their application, which is crucial for exams.

3. What is the correct way to present answers for profit maximisation questions in the board exam?

To score full marks, it is essential to show the two conditions for a firm's profit maximisation, not just the final answer. The solutions demonstrate how to state that:

- Marginal Revenue (MR) must equal Marginal Cost (MC).

- The MC curve must be rising at the point of equilibrium. Following this structured approach, as shown in the solutions, is key to meeting CBSE's expectations.

4. How can I properly draw and label diagrams for supply curve shifts as required by NCERT?

Our NCERT solutions provide accurately drawn diagrams to guide you. For a supply curve shift, you must:

- Correctly label the X-axis (Quantity) and Y-axis (Price).

- Draw the initial supply curve (e.g., S1) and the new curve (e.g., S2).

- Use arrows to clearly indicate the direction of the shift (right for increase, left for decrease). This precision is vital for scoring well in diagram-based questions.

5. How does the concept of a 'price-taking' firm affect the way I solve revenue problems in this chapter?

A 'price-taking' firm in a perfectly competitive market accepts the market price as given. When solving problems, this means the market price (P) is constant for the firm. Therefore, the firm's Average Revenue (AR) and Marginal Revenue (MR) are always equal to the price (P = AR = MR). The solutions consistently apply this principle in all revenue calculations.

6. Is it necessary to practice every question from the NCERT textbook for Chapter 4?

Yes, practicing every question from the NCERT textbook is highly recommended. Board exam questions are often based directly on these exercises. Using our solutions ensures you cover all question types, from theoretical explanations of perfect competition to numericals on price elasticity of supply, leaving no gaps in your preparation.

7. Beyond just getting the answers, how can I use these solutions to truly understand the chapter concepts?

To deepen your understanding, first attempt to solve the textbook questions on your own. Afterwards, compare your method with the detailed steps in our solutions. Pay close attention to how concepts like the shut-down point, normal profit, and super-normal profit are applied in the answers. This practice connects theory to problem-solving and prepares you for higher-order thinking questions.