An Overview of Return on Investment and Return on Equity

Return on investment (ROI) and return on equity (ROE) are two essential indicators frequently used to determine success when generating money from stock investments. Although they assess different things, ROI and ROE are both significant. While ROE calculates the percentage return on invested equity, ROI calculates the percentage return on investment. In other words, ROE assesses an investment's "efficiency," but ROI measures its "profitability."

ROI and ROE analysis may come up if you're trying to add real estate to your investment portfolio. If you genuinely want to boost your returns on your portfolio, these terms will allow you to assess the strength of your investment. These performance measures are the most frequently used to gauge how well your investment is doing.

What is Return on Equity (ROE)?

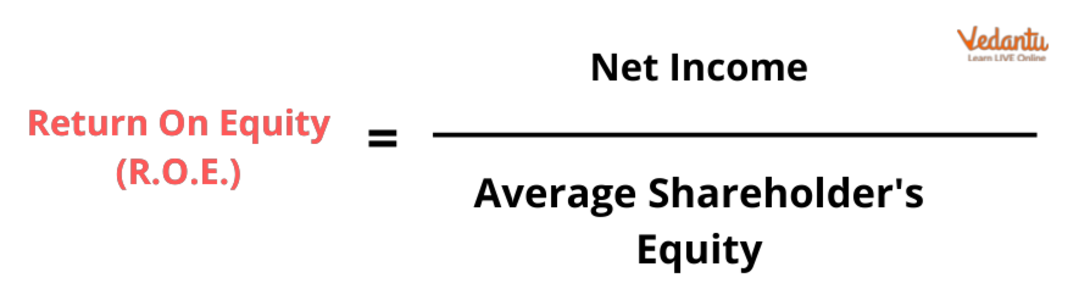

A metric of financial performance known as return on equity (ROE) is obtained by dividing net income by shareholders' equity. ROE is the return on net assets since shareholders' equity is determined by subtracting a company's debt from its assets.

ROE is regarded as a barometer of a company's profitability and how well it produces profits. The management of a firm is more effective at producing income and growth from its equity funding and the higher the ROE.

A company's net income ratio to its shareholders' equity is known as return on equity (ROE).

A company's profitability and the effectiveness of its revenue generation are measured by its return on equity (ROE).

A corporation is better at turning its equity funding into profits the higher the ROE.

Divide net income by shareholders' equity to get a return on equity (ROE).

Depending on the sector or industry in which the firm works, ROEs will change.

Calculating Return on Equity (ROE)

Any corporation may compute its ROE in percentage form if its net income or equity are also both positive figures. Before dividends to common shareholders, dividends to preferred shareholders and interest to lenders are considered when calculating net income.

The sum of a company's income, net costs, and taxes for a specific period is known as net income. Equity added at the beginning of the term is used to compute average shareholders' equity. The period's start and finish should fall within the time frame in which net income is generated.

The income statement includes net income for the most recent full fiscal year, often known as the trailing 12 months, as a total of the financial activities during that time. The balance sheet, a running balance of all changes in a company's assets and liabilities over time, is where investors may find their equity.

Due to the discrepancy between the income statement and the balance sheet, it is deemed best practice to compute ROE using average equity over a period.

ROE

What Return on Equity Tells You?

The usual ROE for a stock's peers will determine whether an ROE is considered excellent or terrible. For instance, utilities have many assets and debts on their balance sheet but only a minor net revenue. In the utility business, a typical ROE can be 10% or less. A retail or technology company with lower balance sheet accounts than net income may often have 18% or higher ROE values.

A decent rule of thumb is to aim for an ROE comparable to or slightly higher than the industry average for companies doing the same type of business. Assume, for instance, that TechCo, a corporation, has consistently maintained an ROE of 18% for the previous five years, higher than the 15% average of its rivals. Investors can conclude that TechCo's management does a better job than average of generating profits from the company's assets.

Return on Equity

How do You Define ROI?

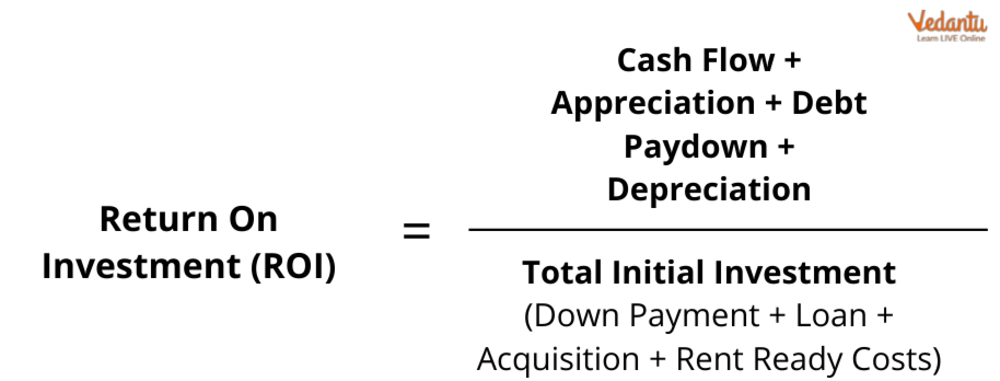

Return on investment, or ROI, is a straightforward notion that only quantifies that proportion. Return on investment may be computed by dividing the profit from an investment (in cash or shares) by the initial investment.

Return on Investment

Take a hypothetical Rs. 1,000 stock investment that yields a 10% annual return. If you invested Rs. 1,000 and generated a profit of Rs. 100, your return on investment (ROI) would be 10%.

Return on investment (ROI) is widely used since it is simple to compute and gives a clear picture of an investment's profitability. Remember that return on investment is a relative number, however. That is to say, all it can tell you is how well or poorly an investment has done in relation to other investments.

Suppose, for the sake of argument, that you have two investments:

Option A: Buying stock that increases in value by 10%

Option B: A 20%-profitable stock investment

Even if the returns on both investments are 10%, Investment B is obviously the better choice. This is why additional measures, such as return on equity (ROE), are typically employed with ROI.

The Formula for Return on Investment

Formulas for determining a return on investment are as follows:

Determine the company's net profit for the year. To determine pretax profit, we must first deduct fixed and variable overhead. After taxes are removed, this is the business's net profit.

Count the money it will take to make a profit. To start an investment, a corporation must spend a certain amount. Assuming the corporation put 20% down, or Rs. 80,000, on a Rs. 400,000 property using a conventional business loan, the investment cost is Rs. 80,000.

Divide net ROI by investment cost. The return on investment may be expressed as a decimal by dividing the two amounts. The formula for converting this number to a percentage is as follows: (number) x (100).

Difference between ROI and ROE

ROI and ROE are two useful performance indicators that aid in determining how strong or effective a business or investment is in generating profits. Consequently, the return on investment formula (ROI) is crucial for evaluating how successfully (or poorly) a firm operates. What is ROI in business is a performance metric used to evaluate a company's or investment's profitability by accounting for earnings or losses concerning the investment's cost. On the other hand, return on equity (ROE) is a financial term that measures a company's profitability concerning its equity.

Purpose

Even though these phrases are essential, they cannot be used interchangeably since they have different meanings. ROI aims to describe the profit generated from a business choice or investment. The goal of measuring an investment's profitability is determining how well it will generate money for your company. This is why ROI calculations are used. Rather than measuring the return on the company's investment, ROE evaluates the shareholder investment return. The goal of calculating ROE is to assess how much profit a business makes concerning its shareholders' equity.

Difference between ROI and ROE

Conclusion

The variables that affect a company's earnings are Return on Equity and Return on Investment. They may be computed in a variety of ways and have a significant influence in deciding how the industry develops. They both have benefits and drawbacks. For a firm to operate well, it has to have an income rate two times higher than its debt. Otherwise, there is a greater risk of difficulties for the business.

FAQs on ROI and ROE: Calculating Returns on Investment and Equity

1. What is the fundamental difference between Return on Investment (ROI) and Return on Equity (ROE)?

The fundamental difference lies in what each ratio measures. Return on Investment (ROI) assesses a company's overall profitability by measuring the returns generated on the total capital employed (both debt and equity). In contrast, Return on Equity (ROE) specifically measures the rate of return generated for the company's owners or equity shareholders on their investment amount.

2. How do you calculate ROI and ROE using the standard formulas for the 2025-26 session?

As per the CBSE 2025-26 syllabus, the formulas are:

Return on Investment (ROI) = (Net Profit before Interest, Tax, and Dividend / Capital Employed) x 100. Here, Capital Employed includes both Shareholders' Funds and Non-Current Liabilities.

Return on Equity (ROE) = (Net Profit after Tax / Shareholders' Equity) x 100. This focuses only on the profit available to equity holders.

3. Can you provide a simple example to show the calculation for ROI and ROE?

Certainly. Imagine a company with a Net Profit After Tax of ₹50,000 and Shareholders' Equity of ₹4,00,000. Its Profit Before Interest and Tax is ₹80,000 and its Total Capital Employed is ₹5,00,000.

ROE Calculation: (₹50,000 / ₹4,00,000) x 100 = 12.5%.

ROI Calculation: (₹80,000 / ₹5,00,000) x 100 = 16%.

4. Why is a high Return on Equity (ROE) considered an important indicator for investors?

A high ROE is important because it indicates that the company's management is highly effective at using the money invested by shareholders to generate profits. For an investor, a consistently high or growing ROE suggests:

Efficient Profit Generation: The company is skilled at turning equity financing into net income.

Potential for Growth: Profits can be reinvested (retained earnings) to fuel further growth without diluting ownership.

Higher Shareholder Value: Strong profitability often translates into higher dividends and an increased stock price over time.

5. How does a company's debt level (capital structure) influence its Return on Equity (ROE)?

A company's debt level significantly influences its ROE through a concept called financial leverage or 'Trading on Equity'. If a company can earn a higher Return on Investment (ROI) than the interest rate it pays on its debt, the excess profit goes to the equity shareholders. This magnifies the return on their equity. For example, if ROI is 15% and the interest on debt is 10%, using more debt can boost ROE. However, this also increases financial risk, as high debt payments must be made regardless of profit levels.

6. What is generally considered a “good” ROI or ROE, and why does it differ across industries?

While there's no universal number, a common benchmark for a good ROE is often considered to be between 15% and 20%. However, this benchmark is highly contextual. These ratios differ across industries because of varying business models and capital requirements.

Capital-intensive industries like manufacturing or utilities may have lower ROIs due to large asset bases.

Technology or service-based industries with fewer physical assets might show much higher ROIs and ROEs.

Therefore, it is most meaningful to compare a company's ROI and ROE against its direct competitors and its own historical performance.

7. Can a company have a high ROE but a low ROI? What would this combination signify?

Yes, it is possible for a company to have a high ROE and a relatively low ROI. This situation typically signifies that the company is using a significant amount of debt in its capital structure. The low ROI indicates that its core operations are not exceptionally profitable relative to its total asset base. However, by successfully using financial leverage (where the return on assets is greater than the cost of debt), it can magnify the returns available to equity shareholders, resulting in a high ROE. This can be a high-risk strategy.