Reissue of Shares Meaning

When some of the shareholders are unable to pay allotment money or call money, their shares are forfeited by the company. After the forfeiture, the company can reissue the shares. In this type of issue, neither prospectus is issued, nor an offer is made by the company.

The company can reissue the shares of previous allottees at par, at a premium, or discount. Usually, these shares are reissued at a discount (at a price less than the face value of the share).

Reissue of Forfeited Shares

The company forfeits shares because a part of the due amount of such shares is received, and the balance remains unpaid. On forfeiture, the allotment of the member holding shares is cancelled. Therefore, the company can reissue the forfeited shares at any price, but it should not be less than the amount in arrears of such shares.

For example - A paid Rs.5 as application money for a share having a nominal value of Rs.100. On his failure to pay further allotments, the company forfeited his shares. So, the amount the company has in arrears is Rs.6. The company can reissue the shares at a price more than Rs.6.

Reissue of Shares

Share Forfeiture and Reissue Entry

On the Forfeiture of Shares

Equity Share Capital Account Dr.

To Equity Share First Call Account

To Equity Share Second Call Account

To Share Forfeiture Account

On Reissue of Shares

At Par

Bank Account Dr.

To Equity Share Capital Account

At a Premium

Bank Account Dr.

To Equity Share Capital Account

To Securities Premium Reserve Account

At Discount

Bank Account Dr.

Share Forfeiture Account Dr.

To Equity Share Capital Account

Example - XYZ Ltd. forfeits 200 equity shares of Rs.10 each issued at par for non-payment of the first call @ Rs.3 per share and the second and final call @ Rs.2 per share. The shares are reissued as fully paid-up @ Rs. 8 per share. Give the journal entries.

The Profit on Reissue of Forfeited Shares is Transferred to

Any amount of profit on the reissue of forfeited shares is a capital receipt. The amount should be transferred to the capital reserve account because this profit is the capital gain for the company.

The company can treat the credit balance in the Share Forfeiture Account until it reissues such shares. That’s the reason why companies reissue forfeited shares at a discount to adjust the Share Forfeiture Account.

Conclusion

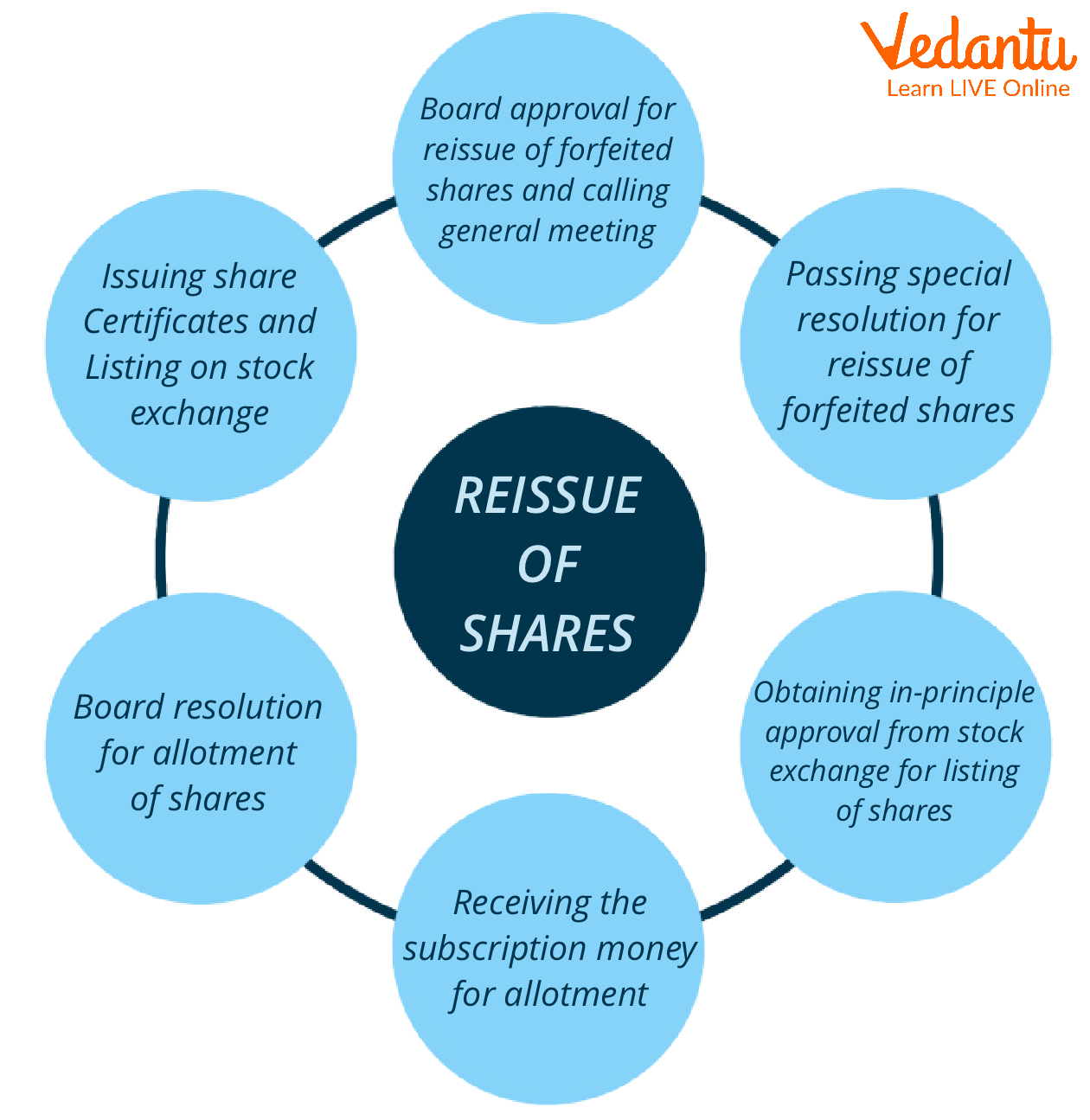

Forfeited shares are available for sale by the company. The company is under obligation to reissue those shares. The company can reissue the shares as per the agreed terms and conditions. The company is required to pass a resolution in its Board Meeting regarding the same. Moreover, the company can conduct auctions to dispose of the forfeited shares. The reissue is merely concerned with the sale of shares. It does not mean reissuing shares in the share market. These can be sold to another person or company.

FAQs on Reissue of Forfeited Shares: Process and Examples

1. What are the important journal entries a student must know for the forfeiture and reissue of shares, a frequently asked topic in board exams?

For the CBSE Class 12 Accountancy exam 2025-26, mastering the following entries is crucial.

1. On Forfeiture of Shares:

Share Capital A/c Dr. (With amount called-up on forfeited shares)

To Share Forfeiture A/c (With amount already received)

To Calls-in-Arrears A/c (With amount unpaid)

2. On Reissue of Forfeited Shares (at a discount):

Bank A/c Dr. (With reissue price)

Share Forfeiture A/c Dr. (With the discount amount)

To Share Capital A/c (With the paid-up value)

3. Transfer of Gain to Capital Reserve:

Share Forfeiture A/c Dr.

To Capital Reserve A/c

2. What is the minimum price at which a company can reissue forfeited shares? Explain this important concept with an example.

The minimum reissue price for a forfeited share is the amount that was unpaid on that share before forfeiture. The rule is that the total amount received for the share (original amount paid + reissue price) must not be less than its face value.

For example, if a share with a face value of ₹10 was forfeited after the shareholder paid ₹6, the unpaid amount is ₹4. The company can reissue this share for a minimum of ₹4. The discount on reissue (maximum ₹6) cannot exceed the amount already credited to the Share Forfeiture Account for that share.

3. Solve a frequently asked problem type: A company forfeited 300 shares of ₹10 each (fully paid) for non-payment of a final call of ₹2. Later, 200 of these shares were reissued at ₹9 per share. Calculate the amount transferred to the Capital Reserve.

This is a typical 3-mark question that tests proportional calculation. Here is the step-by-step solution:

- Amount forfeited per share: ₹10 (Face Value) - ₹2 (Unpaid Call) = ₹8.

- Total amount in Share Forfeiture A/c: 300 shares x ₹8/share = ₹2,400.

- Forfeited amount on 200 reissued shares: 200 shares x ₹8/share = ₹1,600.

- Discount on reissue of 200 shares: ₹1 (₹10 Face Value - ₹9 Reissue Price) x 200 shares = ₹200.

- Gain on reissue transferred to Capital Reserve: ₹1,600 (Forfeited amount on reissued shares) - ₹200 (Discount) = ₹1,400.

4. For exam purposes, why is the profit on reissue of forfeited shares considered a capital gain and not a revenue profit?

Understanding this distinction is key for conceptual clarity. The profit on the reissue of forfeited shares is treated as a capital gain because it does not arise from the company's normal day-to-day business operations. Instead, it results from a transaction related to the company's capital structure. As per accounting principles, such non-recurring, capital-nature profits must be transferred to the Capital Reserve and are not available for distribution as dividends to shareholders.

5. How does reissuing forfeited shares at a discount not violate the Companies Act, 2013, which generally prohibits issuing fresh shares at a discount?

This is a Higher Order Thinking Skills (HOTS) question. The reissue of forfeited shares is not considered a fresh issue of capital. It is essentially the sale of shares held by the company. The 'discount' on reissue is not a loss; it is an adjustment using the amount already paid by the original shareholder and forfeited by the company. The crucial condition is that the sum of the reissue price and the amount already forfeited must not be less than the share's face value, ensuring no actual loss to the company's capital.

6. What is the most important calculation principle to remember for 5-mark questions where only a part of the forfeited shares are reissued?

The most critical principle is the proportional transfer of profit. You can only transfer the gain related to the shares that have actually been reissued to the Capital Reserve. The profit related to the forfeited shares that are yet to be reissued must remain in the Share Forfeiture Account. To calculate the gain, you must first determine the amount forfeited on the specific shares being reissued and then subtract the discount given on their reissue.

7. What are the expected journal entries for reissuing forfeited shares at par, premium, and discount for the 2025-26 board exam?

A student must be prepared for all three scenarios, which are highly expected in exams:

- At Par: The reissue price equals the paid-up value.

Bank A/c Dr.

To Share Capital A/c - At a Premium: The reissue price is more than the paid-up value.

Bank A/c Dr.

To Share Capital A/c

To Securities Premium Reserve A/c - At a Discount: The reissue price is less than the paid-up value.

Bank A/c Dr.

Share Forfeiture A/c Dr. (with the discount amount)

To Share Capital A/c