Open Market Operation: An Introduction

Open market operations (OMO) are actions a central bank takes to control the money supply, such as open market purchases and sales of short-term Treasury securities and other securities. The Federal Reserve (Fed) uses open market operations to influence interest rates in the United States, specifically the federal funds rate used for interbank lending. Buying securities puts money into the economy, which lowers interest rates and makes loans more available.

Open Market Operations

What are Open Market Operations?

The selling and buying of Treasury Bills and other Government Securities by a country's Central Bank in order to control the amount of money in the economy are known as open market operations.

Open market operations are a part of central banks' most important monetary control methods. When the central bank wants to reduce the market's money supply, it sells securities on the open market. The intention is to raise interest rates. This approach is also known as contractionary monetary policy.

Similarly, when the central bank wants to increase the amount of money on the market, it will buy securities. This action is being taken to lower interest rates and promote the nation's economic growth. This strategy is known as expansionary monetary policy.

Types of Open Market Operations

Types of Open Market Operations

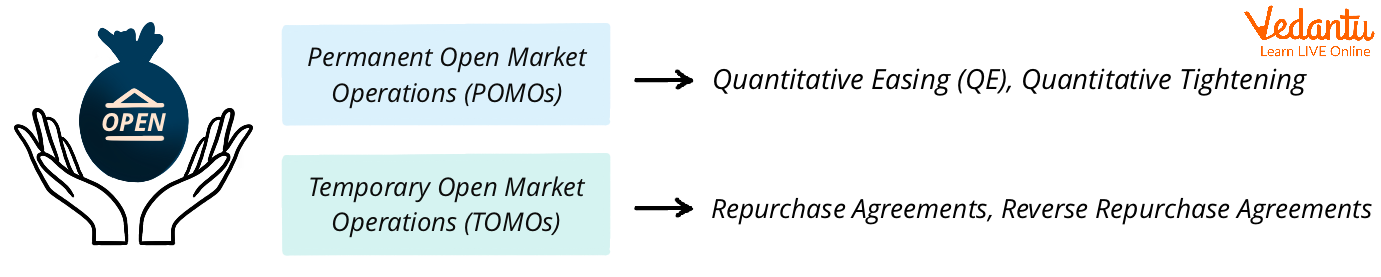

The two types of open market activities are permanent open market operations and transient open market operations.

Permanent Open Market Operations (POMO): These involve the central bank of any country selling and buying securities or treasuries on the open market in order to change the money supply. It is a means of influencing the economy.

Temporary Open Market Operations: These are used to add or subtract reserves from or into the banking system on a short-term basis. Repurchase agreements, also known as Repos or reverse repurchase agreements, or RRPs, are used for short-term open market transactions.

Example: RBI’s Role in Open Market Operation

The Reserve Bank of India conducted open market operations for the first time in 2019. In India, the RBI regulates OMOs by buying and selling G-Secs, government securities, in and out of the market. The main goal is to change the rupee's market liquidity conditions in the long term. When the RBI determines that there is more than adequate liquidity in the market, it sells securities and reduces rupee liquidity. On the other hand, the Reserve Bank of India purchases from the open market when it perceives a liquidity constraint.

Case Study

Explain with an example of a federal bank engaging in outright open market operations.

Understanding how the Federal Reserve of the United States sets monetary policy is critical to comprehending open market operations in India. The United States is the best open market operations example for us to understand the many nuances of free market activities. In order to preserve the stability of the US economy and avoid the negative effects of inflation or deflation, the Federal Reserve Board establishes a goal known as the federal funds rate. Federal funds rates are the interest rates that banks charge one another for overnight loans. Due to this consistent flow of enormous sums of money, banks can ensure that their cash reserves are sufficient to meet client demands.

In addition to serving as a benchmark for other interest rates, the federal funds rate determines the direction of a variety of interest rates, including those on credit cards, mortgages, and savings accounts.

Conclusion

We could conclude that open market processes are critical components of an economy. They are required to maintain a consistent and controlled flow of funds into the market. The Federal Reserve uses open market operations to raise or lower interest rates by buying and selling securities in the open market. They are one of the tools available of the Federal Reserve for accelerating or decelerating the nation's economic activity. Through open market operations, the Federal Reserve injects or removes money into the country's money supply.

FAQs on Open Market Operations: Meaning and Mechanism

1. What are Open Market Operations (OMOs) in the context of the CBSE Class 12 Economics syllabus for 2025-26?

Open Market Operations (OMOs) are a key quantitative monetary policy tool used by a country's central bank, like the Reserve Bank of India (RBI). It involves the outright purchase and sale of government securities and treasury bills in the open market to regulate the total money supply in the economy. This action directly influences the cash reserves of commercial banks, thereby affecting their lending capacity.

2. How does the mechanism of an Open Market Operation work to control the money supply?

The mechanism of OMOs depends on the economic objective:

- To increase money supply (Expansionary Policy): The central bank purchases government securities from commercial banks. This injects liquidity into the banking system, increasing the banks' cash reserves and enabling them to lend more.

- To decrease money supply (Contractionary Policy): The central bank sells government securities. Commercial banks buy them, transferring their cash to the central bank. This absorbs excess liquidity, reduces the banks' reserves, and curbs their ability to extend credit, which helps control inflation.

3. What are the main types of Open Market Operations?

There are two primary types of OMOs:

- Permanent OMOs (POMO): These involve the outright and permanent purchase or sale of securities to have a lasting impact on the money supply and support long-term economic growth.

- Temporary OMOs: These are used for short-term adjustments in liquidity. They are typically conducted through repurchase agreements (Repo) and reverse repurchase agreements (Reverse Repo), which are temporary and reversible in nature.

4. What is the primary objective of the RBI when conducting Open Market Operations?

The primary objective of the RBI is to manage the liquidity in the financial system on a day-to-day basis. By doing so, it aims to steer short-term interest rates and signal its overall monetary policy stance. Ultimately, these operations are used to achieve broader macroeconomic goals like stabilising prices (controlling inflation) and ensuring financial stability.

5. Can you provide a simple example of how an OMO is used to tackle inflation?

Certainly. If an economy is facing high inflation, the Reserve Bank of India (RBI) will decide to reduce the money supply. It will conduct an OMO by selling government securities in the market. Commercial banks purchase these securities, and the payment for them is transferred from their accounts to the RBI. This directly reduces the cash reserves of commercial banks, limiting their capacity to lend money and helping to bring inflation under control.

6. How do Open Market Operations differ from other monetary tools like the Bank Rate?

The key difference lies in their mechanism of action. Open Market Operations directly target the quantity of money (or liquidity) in the economy by adding or removing funds from the banking system. In contrast, the Bank Rate is an interest rate at which the central bank lends to commercial banks. It influences the cost of credit indirectly. OMOs are generally considered more flexible and faster to implement for managing daily liquidity fluctuations.

7. What are the main advantages and limitations of using OMOs?

OMOs have several distinct advantages and limitations.

- Advantages: They are precise and flexible, allowing the central bank to control the exact volume of liquidity. Their effects are quick, and the operations can be easily reversed if needed. The initiative lies entirely with the central bank.

- Limitations: Their success heavily depends on the existence of a well-developed and active securities market. They can sometimes conflict with the central bank's debt management objectives. Furthermore, they are generally more effective in controlling economic booms than in pulling an economy out of a severe recession.

8. How do Open Market Operations by the RBI affect interest rates and the overall economy?

When the RBI buys securities through OMOs, it increases liquidity. With more funds available, commercial banks tend to lower their lending rates to encourage borrowing. Lower interest rates stimulate investment and consumption, boosting overall economic activity. Conversely, when the RBI sells securities, it reduces liquidity, leading to higher interest rates, which can slow down the economy and curb inflation.

9. Who is responsible for conducting Open Market Operations in India?

In India, the Reserve Bank of India (RBI) is the sole authority responsible for conducting Open Market Operations. The RBI carries out these transactions directly with commercial banks and other large financial institutions, not with the general public.

10. Why is a developed securities market essential for the effectiveness of OMOs?

A developed securities market is crucial because it ensures there is a broad and active base of buyers and sellers for government securities. This depth and liquidity allow the central bank to conduct large-scale purchase or sale operations without causing extreme price fluctuations or disrupting the market. Without such a market, the central bank's actions would not be transmitted smoothly and effectively through the financial system.