An Introduction to Commodity Market

The commodity market plays a crucial role in the world economy. Designing policy frameworks that support the economic goals of sustainable growth, alleviating poverty, inflation stability, food production, and climate change mitigation requires an understanding of what drives developments in these markets.

The macroeconomic influence of commodity markets on emerging markets and developing economies is varied, and the relationship between economic growth and commodity demand varies significantly between nations depending on their level of economic development.

Commodity Market

What is the Commodity Market?

A market where commodities are purchased and sold is referred to as a commodity market. Commodities are products or goods that can be exchanged on any global market. There are marketplaces for various raw resources, including wheat, steel, coffee, lumber, corn, oil, and other physical items like gold, silver, diamonds, and other precious metals.

Types of Commodities

Types of Commodities

Commodities can be categorised into two broad categories:

Hard Commodities: Hard commodities are those that are needed by the manufacturing sectors of the economy. These commodities are derived naturally. These are manually taken from the land or the water and should be mined.

Examples: coal, gold, crude oil, gasoline, rubber, etc.

Soft Commodities: Soft commodities comprise goods that are typically livestock or agricultural goods. In contrast to hard commodities, they are produced using suitable methods rather than being mined or extracted.

Examples: wheat, corn, barley, pork, tea, etc.

Commodities Traded in the Commodity Market

Commodity Traded in Commodity Market

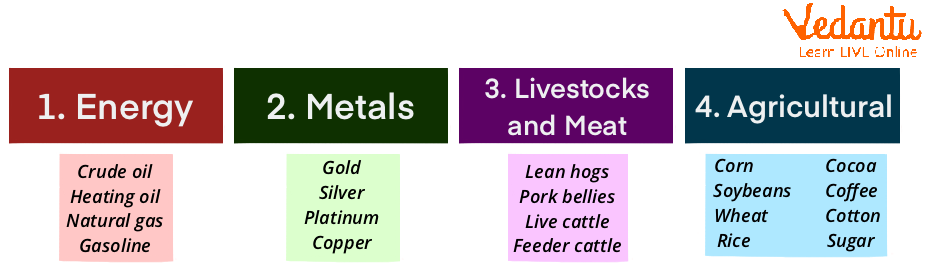

The following are some commodities that are actively traded in the commodity market:

Energy: Due to the widespread distribution of electricity provided by power grids, developed nations have built markets where it is possible to sell electric capacity.

Lumber: Construction lumber in common sizes is traded on specialised marketplaces by specialised brokers. These markets are used by businesses that sell and buy lumber to reduce the amount of inventory that needs to be kept or to meet unexpected spikes in demand.

Wheat: Wheat is a crop that is grown all over the world and has always piqued the interest of investors because it is one of the most vital dietary ingredients. Without owning actual tonnes of wheat, traders can engage in the agricultural markets by trading wheat in the commodity market.

Stamps: Stamps that are considered collectable can be exchanged on active markets by investors and enthusiasts alike. Grading systems are used to determine the worth and condition of the stamps that are being traded.

Gold: The most valued of all precious metals, gold is bought for its beauty, liquidity, investment potential, and industrial properties. In times of economic unrest, gold is regarded as a safe haven commodity and as a hedge against inflation. Most newcomers and experienced traders alike prefer to invest in gold when it comes to commodities trading.

Coffee: The market for coffee is enormous. Coffee is a soft commodity and the second-largest commodity traded globally after oil. Other than water and tea, it is the most consumed beverage worldwide.

How are World Commodity Market Live Prices Decided?

Compared to financial assets, commodities are very volatile investments. They are influenced by natural elements like floods or calamities in addition to geopolitical conflicts, economic expansions, and recessions.

Similar to stock securities, the forces of supply and demand in the market essentially influence the price of commodities. For instance, in the live commodity US market, the price of a barrel of oil declines as the supply does. On the other hand, if demand for oil rises, the live commodity price of the US market does as well.

Two alternative methods are used to quote commodity prices. The market price or market futures price, which is the price that is reported in the news live, is the first. The cash cost of a commodity is its spot price, on the other hand. On the day of purchase, dealers paid this price for the commodity.

Case Study

The commodities exchange is the legal institution that determines, controls, and upholds the policies and processes for trading commodities, such as the standardised commodity contracts and other associated investment products. The trading of different commodities and derivatives takes place in an organised market.

One can trade commodities in India by visiting one of the more than 20 exchanges that make this possible, all of which are regulated by the Securities and Exchange Board of India. The market was governed by the Forward Markets Commission until 2015, when SEBI and it amalgamated to form a single regulatory framework for commercial investing.

1. How many commodity exchanges are there in India? Name some commodity exchanges for trading in India.

Ans. There are 22 separate commodities exchanges in India that were established by the Forward Markets Commission. There are 6 well-known commodity exchanges in India:

National Commodity and Derivative Exchange (NCDEX)

Multi Commodity Exchange of India (MCX)

National Stock Exchange (NSE)

Bombay Stock Exchange (BSE)

National Multi Commodity Exchange India (NMCE)

Indian Commodity Exchange (ICEX)

Summary

The commodity market is a market that involves buying and selling of raw materials and primary products. Commodities can be classified into two different categories: Soft Commodities and Hard Commodities. Soft commodities include agricultural goods, including sugar, corn, wheat, coffee, tea, and livestock. Hard commodities like metals, rubber, coins, and oil are mined or extracted. Energy, lumber, wheat, stamps, gold, and coffee are some of the actively traded comodities in the commodity market. The forces of demand and supply are the main factor in deciding the world commodity market's live price.

FAQs on Introduction to the Commodity Market

1. What is a commodity market?

A commodity market is a physical or virtual marketplace for buying, selling, and trading raw or primary products. Unlike the stock market where you trade shares of companies, this market deals with commodities, which are essential goods from the primary economic sector, such as agricultural products (wheat, coffee), energy resources (crude oil, natural gas), and metals (gold, copper).

2. What are the main categories of commodities traded in the market?

Commodities are generally classified into four main categories based on their nature and origin:

Metals: This includes precious metals like gold and silver, and industrial or base metals like copper and aluminium.

Energy: This category consists of crucial energy sources such as crude oil, natural gas, and coal.

Agriculture: This is a broad category that includes soft commodities like sugar, cotton, and coffee, as well as grains like wheat and corn, and livestock.

Bullion: It specifically refers to precious metals in the form of bars or ingots, such as gold and silver, valued by weight.

3. Can you provide some examples of commonly traded commodities?

Certainly. Some of the most actively traded commodities in the world include:

Gold (XAU): A precious metal used for investment and jewellery.

Crude Oil (Brent/WTI): A primary global energy source.

Wheat: A staple food grain traded worldwide.

Copper: An essential industrial metal used in construction and electronics.

Natural Gas: A key resource for heating and electricity generation.

Coffee: One of the most popular soft commodities.

4. What are the two main types of commodity markets?

The commodity market is primarily divided into two types:

Spot Market: Also known as the 'cash' or 'physical' market, this is where commodities are bought and sold for immediate payment and delivery. The transaction happens 'on the spot'.

Derivatives Market: This market involves trading financial contracts (like futures and options) whose value is derived from an underlying commodity. Traders use these contracts to speculate on future price movements or to hedge against risks, often without ever taking physical possession of the commodity.

5. What is the key difference between the commodity market and the stock market?

The key difference lies in the underlying asset being traded. In the stock market, you buy and sell shares, which represent ownership (equity) in a public company. In the commodity market, you trade actual raw materials or contracts based on them. Essentially, you are investing in a company's performance in the stock market, whereas you are investing in the price movement of a physical good in the commodity market.

6. Who are the primary participants in the commodity market and what are their roles?

The two primary participants are hedgers and speculators:

Hedgers: These are typically producers (like farmers or mining companies) or consumers (like manufacturers) of commodities. They participate in the market to manage risk. For example, a farmer might sell a futures contract to lock in a price for their crop before it's harvested, protecting them from a potential price drop.

Speculators: These are traders who aim to profit from price fluctuations. They buy or sell commodity contracts based on their predictions of future price movements. Speculators provide essential liquidity to the market, making it easier for hedgers to find buyers or sellers for their contracts.

7. How do speculators and hedgers create a functional market together?

Hedgers and speculators have a symbiotic relationship that is crucial for a healthy commodity market. Hedgers want to transfer their price risk to someone else. Speculators are willing to assume that risk in the hope of making a profit. By doing so, speculators provide the necessary capital and liquidity, ensuring there is always a counterparty available for a hedger's trade. This balance allows for efficient price discovery and risk transfer, which are the core functions of the market.

8. What is the primary function of the commodity market in an economy?

The primary function of the commodity market is to facilitate price discovery and risk management for essential raw materials. It allows the forces of supply and demand to determine a fair market price for goods, providing a transparent benchmark for producers and consumers globally. Furthermore, it enables those exposed to price volatility, like farmers and airlines, to hedge their risks, which contributes to economic stability.

9. Why are commodity prices often considered more volatile than stock prices?

Commodity prices can be more volatile because they are directly influenced by factors that affect physical supply and demand, which can be unpredictable. These factors include:

Weather events: Droughts, floods, or hurricanes can instantly impact agricultural output.

Geopolitical tensions: Conflicts or political instability in major oil-producing regions can cause sharp price spikes.

Supply chain disruptions: Issues with shipping, storage, or transportation can create shortages or surpluses.

Seasonality: Agricultural commodities have specific growing and harvesting seasons that affect their availability and price throughout the year.

Stock prices, while also volatile, are primarily tied to a company's earnings, management, and industry trends, which can sometimes be more insulated from such immediate physical-world events.