What is the Friedman Doctrine?

Milton Friedman's theory is sometimes called the ‘Shareholder Theory’. The Friedman Doctrine has a few different names. According to this view of business ethics, "an entity's primary duty resides in the happiness of the shareholders," created by American economist Milton Friedman, the company should put shareholder interests first. Therefore, the company should continually try to raise its sales to benefit its owners.

In Friedman's view, the shareholders represent the organisation's lifeblood and need special consideration. To maximise profits, a company must seek avenues for expanding its revenue base via activities like value creation and product expansion, all while keeping expenses as low as possible. Instead of having an outsider make essential choices like funding for social activities, Friedman argued that shareholders should have such authority.

All About Milton Friedman's Doctrine

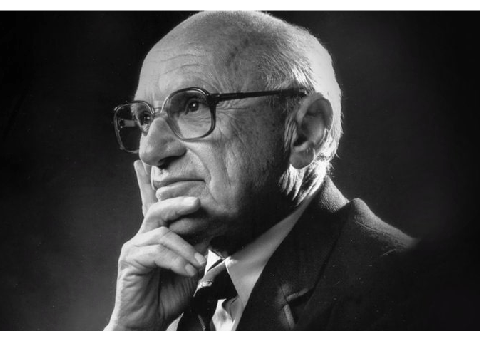

Who Was Milton Friedman?

All About Milton Friedman

American statistician and economist, Milton Friedman was a proponent of unrestricted capitalism and freedom and a prominent figure in developing the Chicago School's fiscal and monetary policy approach. For his work regarding analysing consumer behaviour, developing a theory of money, and illuminating the complexities of stabilisation policy, he was awarded the Nobel Prize in economics in 1976.

Friedman has written several books, the most famous of which are titled "Capitalism and Freedom." In 1988, President Reagan presented him with the Medal of Freedom. With his fellow monetarists, Friedman took on the Keynesian establishment by arguing for a return to a free market, including reduced government or deregulation in most sectors of the economy.

When Friedman passed away in 2006 at the ripe old age of 94, the Wall Street Journal obituary said that his ideas had "reshaped contemporary capitalism" and "laid the conceptual underpinnings for the anti-inflation, tax-cutting, or anti-government policies" of President Ronald Reagan or British Prime Minister Margaret Thatcher.

Is Capitalism the Same as a Free Market?

The Economy in a Free Market Tends to Boom

There are a few distinct varieties of economic systems, two of which are a capitalist economy and a free market economy. The two phrases are often confused, particularly in everyday conversation. However, even though they have specific characteristics, the two aren't the same thing at all.

The rule of supply and demand, which serves as the foundation for determining the price of products and services and their production, lies at the root of the capitalist and free market capitalism economic systems.

However, they are not the same thing at all. The differences between free markets and capitalist economies may be summarised as follows: the former emphasises the development of new wealth and the ownership of the capital and tools of production, while the latter emphasises the trading of existing wealth.

What Did Milton Friedman Believe?

An American economist who favoured less government regulation and a freer market was Milton Friedman. Friedman rejected the Keynesian theory in favour of monetarism, emphasising the significance of monetary policy and that changes in the money supply had immediate and permanent impacts.

Did You Know?

American economist Milton Friedman supported monetarism. According to monetarism, the amount of money the government prints affects the economy. He prefers that the government print the same amount of money each year.

Born to Hungarian-Jewish parents in Brooklyn, NY. Rahway, NJ, was his hometown. Friedman attended Rutgers, Columbia, and Chicago. He co-founded the Chicago school of economics with George Stigler.

Milton Friedman's monetarism gained favour in the 1970s, and he became Reagan's economic counsellor.

Friedman said the government should restrict economic control.

He opposed conscription and believed ending it was his proudest achievement.

Friedman expressed his ideas through films, books, and interviews for decades. Capitalism and Freedom and Free to Choose were his best-known publications.

Friedman, 94, died in San Francisco of heart failure. His wife and children survived him. His ashes were strewn in San Francisco Bay.

Conclusion

The United States' very own Milton Friedman was honoured with the Nobel Prize in Economics. Many people believe that the present monetarist economic movement would not be possible if it were not for the ideas and research that was offered by him. This is a viewpoint that is held by many people. Friedman is considered a founding member of the Chicago School of Monetarist Economics and is known to be a prominent person in the field of economics. He has been called a leading figure in the field.

FAQs on Milton Friedman's Economic Theory Explained

1. What is the main idea behind Milton Friedman's economic theory?

Milton Friedman's main economic theory is known as monetarism. It argues that the amount of money in an economy (the money supply) is the most important factor affecting economic activity and inflation. He championed free-market capitalism and believed that government intervention in the economy should be minimal.

2. What did Friedman mean when he said inflation is a monetary phenomenon?

When Milton Friedman said, "Inflation is always and everywhere a monetary phenomenon," he meant that prices rise consistently only when the government prints money faster than the economy grows. In his view, inflation is not caused by unions or greedy businesses, but by an excessive increase in the money supply controlled by the central bank.

3. What is the Friedman Doctrine, or his theory on corporate social responsibility?

The Friedman Doctrine, also known as the Shareholder Theory, states that a company's only social responsibility is to increase its profits for its shareholders. He argued that as long as a company stays within the law and engages in open and free competition, its primary goal should be shareholder value, not solving social problems.

4. How does Friedman's monetarism differ from Keynesian economics?

The main difference lies in their view of the government's role in managing the economy. Here’s a simple comparison:

- Keynesian Economics: Argues that the government should actively use spending and taxes (fiscal policy) to manage economic downturns and control unemployment.

- Friedman's Monetarism: Argues that such government intervention is often harmful and destabilising. Instead, he advocated for a steady, predictable increase in the money supply and letting free markets operate with minimal interference.

5. Besides money supply, what other free-market policies did Milton Friedman support?

Milton Friedman advocated for many policies designed to increase individual freedom and reduce government control. Some well-known examples include a voluntary military, free-floating exchange rates, abolishing medical licensing, and implementing school vouchers to give parents more choice in education.

6. Was Milton Friedman against all forms of government intervention in the economy?

No, this is a common misconception. While he advocated for a very limited role, Friedman believed the government was essential for certain functions. These included enforcing the law, protecting property rights, and providing a basic social safety net, which he proposed in the form of a negative income tax. His main goal was for the government to set the 'rules of the game' and then let the market play.

7. Why did Friedman believe a steady, predictable growth in the money supply was so important?

Friedman argued that a steady and predictable monetary policy creates economic stability. When businesses and individuals know what to expect from the central bank, they can make long-term plans with confidence. Sudden, unpredictable changes in the money supply, he believed, create economic shocks that lead to recessions and high inflation, disrupting the natural function of the market.

8. What makes Milton Friedman one of the most influential economists of the 20th century?

Milton Friedman's influence comes from how he fundamentally challenged the Keynesian consensus that dominated economic policy after World War II. His ideas on monetarism and free markets gained widespread acceptance during the high inflation of the 1970s. He won the Nobel Prize in Economic Sciences in 1976, and his work directly influenced the economic policies of world leaders like Margaret Thatcher in the UK and Ronald Reagan in the US.