Classical Theory of Employment: An Overview

In Britain, classical economics theory began in the late 18th century. Adam Smith popularized the concept in his book Wealth of Nations, which promoted the laissez-faire philosophy, free trade, and competition to stimulate economic growth.

Classical economists include Adam Smith, Jean-Baptiste Say, David Ricardo, Thomas Robert Malthus, and John Stuart Mill.

The neoclassical model emphasizes the supply and demand relationship as the primary driving force behind the production and consumption of goods and services.

Keynesian economic theory encourages government intervention in the economy.

Meaning of Classical Economics

Markets, according to classical economics, work best on their own. According to this, the government should not meddle too much. Adam Smith served as an example of this school of economic theory in his 18th-century publications. Adam Smith, a Scottish political economist and philosopher, is widely regarded as the Father of Economics.

Demand changes in response to supply changes, according to classical economics. As a result, the economy is always striving for equilibrium.

Others who contributed to classical economics besides Smith, classical economists list are given below:

David Ricardo is a political economist from the United Kingdom.

Jean-Baptiste Say, a French businessman and economist

Rev. Thomas Robert Malthus, a British scholar and cleric

John Stuart Mill is a political economist and government official from the United Kingdom.

Many writers preferred Smith's open markets to protectionism. Smith lived during a time when protectionism was widely accepted and practiced. A protectionist government seeks to reduce imports by enacting quotas, taxes, and other restrictions.

Classical Economics Versus Keynesian Economics

In the 1930s, Keynesian economics emerged as an alternative to classical economics. Keynesian economists advocate limiting the money supply and spending deficits. They also advocate a graduated income tax to combat the recession and wealth disparities.

According to Keynesian theory, the private sector occasionally engages in actions that are harmful to the economy. When this happens, the government should step in.

Traditional economists oppose Keynesian economics. They argue that government intervention exacerbates recessions.

Classical Economics versus Keynesian Economics

Traditional economists blame the Great Recession on government intervention. The Great Recession followed the global financial crisis of 2007-2008. Classical economists warn that America's future is in jeopardy unless it changes course.

Classical economists believe that the market should have complete freedom to set commodity and wage prices. They argue that supply can create demand on its own. Alternatively, output will generate enough revenue to make purchases.

Classical economics uses the Model T Ford as an example of this concept. The Ford Motor Company manufactured the Model T from 1908 to 1927. In reality, it was the first low-cost automobile.

Case Study: Classical Economics as an Example

Israel has emerged as a prime example of how fundamental principles of the traditional economic model generate economic development. Despite the fact that many tourists have visited recently to explore its historical and cultural treasures, the nation's administration has implied the sound science of economics. They advocated for a knowledge economy and a free market. The economy is currently dominated by the technology and industrial manufacturing sectors. Being one of the world's top 25 richest countries has been made possible by economic liberalization and significant investments in the technology sector.

Conclusion

This article has aided in the definition of classical economics. The principles of traditional economic theory, their variations, and some concrete examples are discussed here. Classical economic principles continue to have a significant impact in the current economic climate. Some classical economic ideas have somewhat effective applications in various aspects of our daily lives.

FAQs on Classical Theory Explained with Examples

1. What is the Classical Theory of Economics, and who were its main proponents?

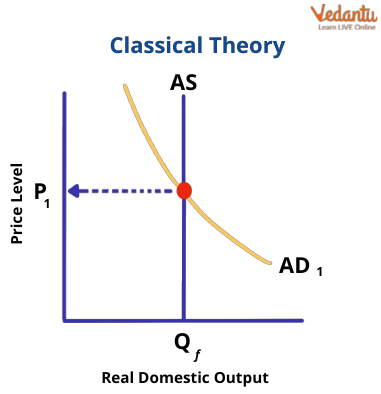

The Classical Theory of Economics is a school of thought that emerged in the late 18th and early 19th centuries, primarily in Britain. It posits that a free-market economy, with minimal government intervention, will automatically adjust to achieve full employment of its resources. Its major proponents include economists like Adam Smith, who introduced the concept of the 'invisible hand', David Ricardo, known for his work on comparative advantage, and Jean-Baptiste Say, who formulated Say's Law of Markets.

2. What are the core assumptions of the Classical economic model?

The Classical theory is built on several key assumptions about how an economy functions. These include:

Full Employment: The belief that the economy naturally tends toward a state where everyone willing to work at the prevailing wage rate is employed.

Wage-Price Flexibility: The assumption that wages and prices are flexible and will adjust quickly to shifts in supply and demand, ensuring markets clear.

Say's Law of Markets: The principle that “supply creates its own demand,” meaning the production of goods generates sufficient income to purchase them.

Laissez-Faire Policy: The advocacy for minimal government intervention, as the free market's 'invisible hand' is the most efficient allocator of resources.

3. How does the Classical Theory of Economics differ from Keynesian Economics?

The primary difference lies in their view on government intervention and the economy's ability to self-correct. Classical economics argues for a laissez-faire approach, trusting that flexible wages and prices will automatically return the economy to full employment. In contrast, Keynesian economics, which emerged in response to the Great Depression, argues that economies can get stuck in prolonged periods of high unemployment. It advocates for active government intervention, such as increased government spending, to manage aggregate demand and stabilise the economy.

4. What does Say's Law of Markets mean, and why is it a cornerstone of Classical theory?

Say's Law of Markets is the principle that “supply creates its own demand.” It suggests that the very act of producing goods and services generates an equivalent amount of income (in the form of wages, rent, and profit) for workers and entrepreneurs. This income is then used to purchase the goods and services produced. It is a cornerstone of Classical theory because it implies that a general overproduction or a deficiency in aggregate demand is impossible, thereby reinforcing the idea that the economy will always gravitate towards full employment equilibrium without needing external intervention.

5. How does the assumption of wage-price flexibility ensure an economy self-corrects according to Classical economists?

According to Classical theory, wage-price flexibility is the key automatic adjustment mechanism. For example, if there is unemployment (an excess supply of labour), wages will fall. This lowers production costs for firms, making it profitable for them to hire more workers, thus eliminating unemployment. Similarly, if there is an oversupply of a certain product, its price will drop, which encourages more consumers to buy it and discourages further production until the market clears. This flexible response of wages and prices is believed to ensure that both labour and product markets always find their equilibrium point naturally.

6. Can you provide a real-world example of a policy influenced by Classical economic thought?

A modern example of a policy influenced by Classical economics is the deregulation of industries. For instance, when governments remove price controls, reduce licensing requirements, or privatise state-owned enterprises in sectors like aviation or telecommunications, they are operating on the Classical principle that free markets and competition lead to greater efficiency, innovation, and consumer benefits than government control. The emphasis on free trade agreements to reduce tariffs and non-tariff barriers also stems directly from the Classical belief in laissez-faire.

7. Why did the Great Depression of the 1930s pose a major challenge to the Classical theory?

The Great Depression was a significant blow to Classical theory because it presented a real-world scenario of prolonged, high unemployment that the theory claimed was impossible. According to Classical logic, the economy should have self-corrected quickly. However, unemployment remained high for years, suggesting that wages and prices were not flexible downwards as assumed (a concept later termed 'sticky wages'). This persistent disequilibrium showed that the market's 'invisible hand' was not enough to restore full employment, paving the way for the Keynesian revolution in economic thought which focused on managing aggregate demand.

8. What are the main criticisms levelled against the Classical Theory of Income and Employment?

The main criticisms of the Classical theory, largely highlighted by J.M. Keynes, include:

Unrealistic Assumption of Full Employment: Critics argue that economies can and do experience long-term involuntary unemployment.

Failure of Say's Law: The law ignores the fact that people can save a portion of their income. If these savings are not immediately channelled into investment, aggregate demand will be less than supply.

Inflexibility of Wages: In reality, wages tend to be 'sticky' downwards due to factors like labour union contracts and minimum wage laws, preventing the market from clearing during a downturn.

Neglect of Aggregate Demand: The theory's strong focus on the supply side fails to account for the crucial role of overall demand in determining the levels of income and employment.