An Overview of Activity and Profitability Ratios

Using financial ratios, one financial number is expressed concerning another. Financial ratios may help with forecasting, stock selection, firm valuation, and security valuation.

Financial ratios may be categorised using different criteria. Although the titles of these categories and the measures each contains might differ greatly, activity, liquidity, solvency, profitability, and valuation ratios are often used. Every type evaluates a separate element of a business. All areas are crucial to assess a company's total capacity to produce cash flows from its business activities.

Asset utilisation ratios and operating efficiency ratios are other names for activity ratios. They assess how successfully a business manages its many assets and other day-to-day operations. These ratios often incorporate data from the balance sheet and income statement in the numerator and denominator.

Activity & Profitability Ratios

What is an Activity Ratio?

A financial indicator called an activity ratio shows how effectively a firm uses the assets on its balance sheet to produce revenue and cash. Analysts, also known as efficiency ratios, use activity ratios to assess a company's inventory management practices, which are crucial to its operational flexibility and overall financial health.

Any form of financial indicator that aids investors and research analysts in determining how effectively a firm uses its assets to create sales and cash is called an activity ratio.

Activity ratios can be used to compare two companies operating in the same industry or to track the financial health of a single organisation over time.

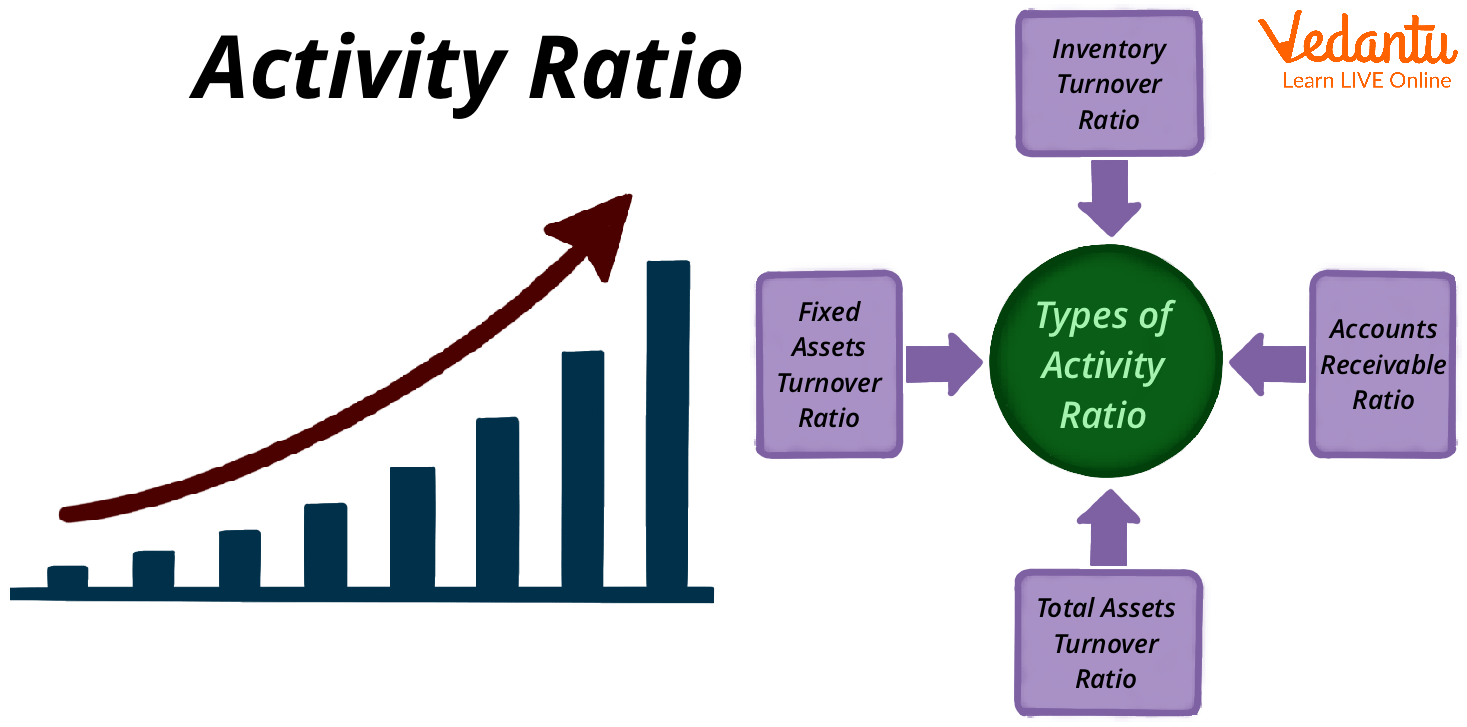

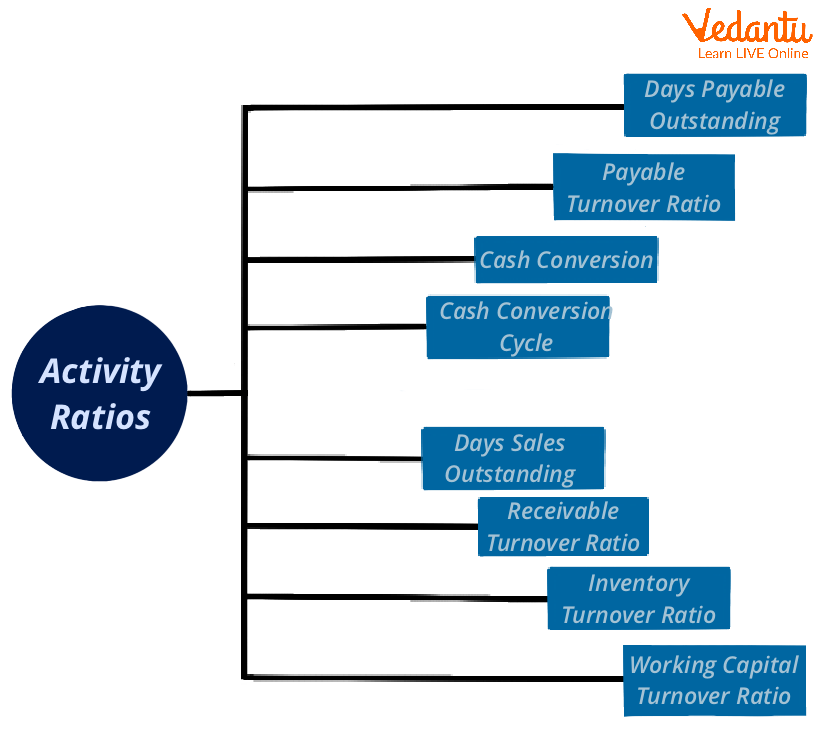

Activity ratios can be further broken down into assessments of return on equity, total asset turnover, inventory turnover and various other indicators.

Activity Ratio

Activity Ratios

Activity ratios are beneficial when used to compare two firms that are competitors in the same industry to see how one company compares to its rivals. Activity ratios, however, may also be used to monitor a company's financial performance across several recording periods and identify changes over time. These figures may be plotted to show a potential performance picture for a corporation.

The Following Subcategories of Activity Ratios Exist:

1. Accounts Receivable Turnover Ratio - An organisation's capacity to collect money from its clients is determined by its accounts receivable turnover ratio. The average statements receivable amount is multiplied by the total credit sales during a specific time. A low ratio indicates a problem with the collecting procedure.

2. The Merchandise Inventory Turnover Ratio - The turnover ratio for goods inventories is a statistical indicator of how frequently new stock is purchased and sold within a specific time frame. The average inventory is subtracted from the cost of goods sold during a given time frame. The numbers should be high for a corporation to move its stock quickly.

3. The Total Asset Turnover ratio - The efficiency with which a company utilises its assets to make a sale is gauged by the total assets turnover ratio. To determine how well a firm uses its resources, total sales are divided by total assets. Smaller percentages could suggest that a business is having trouble moving its goods.

4. Income from Equity - The earnings generated from shareholder equity are measured by a performance indicator called return on equity (ROE). Net income is divided by the total number of outstanding stock shares in the market to arrive at ROE.

Activity Ratio

What are Profitability Ratios?

Profitability ratios are a group of financial measurements used to evaluate a company's profitability of its revenue, operational expenses, balance sheet assets, or shareholders' equity at a single moment in time. Efficiency ratios, which look at how well a firm utilises its resources to create revenue, may be contrasted with profitability ratios (as opposed to after-cost profits).

Which Types of Profitability Ratios Exist?

Companies may get valuable insight into their financial health and performance with the help of a variety of profitability statistics. Generally speaking, these proportions fall into two broad classes:

Margin Ratios: A company's capacity to turn revenues into profits is measured by margin ratios. All examples are examples of the margin of production, including gross margin, operating margin, net margin, cash flow margin, EBIT, EBITDA, EBITDAR, NOPAT, operating cost ratio, and overhead ratio.

Return Ratios: The return ratio measures the efficiency with which a corporation returns capital to its investors. Returns on assets, equity, cash, debt, retained profits, revenue, risk-adjusted return, invested capital, capital employed, and return on capital employed are all types of returns. (Total Revenue - Total Expenses) / Total Revenue.

Examples

One of the most common tools in the toolbox of a financial analyst is the profitability ratio, which can be broken down into two broad classes: margin ratios and return ratios. From several perspectives, margin ratios provide information about a business's capacity to convert sales into profits. Various methods assess a company's ability to create a profit for its shareholders by looking at its return ratios.

Profit margin, return on assets (ROA), and return on equity (ROE) are all examples of profitability ratios (ROE). Return on capital employed (ROCE) and return on invested capital (ROIC) are two others (ROCE).

Activity Ratios Vs. Profitability Ratios

Fundamental analytical methods like activity and profitability ratios assist investors in assessing many dimensions of a company's financial health. Efficiency ratios determine how well a corporation uses its resources to produce profits, whereas a list of profitability ratios shows how much money a company makes. A list of Profitability ratios can assist analysts in comparing a firm's earnings to those of its competitors in the same industry and following the development of the same company across multiple reporting periods.

Activity Ratio vs Profitability Ratio

Conclusion

A business's run may be predicted by looking at its activity ratio, which gauges how rapidly assets can be converted into cash or sales. Departments of management and accounting can assess their effectiveness using a variety of activity ratios. Inventory turnover and total asset turnover are the two most common ratios. Analysing and comparing ratios with other companies in the sector is usually advised. Most businesses frequently aim for a more significant percentage or value since doing so typically indicates that the company is operating profitably and creating cash flow.

FAQs on Activity and Profitability Ratios Explained

1. What are Activity Ratios and why are they important for a business?

Activity Ratios, also known as Turnover Ratios or Efficiency Ratios, are financial metrics that measure how efficiently a company is using its assets to generate revenue and cash. They are important because they provide insight into the operational efficiency of a business. By analysing these ratios, management can identify areas of poor asset utilisation, such as slow-moving inventory or inefficient collection of receivables, and take corrective action.

2. What are Profitability Ratios and what do they indicate about a company's performance?

Profitability Ratios are financial metrics used to assess a business's ability to generate earnings relative to its revenue, operating costs, balance sheet assets, and shareholders' equity. They indicate the overall efficiency and performance of a company. A higher profitability ratio generally suggests that the company is effective at converting its sales and assets into actual profits for its shareholders.

3. What is the key difference between how Activity Ratios and Profitability Ratios are used in financial analysis?

The key difference lies in their focus. Activity Ratios focus on operational efficiency—they measure how well a company utilises its assets (like inventory or accounts receivable) to generate sales. In contrast, Profitability Ratios focus on financial effectiveness—they measure the company's ability to generate profits from its sales and investments. In simple terms, Activity Ratios look at the 'speed' of operations, while Profitability Ratios look at the 'outcome' or profit from those operations.

4. What are the common types of Profitability Ratios, explained with their formulas?

Several Profitability Ratios are used to analyse a company's performance. The main types as per the CBSE curriculum include:

- Gross Profit Ratio: Measures the margin on sales. Formula: (Gross Profit / Revenue from Operations) × 100.

- Operating Ratio: Measures the proportion of costs associated with business operations. Formula: (Cost of Revenue from Operations + Operating Expenses) / Revenue from Operations × 100.

- Net Profit Ratio: Shows the percentage of revenue that remains after all expenses, including taxes, have been deducted. Formula: (Net Profit after Tax / Revenue from Operations) × 100.

- Return on Investment (ROI): Measures the overall profitability of the business. Formula: (Net Profit before Interest, Tax, and Dividend / Capital Employed) × 100.

5. How does a high Inventory Turnover Ratio (an Activity Ratio) signal operational efficiency?

A high Inventory Turnover Ratio indicates that a company is selling its goods quickly. This is a strong signal of operational efficiency because it means that capital is not tied up in slow-moving stock. Quick inventory turnover minimises holding costs (like storage and insurance), reduces the risk of inventory becoming obsolete or expiring, and improves cash flow. It suggests strong sales performance and effective inventory management.

6. Is a higher ratio always better for both Activity and Profitability Ratios? Explain with an example.

No, a higher ratio is not always better, especially for Activity Ratios. While a higher Profitability Ratio (like Net Profit Ratio) is almost always desirable, an extremely high Activity Ratio can signal underlying problems. For example, a very high Debtor Turnover Ratio might indicate an overly aggressive or strict credit policy. This could drive away potential customers who prefer more flexible payment terms, ultimately hurting sales and market share.

7. Can you explain the Debtor Turnover Ratio and Working Capital Turnover Ratio with their significance?

Certainly. Both are key Activity Ratios:

- Debtor Turnover Ratio: This ratio measures how efficiently a company collects its credit sales (accounts receivable). Its formula is Net Credit Sales / Average Trade Receivables. A higher ratio indicates prompt collection from debtors, which improves a company's liquidity.

- Working Capital Turnover Ratio: This ratio shows how effectively a company is using its working capital to generate sales. Its formula is Revenue from Operations / Working Capital. A high ratio indicates efficient use of working capital, but an excessively high ratio might suggest that the business is under-capitalised and facing a risk of overtrading.

8. How can a manager use the Net Profit Ratio to make strategic business decisions?

A manager can use the Net Profit Ratio to assess the overall profitability and efficiency of the business after all expenses and taxes. By tracking this ratio over time, a manager can identify trends. A declining ratio might prompt a detailed review of all costs, both operational and non-operational, to find areas for cost reduction. It also helps in setting performance benchmarks, comparing profitability with competitors, and making strategic decisions about pricing, cost control, and business expansion.