Determination of Income and Employment Class 12 important questions with answers PDF download

FAQs on Important Questions For Class 12 Macro Economics Chapter 4 Determination of Income and Employment - 2025-26

1. What are the most important areas to focus on when preparing for board mark questions in CBSE Class 12 Macro Economics Chapter 4: Determination of Income and Employment?

The most important areas include Aggregate Demand and its components, Consumption and Saving Functions, Equilibrium Income determination, Multiplier effect, Inflationary and Deflationary Gaps, and measures to correct excess or deficient demand. These topics consistently feature in board exams, often in 3- and 6-mark questions as per CBSE trends.

2. How does CBSE structure HOTS (Higher Order Thinking Skills) questions for Chapter 4, and how should students approach them?

HOTS questions typically require application of concepts beyond definitions. For example, you may need to interpret an economic scenario, calculate using formulas (like the multiplier), or evaluate the effectiveness of monetary tools. To score well, break the question into steps:

- Identify what the question is testing (concept or calculation).

- Write all relevant formulas (e.g., multiplier K = 1/(1-MPC)).

- Justify each step in your reasoning.

3. Which question types from Chapter 4 are most frequently asked for 3-mark and 4-mark sections in board exams?

Commonly repeated types include:

- Explaining differences (e.g., ex-ante vs ex-post investment; voluntary vs involuntary unemployment).

- Interpreting formulae (e.g., write and explain S = –a + (1–b)Y).

- Simple numericals on equilibrium income and multiplier.

- Steps for correcting demand gaps using policy tools.

4. Why is understanding the relationship between APC and APS critical for scoring in board exams?

Average Propensity to Consume (APC) and Average Propensity to Save (APS) are vital because their relationship shows how national income is distributed between consumption and saving. Board questions often ask direct relations (APC + APS = 1) or apply these to scenarios. Mastering the formula and its economic reasoning ensures full marks in related exam questions.

5. How can students avoid common calculation mistakes in investment multiplier numericals during board exams?

To avoid losing marks:

- Always use MPC (not MPS) in the formula K = 1/(1–MPC).

- Plug in the correct values with units (e.g., Rs. or lakhs).

- Apply each step sequentially and check your multiplication/division.

- For multi-step questions, clearly state intermediate results.

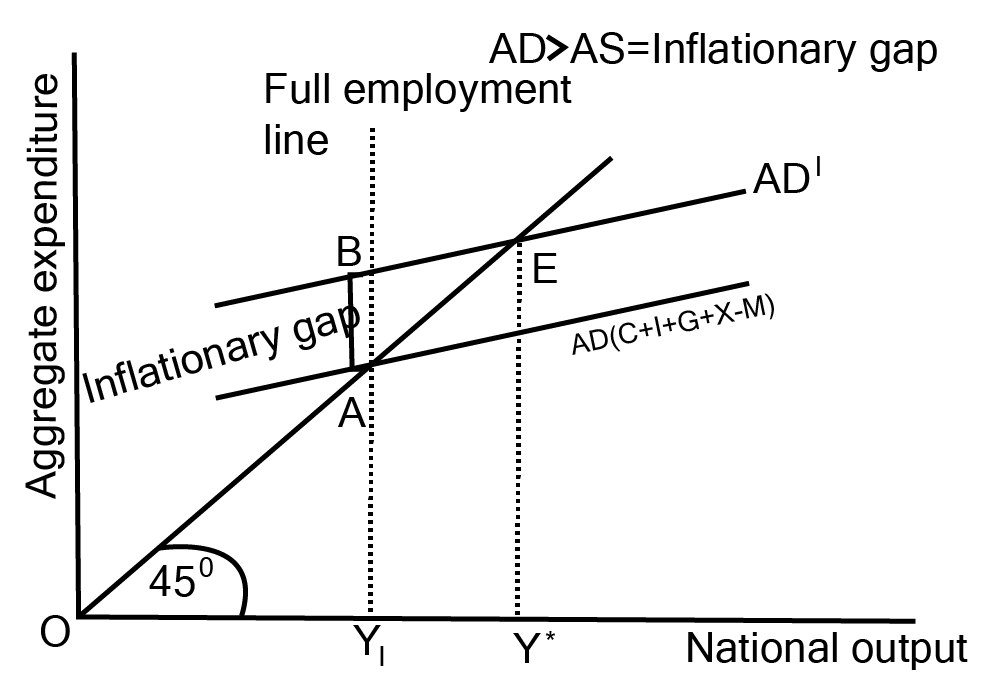

6. What key concepts should be included when answering a 6-mark question on the inflationary or deflationary gap for CBSE exams?

Your answer should cover:

- Definition of the gap (inflationary: excess demand; deflationary: deficient demand).

- Relevant formula or diagram (aggregate demand and supply intersection).

- Causes and economic impact.

- Monetary and fiscal policy tools to correct the gap, explaining each (e.g., changes in CRR/SLR, open market operations, government spending).

7. In exam scenarios, how should students distinguish between voluntary and involuntary unemployment as required by CBSE?

Voluntary unemployment occurs when people choose not to work at the current wage. Involuntary unemployment means individuals are willing to work at the prevailing wage but cannot find jobs. Exam answers should define both, give clear examples, and possibly relate to their role in full employment equilibrium—as often required by CBSE’s 3-mark and 4-mark questions.

8. What strategies should be followed to efficiently tackle long-answer (6-mark) board questions from this chapter?

For long answers:

- Structure your response with headings or numberings (definition, explanation, diagram where required, real-world example, and conclusion).

- Highlight key concepts in bold or underline during revision.

- Connect each point to the question’s requirement using CBSE’s marking scheme (like distinguishing between causes, effects, and remedies).

9. How can misconceptions about the working of the multiplier lead to loss of marks, and how can they be avoided in exam answers?

Frequent misconceptions include believing the multiplier effect is instant or ignoring leakages (taxes, savings, imports). To avoid losing marks:

- Explain that the multiplier operates in successive rounds of spending until equilibrium is reached.

- State that any leakages reduce the final impact.

- Always use MPC accurately in the calculation.

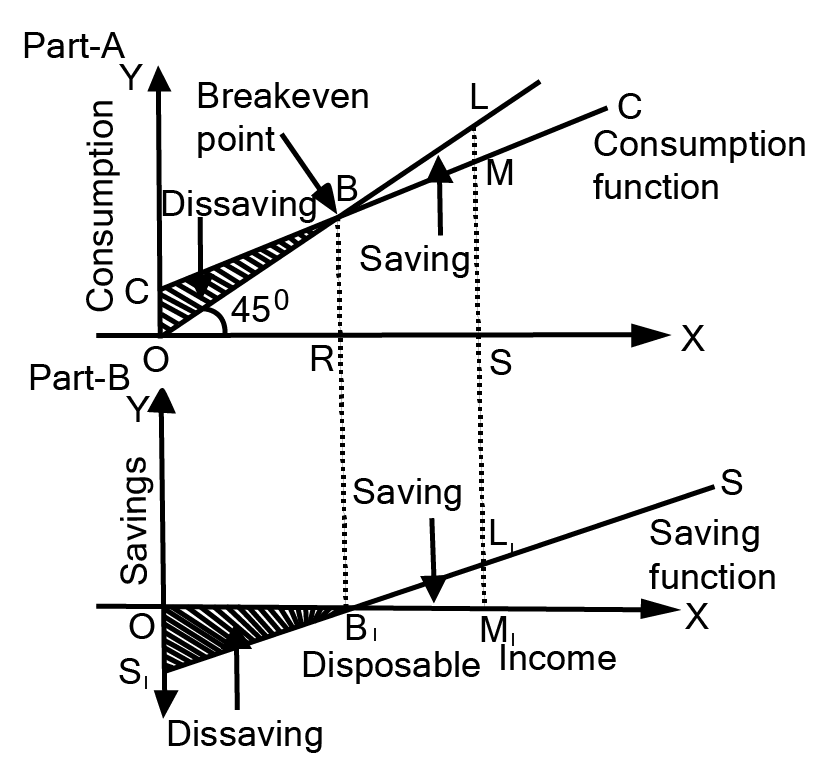

10. What is the significance of the break-even point on the consumption function curve in the context of board marking?

The break-even point is where income equals consumption (Y = C), meaning saving is zero. This is a crucial marking point in diagram and explanation questions, especially when identifying or deriving the saving function from the consumption curve, as per CBSE requirements.

11. How can students interpret and solve numerical problems involving equilibrium income for maximum board marks?

Follow a systematic process:

- Write the key formula (Y = C + I, or extended for additional components).

- Substitute the given values carefully, maintaining stepwise clarity.

- Show calculation for income as well as, if asked, related values like consumption or saving.

12. Why are questions related to correcting excess and deficient demand so important for board exams?

These questions test both theoretical understanding and practical application of macroeconomic policy. Students must know the various tools (like CRR, SLR, open market operations, government expenditure) and explain how each tool works to restore equilibrium. Their frequent appearance and alignment with current economic issues make them essential for revision and scoring high in board assessments.

13. How should diagrams for savings and consumption functions be labeled and explained in long-answer questions?

Diagrams must include:

- X and Y axes clearly labeled (Income, Consumption/Saving).

- 45° line (where income equals consumption).

- Curves for both consumption and saving functions.

- Breakeven point and intercepts explained in text.

14. What type of analytical reasoning might the CBSE expect in 4-mark HOTS questions related to Chapter 4?

CBSE often expects:

- Interpreting the effects of changes in macro variables (like investment, interest rate, or government policy) on national income and employment.

- Applying formulas in new or unfamiliar scenarios.

- Comparing theoretical models to real-world examples or recent economic situations.

15. What are the current exam trends for selection and distribution of important questions from Chapter 4, according to the CBSE 2025–26 syllabus?

Recent papers tend to balance between short answer conceptual queries (1–2 marks), application-based calculation questions (3–4 marks), and detailed analytical or policy-focused questions (6 marks). Key areas include multiplier, demand and supply equilibrium, gaps (inflationary/deflationary), and policy correction tools. Preparing sample answers for each type improves overall scoring potential in the board exam context.