How to Calculate Simple Interest: Step-by-Step Guide

When we take a loan from a bank, all the banks charge a rate of interest at which the money is borrowed. Here, we will learn about the simple interest banks put when we lend money from them. But first, we need to understand the term interest, and then we shall learn the Simple Interest. After learning about simple interest concepts, we will go through some simple interest word problems.

What is Interest?

The cost of borrowing money is defined as interest.

Banks, private lenders, etc., all use it.

It is calculated using a predetermined percentage often chosen or specified by the party giving the loan.

The Principal Amount refers to the total amount borrowed.

When we borrow money and subsequently repay it, we pay back the principal sum and the computed additional interest sum.

A borrower is the one who takes out the loan.

A lender is an individual who disburses the funds.

Interest can be of 2 types-

Simple interest

Interest and Deposit Cycle

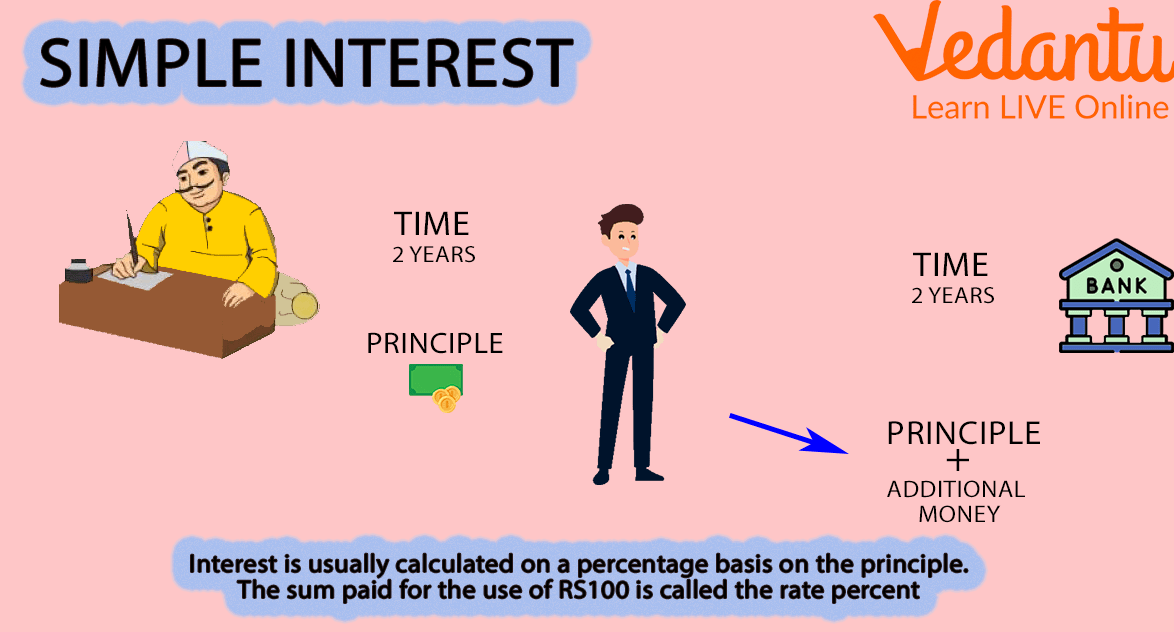

Concept of Simple Interest

Simple interest is an interest rate calculated on the principal amount or the portion of the principal that is still owed.

It does not take compounding into account.

Simple interest may be used on a schedule other than annually, such as every month, week, or even every day.

Simple Interest Representation

All Formulas of Simple Interest

Below are all formulas of simple interest that have been discussed in detail.

Mathematically,

Simple interest (S.I.) = $\dfrac{P \times R \times T}{100}$

Where

P= Principal amount which is to be borrowed

R= Rate of interest fixed by the person who is giving a loan

T= Time in years

It can also be written as

2. $P=\dfrac{S I \times 100}{R \times T}$

3. $R=\dfrac{S I \times 100}{P \times T}$

$T=\dfrac{S I \times 100}{P \times R}$

$S.I.=A-P$

Where S.I. is a Simple interest

A is the amount

P is the Principle

With the help of the above two formulas, we can solve simple interest word problems.

Below are the simple interest questions with solutions which can clear the simple interest concepts.

Simple Interest Questions with Solutions

Q 1. What is the interest paid on Rs. 5430/- for 3 years, at 10%?

Choose the correct options:

Rs. 610 /- per annum

Rs. 1030 /- per annum

Rs. 1629 /- per annum

Rs. 500 /- per annum

Ans: Given:

$\mathrm{P}=5430$

$\mathrm{R}=10 \%$

$\mathrm{~T}=3 \text { years } \%$

Simple interest (S.I.) $=\dfrac{P \times R \times T}{100}$ S.I. $=\dfrac{5430 \times 10 \times 3}{100}$

S.I. $=1629 /-$ per annum

Q 2. Richard deposited 5800 and got back an amount of 7000 after a year. Find the simple interest he got.

Ans: Principal (P)= 5800, Amount $(A)= 7000$

S.l. $=\mathrm{A}-\mathrm{P}$

Where S.I. is a Simple interest

$A$ is the amount

$\mathrm{P}$ is the Principle

$=7000-5800= 1200$

Q 3. Seth invested a certain amount of money and got back an amount of Rs 9000. If the bank paid interest of Rs 700, find the amount Sam invested.

Ans: Amount $(A)= 9000$,

Simple Interest (S.I.) $= 700$

S.I. $=\mathrm{A}-\mathrm{P}$

Where S.I. is a Simple interest

$A$ is the amount

$P$ is the Principle

So $P=A-S I$

$=9000-700=7300$

Therefore, Seth invested $7300$.

Q 4. David deposited 20000 for 5 years at a rate of 8% p.a. Find the interest and amount David got.

Ans: Principal $(P)= 20000$,

Time $(T)=5$ years,

Rate $(R)=8 \%$ p.a.

Where S.I. is a Simple interest

$A$ is the amount

$P$ is the Principle

Therefore acc. To this question, $A=P+S I$

$=10000+800= 18000$

Therefore, the amount David got was $18000$.

Simple Interest Problems for Practice

Q 1. How much time will it take to yield Rs. 8000/- on Rs. 28200/-, if the rate of interest is 8.0%?

A. 2.5 years

B. 4 years

C. 2.3 years

D. 3 years

Ans: 4 years (Option B)

Q 2. If Rs. 5 becomes Rs. 12 in 20 years at simple interest, what will be the rate % p.a.?

Ans: 7%

Summary

Money cannot be borrowed for free in the real world. You frequently need to take out a loan from a bank to borrow money. In addition to the loan amount, you must pay back additional funds based on the loan amount and the time you borrowed the money. We refer to this as simple interest. In the given article, the topic of simple interest and related word problems are discussed, including the definition and all the formulas.

FAQs on What Is Simple Interest?

1. What is simple interest in basic terms?

Simple interest is a straightforward method for calculating the interest charge on a loan or investment. It is calculated only on the original principal amount and does not include interest on the interest that has accrued in previous periods. This means the amount of interest earned or paid is the same for each time period.

2. What is the formula used to calculate simple interest?

The formula to calculate simple interest (SI) is:

SI = (P × R × T) / 100

Where:

- P stands for the Principal, which is the initial amount of money borrowed or invested.

- R stands for the Rate of interest per year, expressed as a percentage.

- T stands for the Time, which is the duration for which the money is borrowed or invested, usually in years.

3. Can you provide an example of how simple interest works?

Certainly. Suppose you borrow ₹5,000 from a friend at a simple interest rate of 8% per year for 3 years. Using the formula SI = (P × R × T) / 100:

SI = (5000 × 8 × 3) / 100 = ₹1,200.

This means that over 3 years, you will pay ₹1,200 in interest. The total amount to be repaid will be the principal plus the interest, which is ₹5,000 + ₹1,200 = ₹6,200.

4. What is the main difference between simple interest and compound interest?

The primary difference lies in how the interest is calculated after the first period. Here's a simple breakdown:

- Simple Interest: Is always calculated on the original principal amount, regardless of how much time has passed. The interest earned each year is constant.

- Compound Interest: Is calculated on the principal amount plus the accumulated interest from previous periods. This is often called “interest on interest,” and it causes the investment or loan to grow at a faster rate.

5. Why does the principal amount not change in simple interest calculations?

The principal amount remains constant in simple interest because, by definition, the interest is calculated only on the initial sum of money. Any interest that is earned is kept separate and is not added back to the principal to earn further interest in subsequent periods. This linear approach is the key feature that distinguishes it from compound interest, where the principal grows over time.

6. In what real-world scenarios is simple interest most commonly used?

Simple interest is most often used for short-term loans and financial products where the calculation needs to be straightforward. Common examples include:

- Automobile loans or financing.

- Short-term personal loans from banks or credit unions.

- Retail instalment contracts, like when buying appliances or furniture on credit.

- Certain types of bonds.

7. What is the meaning of 'Amount' in simple interest problems?

In the context of simple interest, the 'Amount' (A) refers to the total sum of money that is to be paid back to the lender or will be received by the investor at the end of the loan or investment period. It is the sum of the original principal and the simple interest earned. The formula is:

Amount (A) = Principal (P) + Simple Interest (SI)

8. What are the advantages of simple interest for a borrower?

For a person taking a loan, simple interest has a key advantage: predictability and lower cost over time compared to compounding. Since interest is only charged on the original principal, it's easier to calculate the total amount owed. Furthermore, it prevents the rapid escalation of debt that can occur with compound interest, where you end up paying interest on the interest itself.