Download Class 11 Accountancy NCERT Solutions PDF

FAQs on NCERT Solutions For Class 11 Accountancy - 2025-26

1. How are the NCERT Solutions for Class 11 Accountancy structured for the 2025-26 session?

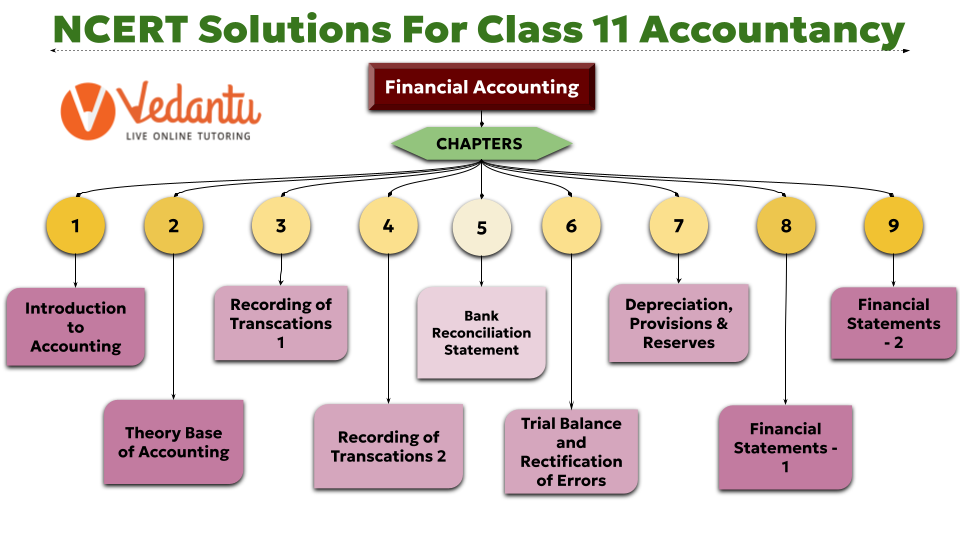

The NCERT Solutions for Class 11 Accountancy are structured according to the latest CBSE syllabus for 2025-26 and are divided into two main parts to cover the entire curriculum comprehensively:

- Part I - Financial Accounting: This section focuses on the foundational principles of accounting. The solutions provide step-by-step methods for chapters like Introduction to Accounting, Theory Base of Accounting, Recording of Transactions, Bank Reconciliation Statement, and Depreciation.

- Part II - Financial Accounting: This section builds on the fundamentals by covering the preparation and analysis of Financial Statements, including complex adjustments.

This two-part structure ensures a logical progression from basic concepts to their practical application in preparing financial reports.

2. What is the correct method for preparing a Bank Reconciliation Statement as per the Class 11 NCERT Solutions?

The NCERT Solutions demonstrate a systematic method for preparing a Bank Reconciliation Statement (BRS). The key steps involve:

- Starting with the balance as per the Cash Book or Passbook.

- Identifying the transactions that cause a difference between the two balances, such as cheques issued but not presented for payment, or interest credited by the bank but not recorded in the Cash Book.

- Making necessary additions or subtractions to the starting balance to reconcile it with the other book's balance.

The solutions provide clear, solved examples for each type of discrepancy to help students master the preparation of a BRS.

3. How do the NCERT Solutions for Class 11 Accountancy explain the process of rectifying errors?

The solutions explain error rectification by first identifying the type of error, such as:

- Errors of Omission: Forgetting to record a transaction.

- Errors of Commission: Recording with a wrong amount or in the wrong account.

- Errors of Principle: Violating a fundamental accounting principle (e.g., treating a capital expense as revenue).

- Compensating Errors: Two or more errors that cancel out each other's effect.

The solutions then provide the correct rectifying journal entries for each case, explaining how to use a Suspense Account if the Trial Balance does not match.

4. Why do the NCERT Solutions place a strong emphasis on the 'Accounting Equation' from the very first chapter?

The NCERT Solutions emphasise the Accounting Equation (Assets = Liabilities + Capital) from the start because it is the bedrock of the dual-aspect concept in accounting. By establishing this principle early, the solutions ensure students understand that every transaction has two corresponding effects. This foundational knowledge is crucial for correctly preparing all subsequent financial statements, especially the Balance Sheet, where both sides must always be equal.

5. What is the difference between 'Provisions' and 'Reserves' as clarified in the NCERT Solutions?

The NCERT Solutions for Class 11 Accountancy clearly differentiate between these two concepts. A Provision is a charge against profit made to account for a known, present liability where the exact amount is uncertain (e.g., Provision for Doubtful Debts). In contrast, a Reserve is an appropriation of profit, meaning it is set aside voluntarily from profits to strengthen the company's financial position for future growth or unforeseen contingencies (e.g., General Reserve). The solutions show the correct accounting treatment for both in the financial statements.

6. How do the solutions for 'Financial Statements - 2' build upon the concepts learned in 'Financial Statements - 1'?

In 'Financial Statements - 1', the solutions focus on preparing the basic Trading Account, Profit & Loss Account, and Balance Sheet. The solutions for 'Financial Statements - 2' introduce a higher level of complexity by incorporating crucial year-end adjustments. These include accounting for closing stock, outstanding expenses, prepaid expenses, accrued income, and depreciation. This progression teaches students how to create financial statements that present a 'true and fair' view of a business's financial performance and position, which is more aligned with real-world practices.

7. According to the NCERT solutions, how is depreciation calculated and why is it important?

The NCERT Solutions explain that depreciation is the systematic allocation of the cost of a tangible asset over its useful life. The solutions provide detailed step-by-step methods for calculating it using primary methods like the Straight-Line Method (SLM) and the Written Down Value (WDV) Method. It is important because it helps in matching the cost of the asset with the revenues it generates and shows the true value of assets on the Balance Sheet, adhering to the matching principle of accounting.

8. What chapters have been removed from the Class 11 Accountancy syllabus for the 2025-26 exams?

For the academic year 2025-26, chapters such as 'Bills of Exchange', 'Accounts from Incomplete Records', and 'Applications of Computers in Accounting' have been removed from the NCERT syllabus. The provided solutions are fully aligned with this updated curriculum, allowing students to focus only on the topics relevant for their final examinations.