What do You Mean by Sovereign Wealth Funds?

The States harness the power by making and enforcing laws, collecting taxes, participating in wars, and engaging in trade. As a result, a Sovereign Wealth Fund is a pool of funds owned and used by the central government for its own investment purposes. Just as Adam Smith predicted that sovereign states could and do acquire wealth, governments invest this money in businesses and real estate around the world to benefit their economies and citizens. Popular sources for funds include money from state-owned natural resources like oil and minerals, foreign currency operations etc.

The first sovereign wealth fund was established by the Singapore government in 1981 and was known as the Singapore Government Investment Corporation (GIC). In India, SWF was established by then-Finance Minister Mr Arun Jaitley in his 2015-2016 federal budget. His SWF in India is the National Investment and Infrastructure Fund (NIIF).

Sovereign Wealth Fund

The History of Sovereign Wealth Funds

Kuwait was the first country in the world to launch a sovereign wealth fund. After Kuwait discovered oil in 1953, it decided to set up a fund to invest its surplus oil revenues. Soon it was considered the richest country in the whole world.

In 1990, the small Persian Gulf country was invaded and occupied by Iraq, then liberated by 35 US-led nations. The reason for this war was oil and the money that came with it, leaving Kuwait with a population of just 4.1 million.

Today Kuwait, whose Sovereign Wealth Fund is worth over $500 billion, is considered to have one of the largest funds in the world.

East Asian countries such as China, Hong Kong and Singapore are also known to have sovereign wealth funds. Unlike oil producers, these countries built up excess reserves when the Asian export boom started exporting more than importing. Their surplus funds are sent to financial markets around the world to make more and more money.

But just as sovereign wealth funds represent the peak of globalisation and a superior way for a country to diversify its wealth, they can also represent the trough of globalisation in a world of desire. With global trade facing major hurdles and a tense political climate evident, sovereign wealth funds appear to have millions of countries bidding rather than independent merchants just looking to make money.

Sovereign Wealth Fund Logo

Types of SWFs

The stabilisation fund's main purpose is to support the government in the event of an emergency or unexpected situation that causes economic shock—for example, the rapid rise in unemployment and oil and other natural resources that increase government expenditures.

The Future generation fund aims to cover the new costs of the future elderly population. This reduces the future budget for the country.

The Reserve Investment fund's purpose includes only generating long-term returns. It focuses on long-term investment opportunities to attain high returns.

The pension reserve's purpose is to support the national pension system. The fund is aimed at reducing the budget burden for paying a pension. A country with an increased elderly population can set up this fund.

Significance of SWFs

Some sovereign wealth funds may be owned by a central bank, which accumulates funds in the process of managing a country's banking system, and this type of fund usually holds major economic and fiscal importance. Other sovereign wealth funds are merely designated savings that various companies invest in for investment income and may not play a significant role in tax administration. Accumulated funds can come from foreign currency deposits held by central banks, International monetary funds, and special drawing rights. These are assets of sovereign nations and are typically held in domestic and other reserve currencies such as pounds, dollars, yen etc.

Limitations of SWFs

Some sovereign wealth funds are not as transparent as others. For example, Some sovereign wealth funds may disclose their investment holdings on a regular basis, and other sovereign wealth funds may not disclose investment details.

SWF guarantees no returns, and exchange rates may also affect the Sovereign wealth funds.

Case Study

India surpasses China in sovereign wealth funds. Give points to support your answer.

Ans: India has quietly replaced China as the most sought-after destination for global sovereign wealth funds investments in the private sector which is seen as a sign of the country’s growing attraction for investors. According to the data by New York Global SWF, which tracks over 400 sovereign wealth funds in the year 2020 to date which is nearly three times more than what they have put in china, i.e., dollar 4,5 billion. It started in the year 2019 when a dollar of 10.1 billion was invested by SWFs in India, surpassing the $6.4 billion amount it did in china.

Summary

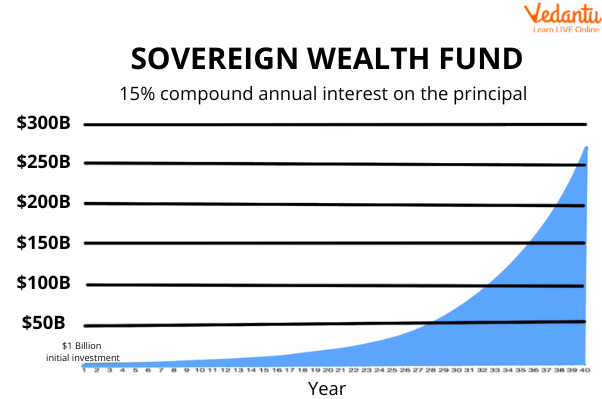

Few human creations represent the pinnacle of globalisation and sovereign wealth funds. Some state funds invest the revenues achieved by the government. Some other sources include budget surpluses and reserves. The Sovereign function is to stabilise the economy of the country through diversification and create wealth for future generations. The Sovereign Wealth Funds have grown significantly in influence over the last two decades, collectively managing more than $8 trillion in assets worth about 10% of the world's Gross Domestic Product.

FAQs on What Are Sovereign Wealth Funds?

1. What is a Sovereign Wealth Fund (SWF) in economics?

A Sovereign Wealth Fund, or SWF, is a state-owned investment fund that a country uses to invest its surplus reserves. Instead of sitting idle, these funds are invested in various assets like stocks, bonds, and real estate to generate wealth for the country's economy and its future generations. They are managed separately from the country's official foreign exchange reserves.

2. What are the primary objectives for establishing a Sovereign Wealth Fund?

Countries establish Sovereign Wealth Funds for several strategic reasons. The primary objectives typically include:

- Economic Stabilisation: To protect the national budget and economy from the volatility of commodity prices, such as oil or minerals.

- Intergenerational Savings: To save and grow wealth from finite natural resources for the benefit of future generations.

- Economic Diversification: To diversify the country's income away from non-renewable resources and create sustainable, long-term revenue streams.

- Strategic Investments: To fund national development projects, such as infrastructure, or to acquire strategic assets abroad.

3. From where do Sovereign Wealth Funds get their money?

The capital for Sovereign Wealth Funds comes from various national sources. The most common sources include:

- Revenues from the export of natural resources, particularly oil and natural gas.

- Surpluses from international trade (balance of payments surplus).

- Profits from state-owned enterprises.

- Proceeds from the privatisation of government-owned assets.

- Excess foreign currency reserves held by the central bank.

4. What are the main advantages for a country to have an SWF?

Having a Sovereign Wealth Fund offers significant advantages, including:

- Income Generation: It provides a stable source of national income apart from taxes, which can be crucial when primary revenue sources like oil decline.

- Economic Cushion: The fund can act as a buffer during economic recessions or financial crises, allowing the government to maintain spending without borrowing heavily.

- Higher Returns: By investing in a diversified portfolio with a long-term horizon, SWFs can earn higher returns than those typically generated by passively held central bank reserves.

5. Are there any disadvantages or risks associated with Sovereign Wealth Funds?

Yes, despite their benefits, SWFs carry certain risks and potential disadvantages. Key concerns include a lack of transparency in their investment strategies, the potential for investments to be used for political leverage rather than purely economic goals, and exposure to global market volatility which could lead to significant losses. Proper governance and clear mandates are crucial to mitigate these risks.

6. Can you provide a real-world example of a major Sovereign Wealth Fund?

A prominent example is Norway's Government Pension Fund Global, which is the world's largest Sovereign Wealth Fund. It was established to invest the surplus revenues from Norway's oil and gas sector. Its primary purpose is to ensure responsible and long-term management of this wealth so that it benefits both current and future generations of the country.

7. Does India have its own Sovereign Wealth Fund?

Yes, India's sovereign wealth fund is the National Investment and Infrastructure Fund (NIIF), established in 2015. Unlike funds based on commodity exports, the NIIF's primary objective is to attract investment from both domestic and international sources to build commercially viable infrastructure projects across the country, thereby boosting economic growth.

8. How is a Sovereign Wealth Fund different from a country's foreign exchange reserves?

The key difference lies in their purpose and investment strategy. Foreign exchange reserves are held by a country's central bank primarily for short-term stability, ensuring liquidity to manage the national currency's value and meet international payment obligations. In contrast, a Sovereign Wealth Fund is a long-term investment vehicle designed to achieve higher returns over time by investing in a diversified portfolio of riskier assets. Essentially, reserves prioritise liquidity, while SWFs prioritise long-term profit.