An Overview

The need for reconciling accounts and financial accounts arise due to discrepancy between cost accounts and financial account. The process of correcting these accounts is known as the reconciliation of cost and financial accounts. When prepared following financial accounting regulations, numerous things are only included in the profit and loss account.

If the profit or loss were calculated using financial accounts, it would be adjusted using cost accounts. We see a similar profit as per cost accounting after modifications. If we calculated profit using the cost account, we must change the items to reflect the financial accounts. We create a reconciliation statement with this goal in mind.

Reconciliation Meaning

The profit or loss shown by one set of books may differ from that indicated by the other when cost accounts and financial accounts are handled separately in two separate sets of books. As a result, it becomes important to regularly reconcile the profit or loss indicated by the two sets of accounting.

The reasons for the discrepancy between the data reported by each system are detailed in a note of reconciliation. It is done to look through both sets of accounts' mathematical precision and look for any errors that may have been made.

Reconciliation of Cost and Financial Statements

Need for Reconciliation

Several factors call for a reconciliation between the two books:

It explains the causes of the profit or loss discrepancy between cost and financial statements.

It guarantees that no revenue or expense item has been left off the books and that overhead costs are not being under or over-recovered.

It assists in verifying the mathematical precision of both sets of accounts.

It guarantees the accuracy of cost accounting to properly determine the cost of manufacturing.

By emphasising the fluctuations contributing to an increase or reduction in profit, it facilitates internal management.

It encourages coordination and cooperation between cost and financial accounting divisions to provide accurate and trustworthy accounting data.

It allows management to create rules for expenses, depreciation, and stock valuation.

It guarantees managerial judgement.

Need of Reconciliation

Items Accounted for Differently in Cost Accounting and Financial Accounting

Overhead - Cost accounts apply fixed rates of overheads to cost units based on projections, and the amount recovered may differ from the actual costs spent. The profits on two sets of books will differ if such under or over-recovery of overheads is not carried off to the costs profit and loss account.

Stock vVluation - Stocks are evaluated in financial accounts at a lower cost or market value. In cost accounting, the stock is valued at cost using a technique that is appropriate to the unit, such as FIFO, LIFO, average, etc. As a result, stock value may change, which will indicate a profit discrepancy between the two sets of books.

Depreciation - The profits will change if a different methodology is used to calculate depreciation in cost accounts compared to financial accounts.

Items Accounted for differently in Cost Accounting and Financial Accounting

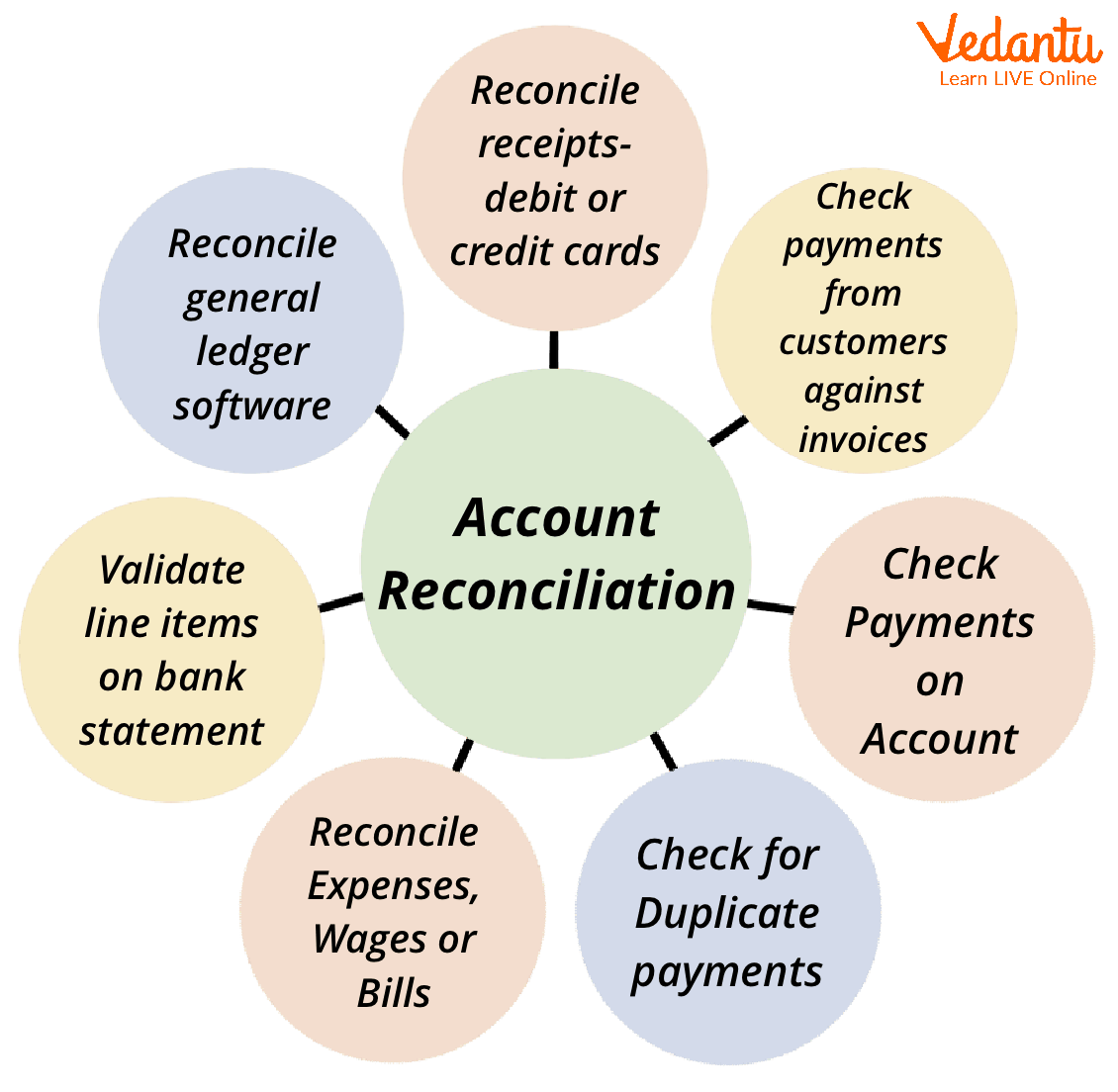

Procedure of Preparing Reconciliation

Step 1 - Start by determining any one of the profit/loss figures (either based on cost books or financial books), which is sometimes referred to as the basic profit figure.

Step 2 - Next, the numerous discrepancies between the profits reported by two sets of books in a certain instance are determined (as explained in the prior section).

Step 3 - Increase the basic profit number (from which we started in Step 1) by the items of difference that have the impact of raising earnings in another set of books. These things are sometimes referred to as "+" items.

Step 4 - Subtract the items of disagreement that have the impact of reducing earnings in other sets of books from the basic profit calculation. (Such goods may be referred to as "-" items).

Reconciliation Procedure

If all of the calculations are accurate mathematically and computationally, the final amount after all the aforementioned changes will be the profit or loss according to another set of books.

Proforma Reconciliation Statement - Assuming that base earnings are calculated using cost accounts, the reconciliation statement can be shown or presented as shown below.

Conclusion

The practice of reconciling the functional outcomes or profits as revealed by cost accounts with those of financial accounts is known as reconciliation. Reconciliation is the process of identifying the items required to bring the balances of two or more connected accounts or statements into an agreement, according to Eric L. Kohler. Additionally, an attempt is made to evaluate the mathematical precision of the profits reported in two separate books. Consequently, reconciliation locates and accounts for the factors contributing to the discrepancy between the functional outcomes reported by cost accounts and financial accounts.

FAQs on Reconciling Cost and Financial Statements

1. How to reconcile cost and financial accounts?

Reconciling cost and financial accounts involves comparing the results from the cost accounting records with those from the financial accounting system. This ensures there are no discrepancies between the two systems. The process typically includes identifying areas of difference and making adjustments to align both sets of accounts.

- Gather both the cost and financial account records

- Identify any items exclusively recorded in one set (like certain expenses or incomes)

- Adjust for timing differences and accounting policies

- Prepare a reconciliation statement highlighting the reasons for any differences

2. What is the cost reconciliation process?

The cost reconciliation process is a systematic approach used to compare and adjust the profit as per cost accounts with the profit as per financial accounts. This process helps identify reasons for differences in reported profits.

- Start by noting profit/loss as per cost accounts

- Add incomes included in financial accounts but not in cost accounts (such as interest or rent received)

- Deduct expenses charged only in financial accounts (like donations or fines)

- Adjust for over/under-absorption of overheads and abnormal gains/losses

3. How do you reconcile financial statements?

Reconciling financial statements is the process of ensuring that entries in the balance sheet, income statement, and other records match actual balances and support each other. This enhances the reliability of financial reporting.

- Cross-check ledgers with bank statements and supporting documents

- Identify discrepancies such as timing differences or unrecorded transactions

- Adjust entries for errors and omissions

- Review and confirm reconciled balances

4. Why is a reconciliation of cost and financial accounts necessary?

Reconciliation of cost and financial accounts is essential to identify and correct differences between the profit calculated by cost accounting and the profit shown in financial accounts. This process ensures transparency, accuracy, and trust in financial reporting.

- It highlights accounting errors or misstatements

- Helps in complying with legal and regulatory requirements

- Facilitates better internal control and decision-making

- Prevents manipulation or misrepresentation of profits

5. What are common reasons for differences in cost and financial statements?

Differences between cost and financial statements often arise because certain items are treated differently in each system. Cost accounts focus on production, while financial accounts capture all business activities. Common reasons include:

- Items included only in financial accounts (like interest income or capital gains)

- Items included only in cost accounts (such as notional rent)

- Different methods of depreciation or overhead absorption

- Stock valuation discrepancies

6. What documents are needed for cost and financial statement reconciliation?

To reconcile cost and financial statements, you need comprehensive records from both systems. Key documents include the trial balances, income statements, cost ledgers, and supporting vouchers or schedules. Access to supplemental records such as stock valuation sheets, depreciation schedules, and overhead allocation statements is also essential. Having all these documents ensures that every aspect of the cost and financial accounts can be cross-checked, making your reconciliation process thorough and reliable.

7. What is a Reconciliation Statement in cost accounting?

A Reconciliation Statement in cost accounting is a formal document that explains the reasons for the difference between profit as per cost accounts and profit as per financial accounts. It lists income and expenses that appear differently or exclusively in one set of records. The statement adjusts profits by adding or subtracting these items to bridge the gap between the two sets of accounts. Compiling this statement helps management verify the accuracy of results from both systems and supports strong financial decision-making.

8. Can reconciliation detect fraud or errors in financial statements?

Yes, reconciliation acts as a control mechanism that can uncover discrepancies caused by errors or fraud in financial statements. By comparing cost accounts and financial accounts, any unexplained differences signal the need for further investigation. Regular reconciliation helps identify issues like omitted expenses, unauthorized transactions, or deliberate misstatements. Early detection of such errors safeguards the company’s assets and upholds the integrity of financial information.

9. How often should cost and financial statements be reconciled?

The frequency of reconciliation depends on the size and complexity of the business, but it is generally recommended to reconcile cost and financial statements monthly or quarterly. Regular reconciliation helps ensure that errors or discrepancies are caught early, supporting accurate profit measurement and better financial control. For businesses with high transaction volumes, more frequent reconciliation—such as weekly—might be necessary to maintain the integrity of records.

10. What are the challenges in reconciling cost and financial accounts?

Reconciling cost and financial accounts can be challenging due to differences in accounting methods, timing, and record-keeping standards. Some common challenges include:

- Lack of uniformity in recording transactions

- Complexity in identifying which items belong to cost or financial records

- Errors in overhead absorption or allocation

- Variations in stock valuation methods

11. What are the benefits of reconciling cost and financial statements?

Reconciling cost and financial statements offers significant advantages for businesses by ensuring financial reliability and accuracy. Key benefits include:

- Detection and correction of errors

- Enhancement of internal controls

- Better transparency and compliance with regulations

- Improved trust in reported profits

12. Is reconciliation required if both accounts show the same profit?

Even if cost and financial accounts show the same profit, reconciliation is recommended. This is because matching profit figures do not guarantee that all transactions and adjustments have been accounted for accurately in both systems. Reconciliation acts as a verification tool, confirming that there are no underlying discrepancies or omitted items. Maintaining this practice reinforces the accuracy and credibility of the company’s financial and cost records.