How to Calculate Rate of Interest in Simple Interest

The rate of interest is the percentage of principal that a lender charges to a borrower. Different banks provide different rates of interest. Simple interest is very commonly used in our daily lives. The rate of interest is always taken as a fraction in the formula for simple interest. In this article, we will discuss about what is simple interest and the formula for calculating simple interest.

What is Simple Interest?

Before we learn the formula for rate in simple interest, we will first learn what simple interest is. Simple interest is a method to calculate the interest gained over a particular sum, at a specific rate in a given period of time. The interest is applied on the amount (principal) you invest in the bank at a fixed interest rate. The formula for calculating simple interest is \[\]\[\left[ {{\text{simple interest}}} \right] = \left[ {{\text{Principal}}} \right] \times \left[ {{\text{percent rate of interest per annum}}} \right] \times \left[ {{\text{time}}} \right]\].

Simple Interest

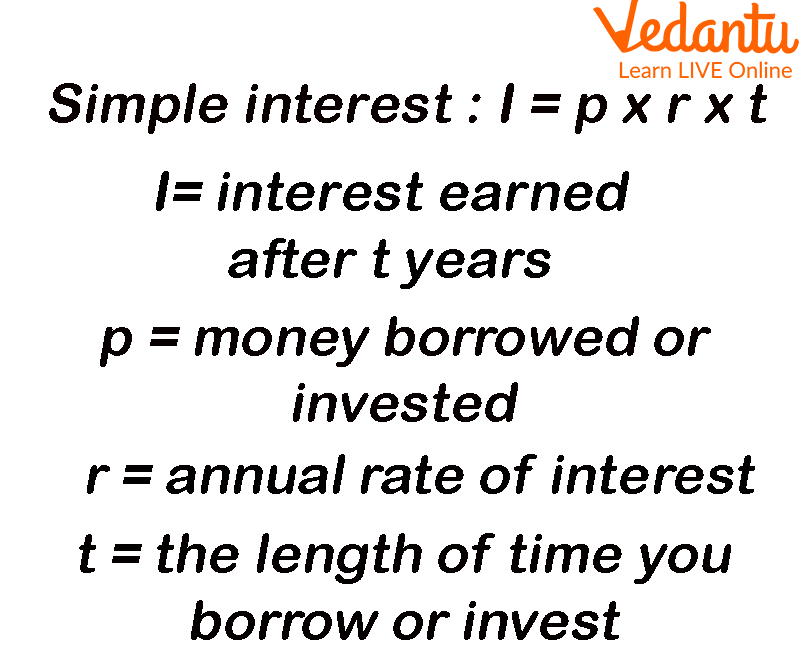

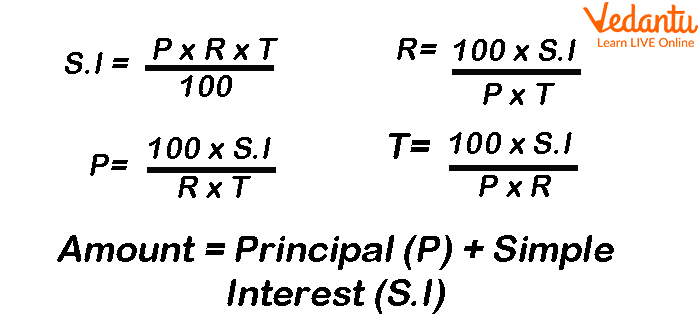

The Formula for Simple Interest

Simple interest is simply calculated using the following formula.

\[{\rm{S}}{\rm{.I = P}} \times {\rm{R}} \times \dfrac{T}{{100}}\] (As R is in percent)

Here, S.I. = Simple interest

\[{\text{p = principal amount }}\]

R = rate of interest in % per annum

T = The duration for which the money is invested.

Amount = It is the total money gained after the investment duration is over. It is calculated as \[{\text{Amount = Principal + Simple Interest }}\]

Formula for Simple Interest and Its Components

Rate of Interest in Simple Interest

The rate of interest is the percentage of principal that a lender charges to a borrower. A 5% rate of interest means you will be charged 5% of the amount you have invested/ loaned from the lender, each year for the given time period. For example, a 2% rate of interest on Rs. 100,000 for 4 years means you will be charged 2% of 100,000 which is 2,000 per year for 4 years. The simple interest here will be \[{\rm{S}}{\rm{.I = 100000}} \times {\rm{[2\% ]}} \times {\rm{4 = 8000}}\]. Thus, the total payable amount will be \[{\text{Principal + }}\] \[{\rm{S}}{\rm{.I = 100000 + 8000}}\] = Rs. 108,000.

The Formula for Rate of Interest in Simple Interest

These are the steps to find the rate of interest.

We first start with a formula for simple interest.

Then we make the rate of interest the subject of the equation and isolate it.

This will give us the formula for the rate of interest. Remember that the rate of interest is always kept a fraction in formulas.

Rate of interest %= \[\dfrac{\text{Simple interest}}{\text{principal} \times \text{time}}\]

Simple Interest and Its Components

We have learned about simple interests and their components. We have successfully understood the formula of simple interest and how its components work. We learned how the rate of interest practically works and how to calculate the rate of interest from the formula for simple interest.

Solved Examples

1. Find the rate of interest if the simple interest is given to be Rs. 4,000 on a principal of Rs. 50,000 for 2 years.

Solution: We are given simple interest, principal amount, and the time period. We are required to find the rate of interest. Using the formula for rate of interest in the simple interest, we get

\[\dfrac{R}{{100}} = \dfrac{{[{\rm{S}}{\rm{.I]}}}}{P \times T}\]

\[\dfrac{R}{{100}} = \dfrac{{\left[ {4000} \right]}}{{\left[ {50000 \times 2} \right]}}\]

The above equation gives

\[\dfrac{R}{{100}} = 0.04\]

Hence, \[R = 4\% \]

2. Find the rate of interest if the total amount at the end of the interest period is given to be Rs. 640,000 on the principal amount of Rs. 500,000 for 7 years.

Solution: We start with writing down the formula for the amount.

\[{\text{Amount = principal + simple interest}}\]

\[{\text{Amount = principal + principal}} \times {\rm{rate}} \times {\rm{time}}\]

Now we put down the values we already have been given,

\[640000 = 500000 + 500000 \times \dfrac{R}{{100}} \times 7\]

or,

\[\dfrac{R}{{100}} \times 7 = \dfrac{{140000}}{{500000}} = \dfrac{{14}}{{50}}\]

\[\dfrac{R}{{100}}= \dfrac{2}{{50}} = 0.04\]

This gives,

\[R =4\% \]

Conclusion

Simple interest is very commonly used in our daily lives. Banks use this method daily to provide loans to customers. We have learned how important simple interests are and how we can calculate them. We also learned how to calculate different components (Principal, Rate of interest, and time period) if any three of the quantities are given.

FAQs on Rate of Interest in Simple Interest: Key Concepts & Examples

1. What is meant by the 'rate of interest' in the context of simple interest?

The rate of interest (R) is the specific percentage of the principal amount that is charged or earned over a certain period, usually per year. For example, a rate of 5% per annum means that for every ₹100 of the principal, ₹5 is added as interest each year. It is a crucial factor that determines how much extra money you pay on a loan or earn on an investment.

2. What is the fundamental difference between the principal, simple interest, and the total amount?

These three terms are the building blocks of interest calculations:

Principal (P): This is the initial or original sum of money that is borrowed or invested.

Simple Interest (SI): This is the extra money calculated on the principal at a given rate for a specific time. It is the 'cost' of borrowing or the 'reward' for investing.

Amount (A): This is the final sum to be repaid or received after the time period. It is calculated by adding the simple interest to the principal (A = P + SI).

3. What are the key concepts you need to understand when learning about the rate of interest?

To master the concept of rate of interest, you should focus on these key ideas:

Principal (P): The initial amount of money.

Rate of Interest (R): The percentage at which interest is calculated, usually expressed 'per annum' (p.a.).

Time (T): The duration for which the money is borrowed or invested, which must be in the same unit as the rate (e.g., years).

Simple Interest (SI): The calculated interest, found using the formula SI = (P × R × T) / 100.

Amount (A): The total money, which is the sum of the Principal and the Simple Interest.

4. How is the formula for Simple Interest (SI = P × R × T / 100) used to find the rate of interest (R)?

The standard Simple Interest formula can be rearranged to find any of its components. To find the rate of interest (R) when you know the simple interest (SI), principal (P), and time (T), you can use the following derived formula: R = (SI × 100) / (P × T). This calculation will give you the rate as a percentage per unit of time (usually per annum).

5. In real-world scenarios, how does the rate of interest influence financial decisions, such as choosing a loan?

The rate of interest is a critical factor in making financial decisions. When taking a loan, a lower rate of interest is always better because it means you will have to pay less extra money (interest) over the loan's duration. For example, if you are choosing between a car loan from Bank A at 8% p.a. and from Bank B at 9% p.a., you should choose Bank A to minimise your total repayment amount. Conversely, when investing or saving money, you would seek a higher rate of interest to maximise your earnings.

6. Why is it important for the rate of interest and the time period to be in the same units?

It is crucial for the rate of interest and the time period to be in the same units to ensure the calculation is accurate. The rate is typically given 'per annum' (per year). If the time period is given in months or days, you must convert it into years before using the formula. For example, if the time is 6 months, you must use T = 6/12 = 0.5 years in the formula. Mismatching units (e.g., using a 'per annum' rate with time in months) will lead to an incorrect calculation of the interest.

7. How does a higher rate of interest impact your savings versus your loans?

A higher rate of interest has opposite effects on savings and loans.

For Savings/Investments: A higher rate is beneficial. It means your money grows faster, and you earn more interest on your principal amount over time.

For Loans/Borrowings: A higher rate is disadvantageous. It increases the cost of borrowing, meaning you will have to repay a significantly larger amount in total over the life of the loan.

Therefore, the goal is always to find the highest possible rate for saving and the lowest possible rate for borrowing.

8. Besides bank loans and savings accounts, what are some other real-world examples where the concept of rate of interest is applied?

The concept of rate of interest is used in many everyday financial situations beyond basic loans and savings. Some common examples include:

Credit Card Dues: If you don't pay your credit card bill in full, a very high rate of interest is charged on the outstanding balance.

Car Financing: When you buy a car on an installment plan, the price includes interest calculated at a specific rate.

Investments in Bonds: Governments and companies issue bonds that pay investors interest at a fixed rate.

Provident Funds (PF): Employee retirement funds earn interest annually at a rate declared by the government.

9. What happens if you take a loan for a period of less than a year? How is the rate of interest applied then?

Even if a loan is for a period shorter than a year, the rate of interest is usually still quoted 'per annum' (p.a.). To calculate the interest correctly, you must express the time period as a fraction of a year. For example, if you borrow money for 3 months at a rate of 12% p.a., the time (T) in the formula would not be 3, but 3/12 or 0.25 years. The simple interest would then be calculated as SI = (P × 12 × 0.25) / 100.