Knowing About the Retrospective Effect

What is the retrospective effect? When a change is implemented that affects the past in addition to the present and the future, it is called a retroactive change. If the corporation makes a change in its accounting standards, for instance, such change must be treated as a change of method with a retrospective effect. To present the financial information for the current year by the new accounting principle, any past periods included in the current year's income statement will need to be revised. To implement a new principle retroactively is to treat the financial outcomes of prior periods as though the new concept had always been in effect.

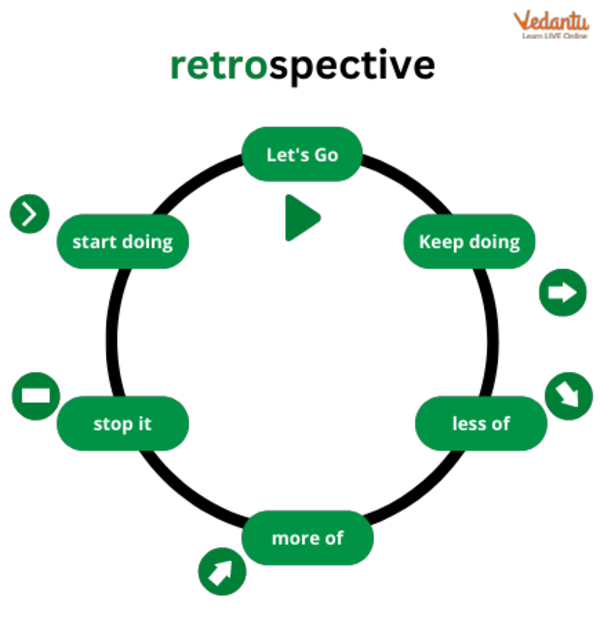

Defining the Term Retrospective

Defining Change in Method of Depreciation

Changes in Depreciation Methods

Depreciation is the loss sustained each year from not recouping the cost of an asset out of the asset's future cash flows. It is the equivalent of the asset's current value divided by its useful life. Depreciation methods are: straight-line and written-down values.

If there is a change in the expected future economic advantages to the firm from a particular asset, the company may decide to switch to a different depreciation method. Accounting Standard 1-Disclosure of Accounting Policies states stated while a firm's accounting guess would alter due to a shift in depreciation technique. This does not constitute a policy shift on the part of the business.

Any change in the method of depreciation in a firm must be noted in the notes section of an income statement. The corporation must additionally provide full disclosure of the rationale and financial impact of the specific adjustment. When a company wants to modify how it accounts for its assets' depreciation, it may do so; however, it must explain why it wants to make the amendment and give documentation to back up its argument. When approved, the corporation must provide a footnote in the financial report explaining the decision to switch depreciation methods and providing supporting documentation.

Necessary Actions for Retroactive Application

When an accountancy principle is changed, it must be applied back to all past periods unless doing so would be difficult or impossible. Below are the necessary actions for a retroactive application:

Incorporate the cumulative impact of the adjustment on preceding periods into the carrying values of assets and debts at the start of the initial period for which financial statements are provided.

Make a corresponding adjustment to the retained profits balance at the start of the first reporting period.

Incorporate the new accounting standard into all previously reported income statements. All income tax consequences directly attributable to the underlying principle change of method with retrospective effect are included in the scope of these retroactive amendments.

There is no need to back-calculate to account for unintended consequences in the financial statements.

Conclusion

Companies employ depreciation procedures to pay for both employee and collective expenditures. To make reliable financial projections, a company may need to adjust its depreciation practices in response to a shift in how those benefits are used in the economy. Adopting a new accounting standard using a complete retrospective technique requires recasting revenues and expenses for all previous periods introduced in the year of acceptance and calculating the cumulative effect of the newly adopted standard from the start of the first historical period introduced.

FAQs on Understanding Retrospective Effect in Law

1. What is the meaning of 'retrospective effect' in a legal and accounting context?

In a legal or accounting context, a retrospective effect means that a new law, rule, or policy is applied to events that occurred before it was enacted. Essentially, it operates backward in time, changing the legal consequences or financial reporting of past transactions and actions as if the new rule had been in place all along.

2. What is the key difference between a law with retrospective effect and one with prospective effect?

The key difference lies in the timing of their application.

- A law with retrospective effect applies backwards to past events. For example, a tax law passed in December 2025 that applies to all income earned since April 2025.

- A law with prospective effect applies only to events that occur from the date of its enactment or a specified future date. For example, the same tax law passed in December 2025 that only applies to income earned from January 2026 onwards.

3. How is the principle of retrospective effect applied when a company changes its accounting policies?

According to Indian Accounting Standard (Ind AS) 8, when a company voluntarily changes an accounting policy, it must apply the change with retrospective effect. This requires the company to restate its previous financial statements (like the Balance Sheet and Statement of Profit and Loss) as if the new policy had always been used. This ensures comparability across different financial years and provides a more accurate view of financial trends.

4. Can you provide a real-world example of a law with retrospective effect in India?

A common example is related to tax amendments. The government might announce a change in the Goods and Services Tax (GST) or income tax rates in the middle of a financial year but declare that the new rates are applicable from the beginning of that year (e.g., from April 1st). This forces businesses and individuals to recalculate their tax liabilities for transactions that have already been completed.

5. Why are laws with retrospective effect often considered controversial?

Retrospective laws are controversial because they undermine the principle of legal certainty. Individuals and businesses make decisions based on the law as it currently exists. When the law is changed backwards, it can:

- Punish actions that were perfectly legal when they were performed.

- Create unexpected financial burdens (like additional taxes on past income).

- Be seen as unfair, as it's like “changing the rules of the game after it has been played.”

6. Are 'retrospective' and 'retroactive' effects the same? How does this apply to criminal vs. civil law?

While often used interchangeably, there's a subtle distinction. 'Retrospective' generally applies a new status to past events, while 'retroactive' can go further to impair or take away vested rights. The most critical application of this concept is in law:

- In Civil/Tax Law: Retrospective application is generally permissible, though often challenged in court.

- In Criminal Law: Article 20(1) of the Indian Constitution strictly prohibits retroactive criminal laws. This means a person cannot be convicted for an act that was not a crime when they committed it. This is a fundamental right protecting citizens from the unfairness of ex-post-facto laws.

7. What is the general presumption by courts regarding the retrospective application of laws?

The general presumption held by courts is that a statute is intended to be prospective in nature unless the legislature has made its intent to apply it retrospectively explicitly clear in the statute's text. This judicial principle aims to protect vested rights and ensure fairness and predictability in the legal system. A court will not apply a law retrospectively if the language is ambiguous.