Step-by-Step Guide to Solving Simple Interest Problems

When one deposits money in a bank, the bank applies to interest on the money deposited. Banks use various types of interest, and one of them is simple interest. Simple Interest is a quick and easy way to calculate the interest on your money, where interest is always applied to the principal at the same rate for each time period. Simple interest is determined by multiplying the principal by the daily interest rate by the number of days elapsed between payments.

What is Simple Interest?(Simple Interest Definition)

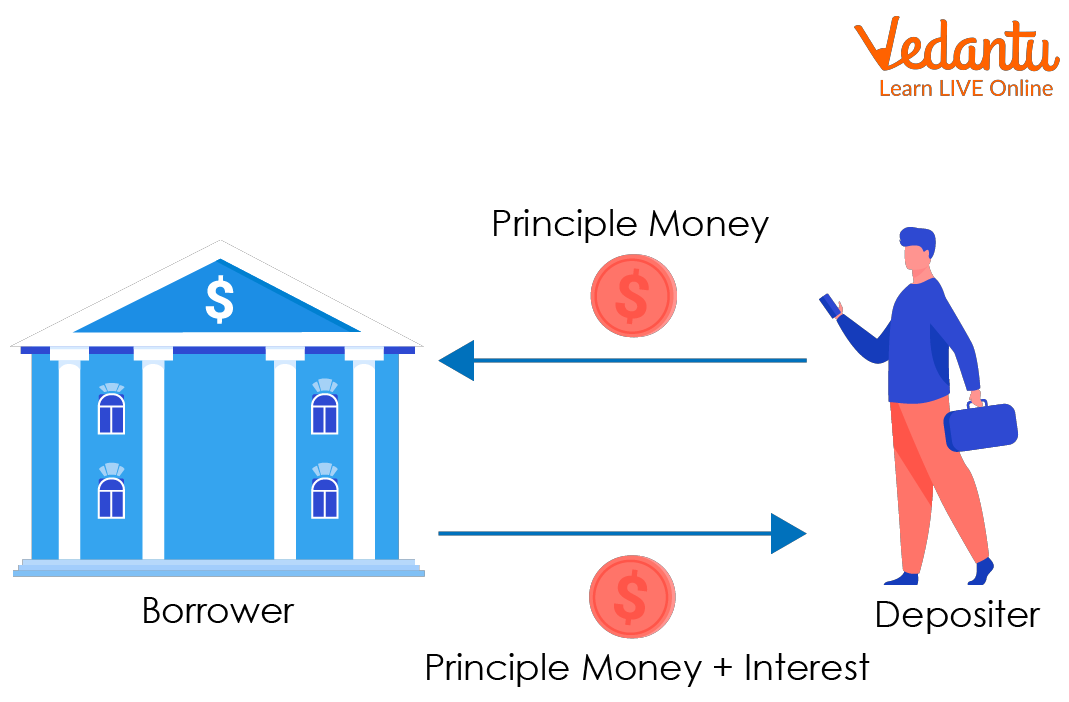

Interest is the income you receive from deposits or fees you pay on loans.

Simple Interest is a measure of interest that does not account for interest or accruals over multiple periods. The interest rate applies only to the principal of the loan or investment and is not affected by interest accrued.

Simple Interest

How to Find Simple Interest?

Simple Interest is calculated by using the formula:

\[{\rm{SI}} = {\rm{P}} \times {\rm{R}} \times {\rm{T}}\]

Where,

P = Principal

R=Percentage rate of Interest per annum [year]

T=time taken in the year

Simple Interest Formula Example

Terms Related to Simple Interest

Some terms like Principal, rate and time used to find Simple Interest. Let’s discuss each:

Principal: The amount borrowed from the bank by a person is called the Principal. The head is designated by the letter P.

Rate: The interest rate is the interest rate at which the principal is paid to someone over a period of time, which could be 5% or 15% etc. The interest rate is denoted by R.

Time: Time is a period given to someone on the principal amount. Time is indicated by the letter T.

Amount: When you get a loan from a bank, you must repay the principal plus interest, and this repayment is called the amount. So, a sum of money at simple interest amounts to the money you have to pay back. The amount is denoted by A.

Thus \[{\rm{A = P + I}}\]

Conclusion

On a specific principal, simple interest remains constant year after year. Consider the day you must return the money, not the day you borrowed it, to determine the amount of time. The interest rate is always given as a fraction in the formula.

Solved Examples

1. If the principal is Rs. 2500 for 1 year at the rate of 15%.Calculate simple interest.

Solution: Using the simple interest formula

\[{\rm{SI}} = {\rm{P}} \times {\rm{R}} \times {\rm{T}}\]

Here P \[ = \]2500, T \[ = \]1year and \[{\rm{R}} = 15\% \left[ {\frac{{15}}{{100}}} \right]\]

So in the above value

\[{\rm{SI}} = 2500 \times \frac{{15}}{{100}} \times 1\]

\[{\rm{SI}} = 375\]

So, simple interest is 375.

2.Mohan pays back 7,000 rupees equal to 5,000 rupees borrowed over two years. Find the interest rate.

Solution: A \[ = \]7000rupees

P \[ = \]5000rupees

We know \[{\rm{A}} = {\rm{SI}} + {\rm{P}}\]

\[{\rm{SI}} = {\rm{A}} - {\rm{P}}\]

\[{\rm{SI}} = {\rm{A}} - {\rm{P}} = 7000 - 5000 = 2000\] rupees

T \[ = \] 2years

Also

\[{\rm{SI}} = \frac{{[{\rm{P}} \times {\rm{R}} \times {\rm{T}}]}}{{100}}\]

\[{\rm{R}} = \frac{{100{\rm{SI}}}}{{{\rm{P}} \times {\rm{T}}}}\]

\[{\rm{R}} = \frac{{[100 \times 2000]}}{{[5000 \times 2]}}\]

\[{\rm{R}} = 20\% \]

So ,\[{\rm{R}} = 20\% \]

3. Naman borrowed Rs 20,000 for 3 years at an interest rate of 3% per annum. Find of the accumulated interest at the end of 3 years.

Solution: P \[ = \]20,000rupees

\[{\rm{R}} = 3\% \]

T \[ = \]3years

\[{\rm{SI}} = \frac{{[{\rm{P}} \times {\rm{R}} \times {\rm{T}}]}}{{100}}\]

\[{\rm{SI}} = \frac{{[20000 \times 3 \times 3]}}{{100}}\]

\[{\rm{SI}} = 1800\]

Therefore accumulated interest at the end of 3 years is 1800

FAQs on Simple Interest Formula Explained

1. What is the formula for simple interest and how is it explained?

The formula to calculate simple interest is S.I. = (P × R × T) / 100. In this formula, P stands for the principal amount (the initial sum of money), R is the annual rate of interest in percent, and T is the time period in years. The interest rate 'R' is a percentage, which is why the formula is divided by 100 to convert it into a decimal for calculation.

2. What do 'Principal', 'Rate', and 'Time' represent in the simple interest formula?

In the context of the simple interest formula, each component has a specific meaning:

Principal (P): This is the original amount of money that is borrowed or invested. For example, if you take a loan of Rs. 10,000, that is your principal.

Rate (R): This is the percentage at which interest is charged on the principal for a year. It is always expressed as a percentage per annum (p.a.).

Time (T): This is the duration for which the money is borrowed or invested. For the standard formula, this duration must be in years.

3. What are some real-life examples where the simple interest formula is used?

Simple interest is often used for short-term loans and financial products where the calculation needs to be straightforward. Common examples include:

Car Loans: Many auto financing schemes calculate interest on a simple interest basis over the loan tenure.

Short-Term Personal Loans: Loans taken for a few months or a year from certain lenders often use simple interest.

Retail Instalment Plans: When you buy an appliance on an instalment plan, the interest charged by the retailer is often simple interest on the purchase price.

4. What is the key difference between Simple Interest and Compound Interest?

The primary difference lies in how the interest is calculated over time. Simple interest is always calculated on the original principal amount, so the interest earned each year remains constant. In contrast, compound interest is calculated on the principal amount plus the accumulated interest from previous periods. This 'interest on interest' effect causes the investment to grow much faster than with simple interest.

5. How does changing the Principal, Rate, or Time individually affect the total simple interest?

Simple interest has a direct, linear relationship with the principal, rate, and time. This means:

If you double the principal (P) while keeping R and T constant, the simple interest also doubles.

If you double the rate (R) while keeping P and T constant, the simple interest also doubles.

If you double the time (T) while keeping P and R constant, the simple interest also doubles.

Essentially, any increase or decrease in one of these variables results in a proportional increase or decrease in the calculated simple interest.

6. How do you apply the simple interest formula if the time is given in months or days?

The standard simple interest formula requires the time period (T) to be in years. If the time is given in other units, you must first convert it to years before applying the formula:

If time is in months: You convert it to years by dividing the number of months by 12. For example, 6 months becomes T = 6/12 = 0.5 years.

If time is in days: You convert it to years by dividing the number of days by 365 (or 366 for a leap year). For example, 73 days becomes T = 73/365 = 0.2 years.

7. Why is simple interest considered easier to calculate but less practical for long-term investments?

Simple interest is easy to calculate because the interest amount is fixed for each period, based only on the initial principal. There's no need to track accumulated interest. However, this simplicity makes it less practical for long-term investments like savings accounts or retirement funds. Real-world financial growth almost always involves compounding, where the interest you earn also starts earning interest. Simple interest ignores this growth potential, making it an unrealistic model for investments that span many years and yielding significantly lower returns compared to compound interest over the same period.