Introduction to Asymmetric Information

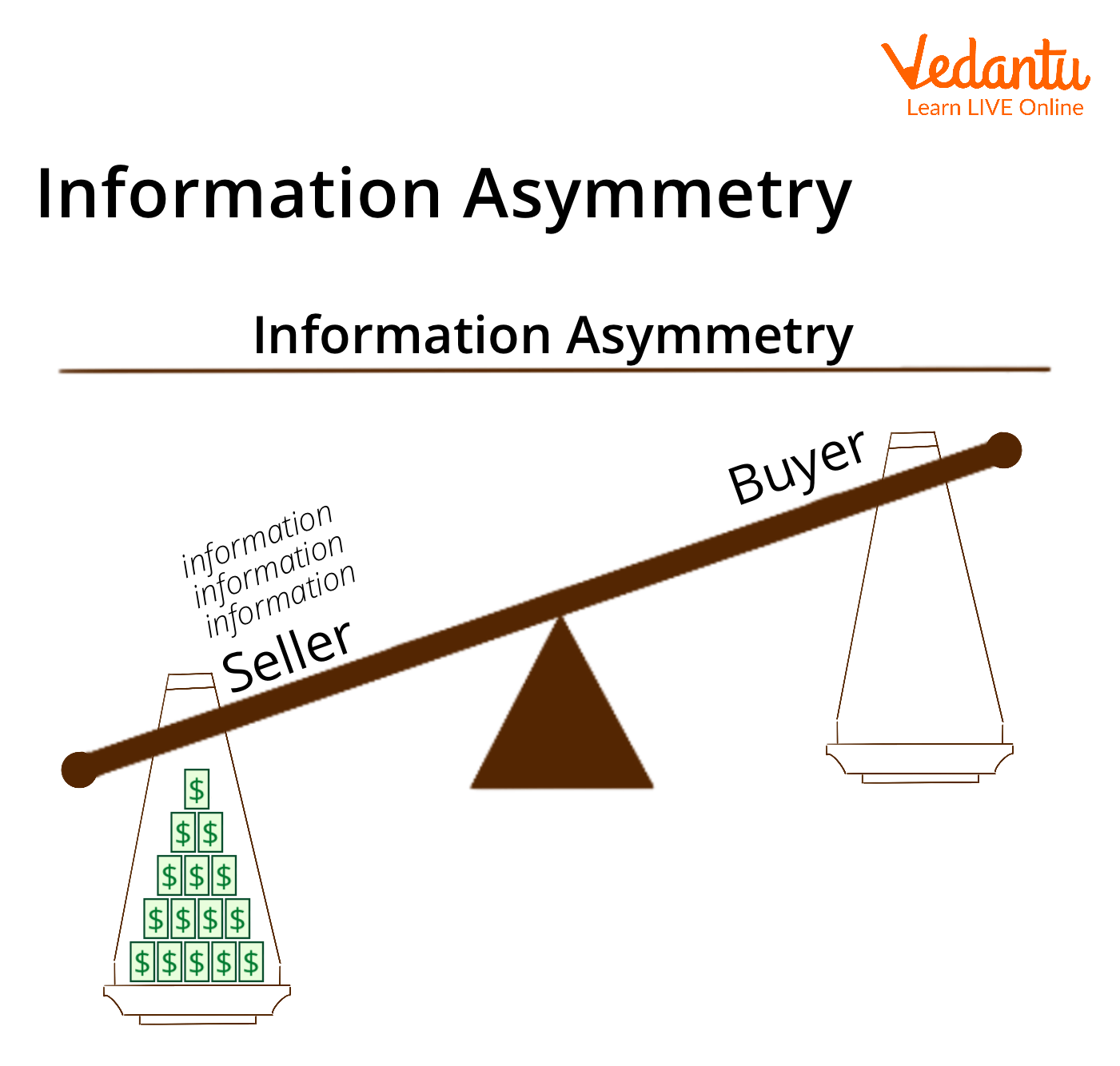

Asymmetric Information is also referred to as Information Failure. This occurs during economic transactions when one side has more material information about the goods and services than the other side. Typically sellers possess greater knowledge about goods or services, but vice-versa is also possible.

What is Asymmetric Information?

Asymmetric Information refers to the information mismatch. It is believed that asymmetric information occurs in almost all economic transactions. In Economics, asymmetric information occurs between the sellers and buyers of goods and services.

One side possesses greater knowledge than the other and therefore tries to take advantage of the information gap.

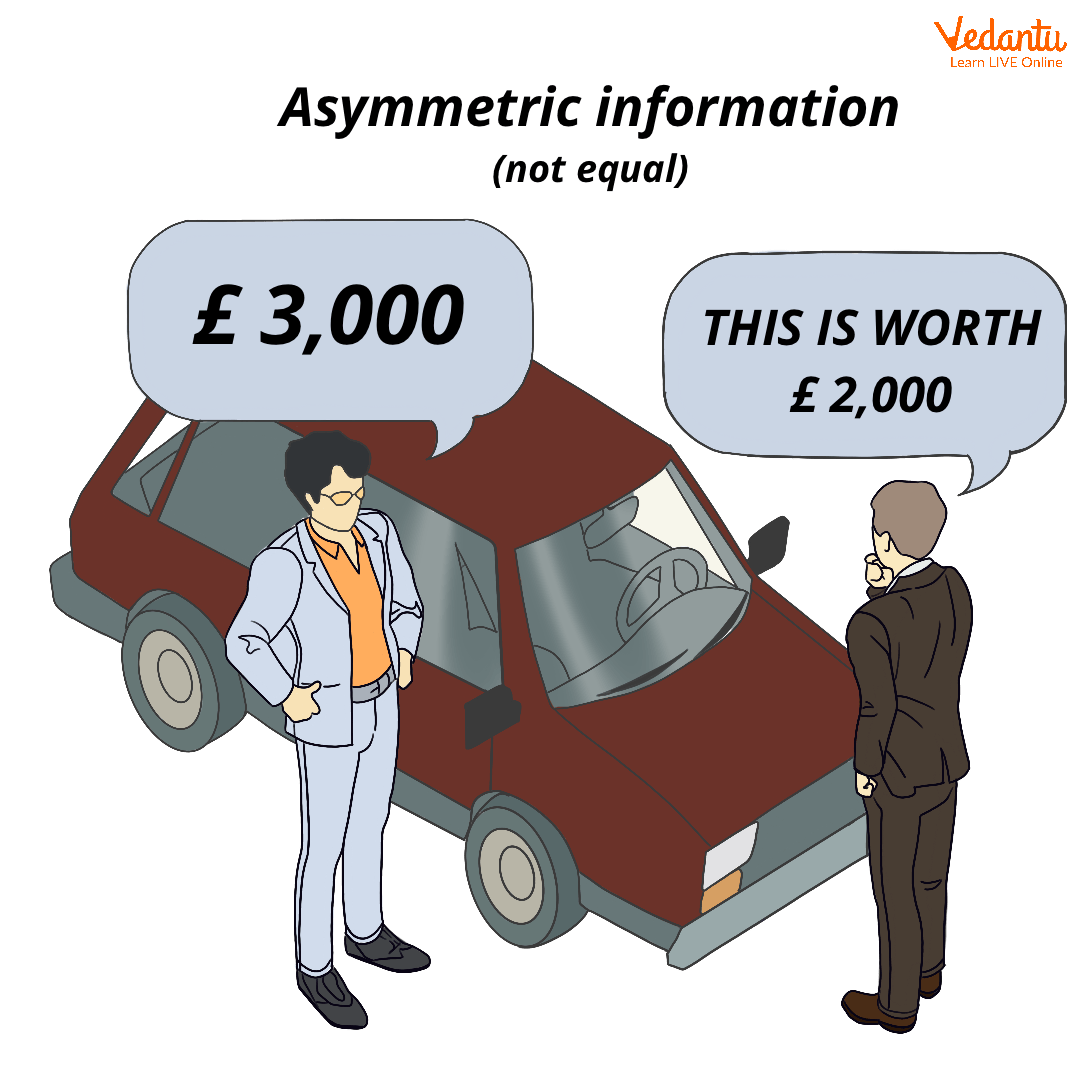

The best example of asymmetric information is when a seller wants to sell his house but does not disclose the information, which can make the buyer question the purchase. As the owner, the seller possesses more and more complete information about the house, including what the drawbacks of the house are. But the seller won’t disclose that information since he wants to sell the house. This information gap between the seller and buyer is defined as Asymmetric information.

Asymmetric information, in a way, is also a specialisation of knowledge; for example, Architects spent years getting specialised education in their field. So they naturally possess more information than their clients, thus having an advantage. Similarly, this principle applies to other professions and services such as Doctors, Teachers, Police Officers, Engineers etc.

Information Asymmetry between Seller and Buyer

Theory of Asymmetric Information

This theory was developed in the 1970s and 1980s in response to market failures. Asymmetric Information theory advocates that an imbalance of information between buyers and sellers can cause market failure. This theory stipulates that sellers may have more information about the goods than the buyers, thus fluctuating the prices of goods sold. This theory believes that buyers not having proper information about the product can make them vulnerable to the situation by providing low-quality and high-quality products for the same price.

Asymmetric Information

Advantages and Disadvantages of Asymmetric Information

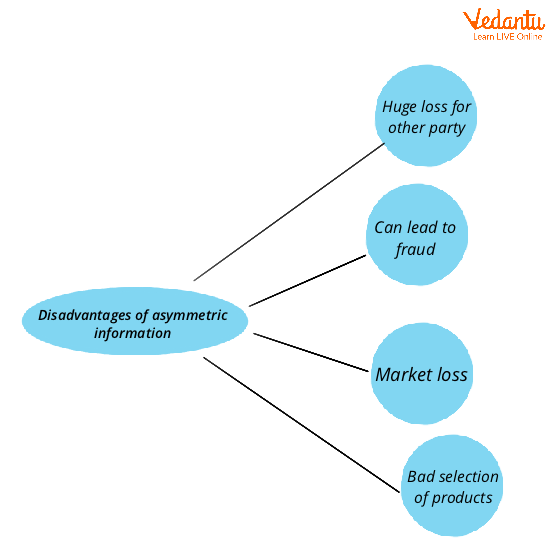

The existence of Asymmetric Information is healthy for a growing economy. It helps in generating more income and growing the economy. Through the means of asymmetric information, sellers are able to sell their products easily in the market by luring the customers/buyers. However, it is also the case that if excessively existing this asymmetric information increases the cases of fraud and malpractices in the market which may create problems for the common citizens of the nation.

Disadvantages of Asymmetric Information

Summary

The advantage of Asymmetric Information is that it is healthy for an economy since it helps in increasing the efficiency of the economy. Asymmetric information can also lead to fraud in many cases. With increasing competition in every business, people tend to make huge profits in whatever way they can. The disadvantage of asymmetric information is that this information gap provides the best means to fraud people and takes advantage of the situation.

FAQs on Asymmetric Information: Causes and Effects

1. What are the two types of asymmetric information?

The two types of asymmetric information are adverse selection and moral hazard. Adverse selection refers to the situation in which one party has more information than the other, and therefore, there happens an imbalance in the information. Adverse selection in asymmetric information occurs before the transaction occurs or is pre-contractual. A moral hazard is a situation in asymmetric information in which one party possesses such information because of which the party gets ready to take a risk, and the cost of risk will not be borne by the party taking the risk.

2. Give an example of asymmetric information.

One common example of asymmetric information is the salesman of second-hand cars. The salesman of second-hand cars already knows about the drawbacks of the car, which he does not disclose to the customer until the transaction takes place. If the customer was aware of the drawbacks of the car, he might not have purchased the car or might not settle for the price. Another example is of the seller selling a house. The seller of the house knows more details about the house than the buyer and thus takes advantage of his knowledge in his favour.

3. What does the lemons problem in Economics refer to?

Lemons problem in Economics refers to the situation where one party has more information about the product than the other party while buying or selling the product. Thus, one party gets the advantage of the information. This is known as the theory of Asymmetric Information. An Institution owner possesses more information and knows what the reality of their service is but in order to lure the customers, he/ she doesn't disclose all the details.