Finance and Economics

Finance is an offshoot of economics that deals with the management, creation, study of money and also covers topics like credit, investments, assets and liabilities that make up financial systems.

What is Finance?

Finance is mainly focussed on the study of prices,interest rates, money flows, and the financial markets. In a broader sense, the concept of finance also focuses on the time value of money, rates of return, capital cost, optimal financial structures and the quantification of risk.

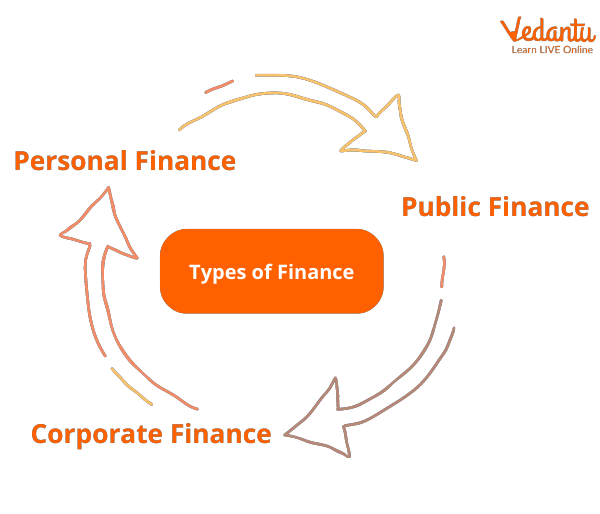

Types of Finance: Personal, Public and Corporate

There are three branches of finance:

Corporate or Business Finance

Personal Finance

Public Finance

Types of Finance

What is Finance in Business?

Corporate finance involves managing assets, liabilities, revenues and debt for a business. Financing in a business is done through a number of ways including equity investments and credit arrangements. This kind of finance is also concerned with determining an excellent debt policy for a new company or the perfect strategy for asset allocation for an investor.

Objective of Business Finance

Personal Finance

Personal finance deals with the financial decisions and activities of an individual or household which include budgeting, insurance, mortgage planning, savings and retirement planning.

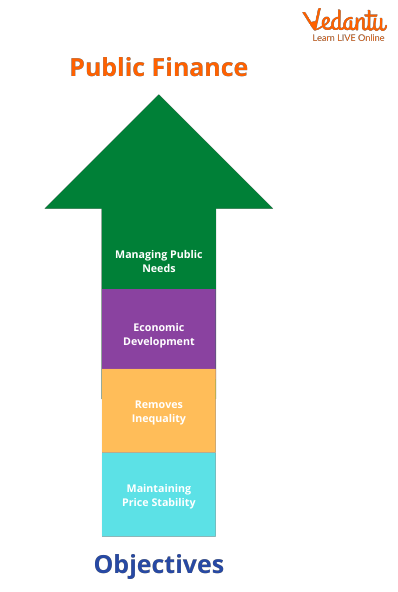

Public Finance

Public finance is a branch of finance which deals with tax systems, expenditures of the government, budget procedures, stabilisation policy, instruments, debt issues and other related concerns of the government.

Objectives of Public Finance

Difference between Finance and Economics

There are various parameters to distinguish between economic and non - economic activities. Economics is a more theoretical concept while finance is more practical. Both economics and finance are interrelated disciplines. The concept of finance is derived from economics which is focused on how goods and services are made, distributed and used. Finance types include personal, public and corporate finance. Economics is divided into Macroeconomics and Microeconomics. Macroeconomics deals with the overall economy and Microeconomics deals with specific factors within the economy.

Finance v/s Economics

Distinguish between Economic and Non - Economic Activities

Economic activity deals with production and consumption of goods and services for monetary gain whereas non - economic activity is performed gladly without any expectation in return. Economic activity is performed with the motive to earn money while non - economic activity is performed for social or psychological gain. Economic activity has a pragmatic approach while non - economic activity is idealistic in nature. Economic activity results in value addition of the national income whereas non - economic activity does not affect the national income.

Case Study

Effect of COVID - 19 on Economy in India

The COVID - 19 pandemic had brought social and economic life to a standstill. In this study, the impact of this pandemic on affected sectors such as aviation, tourism, retail, capital markets, and MSMEs will be assessed. The outbreak impacted nations in many ways, especially the lockdowns made social and economic life disturbed.

The world experienced a multi-sectoral impact of the virus as the economic activities of nations slowed down. The World Health Organisation and the World Bank in a 2019 Report jointly estimated the impact of the COVID - 19 pandemic at 2.2% to 4.8% of the global GDP. The International Monetary Fund chief also stated that the world is faced with extraordinary uncertainty about the depth and duration of the crisis and it was the worst economic fallout since the Great Depression.

This pandemic affected almost every sector including the manufacturing and the services sector: hospitality, tours and travels, healthcare, retail, banks, hotels, real estate, education, IT, recreation, media, and others. The economic stress has caused many employers to lose their jobs. The pandemic-induced lockdown and social distancing made productivity loss on one hand, and they also reduced demand for goods and services by the consumers in the market on the other hand. Thus economic activity collapsed.

Every crisis brings about a special opportunity to rethink on the path undertaken for the development of a human being and society. This COVID - 19 pandemic had a clear message for the Indian economy to adopt sustainable development models.

Summary

Though Finance and Economics are interrelated, they are not identical disciplines. Economics is mainly focussed on local or international markets, human behaviour, goods and services etc. Finance studies the financial system and related to money, banks, loans, investments, savings, etc. Both these disciplines inform and influence each other. Investors also pay special attention to both of these disciplines since both these influence the markets to a larger extent.

FAQs on Finance: An Offshoot of Economics

1. What is finance and why is it considered an offshoot of economics?

Finance is a specialised field that deals with the management, creation, and study of money, investments, and credit. It is considered an offshoot of economics because it applies economic theories and principles to real-world financial systems. While economics studies the broader concepts of production, distribution, and consumption of goods and services, finance focuses specifically on the practical aspects of money management, risk, and capital markets.

2. What are the three main branches of finance as per the CBSE syllabus?

The three primary branches of finance are:

- Personal Finance: This involves managing the financial decisions of an individual or a household, including budgeting, savings, insurance, and retirement planning.

- Corporate Finance: This deals with the financial activities of a business, such as managing assets and liabilities, securing capital, and making investment decisions to maximise shareholder value.

- Public Finance: This branch is concerned with the financial activities of the government, including taxation, government expenditure, budget management, and public debt.

3. What is the main objective of corporate finance in a business?

The primary objective of corporate finance is to maximise the value of the business for its owners (shareholders). This is achieved by making strategic decisions about investments, financing, and dividends. Key activities include managing assets and liabilities, determining the optimal mix of debt and equity financing, and allocating resources to profitable projects to ensure long-term growth and sustainability.

4. How does the theoretical nature of economics contrast with the practical application of finance?

The main contrast lies in their focus and application. Economics is largely theoretical, providing frameworks and models to understand how economies and markets behave on a macro (national/global) or micro (individual/firm) level. It explores concepts like supply and demand, scarcity, and opportunity cost. Finance, on the other hand, is highly practical. It takes those economic principles and applies them to make tangible decisions regarding money, such as valuing a company, choosing an investment, or managing financial risk.

5. How can understanding the principles of personal finance help a student in daily life?

Understanding personal finance provides students with crucial life skills. For example, it helps in:

- Budgeting: Managing pocket money or a part-time income effectively to cover expenses.

- Saving: Learning to set aside money for future goals, like higher education or buying a gadget.

- Avoiding Debt: Understanding the risks associated with borrowing and credit.

- Time Value of Money: Realising that money saved or invested today can grow over time, encouraging early financial planning.

6. Why is public finance crucial for a country's economic stability and development?

Public finance is crucial because it governs how a government manages its funds to meet the collective needs of its citizens. It directly impacts economic stability by using tools like taxation and public expenditure to control inflation, reduce unemployment, and encourage growth. Effective public finance ensures that essential services like healthcare, education, and infrastructure are adequately funded, which is fundamental for the long-term development and welfare of a nation.