What is an Experiment Method?

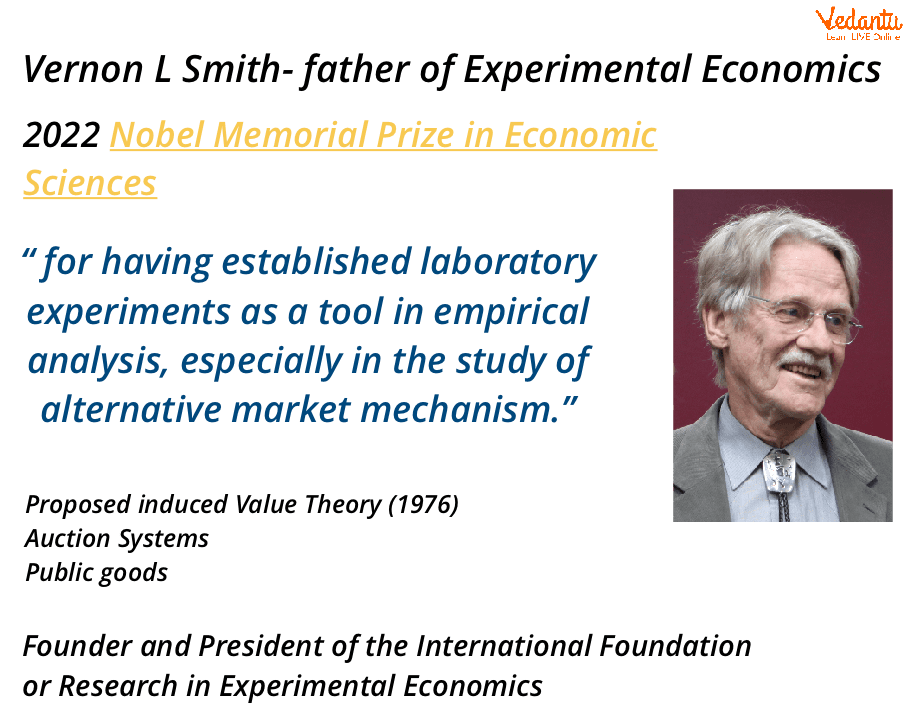

In the mid-1950s, Vernon Smith, for the experimental market, developed the basic structure of experimental economics.

The meaning of Experimental Research is a technique of economics in which scientific experiments are used to study economic theories and human behaviours. Human subjects are used in economic experiments to respond to incentives in a controlled laboratory setting that simulates the key economic aspects of a theoretical or naturally occurring economic problem.

Vernon L Smith

Objectives of Experiments

To categorise the types of experiments, various parameters can be considered. However, one of the most important ones is the models they are trying to evaluate. The experiments are broadly categorised based on the following objectives:

1. Testing the Strong Assumption of Theories

The assumptions that are used in economics can be quite strong sometimes. The sensitivity of their predictions can be tested by the experiments by weakening those assumptions.

2. Institutional Designs Comparison

Alternative institutions or policies can be put into practice in a lab setting, and the results can then be compared based on the effectiveness or other criteria because there is no guidance provided by theory while choosing the Institutions or policies.

3. The Evaluation of Theoretical Predictions

Based on the results of lab experiments, economic theories are tested. For example, market prices are predicted by general equilibrium theory at the point where supply and demand intersect. Experiments with a wide range of trading organisations have demonstrated that this forecast is accurate.

4. Evaluating Assumptions

Experiments do not just examine the predictions of a theory but also the assumptions of theories. Behavioural economists often use this method when trying to replace standard rationality assumptions with more accurate descriptive models that are nevertheless tractable mathematically.

5. Recognising Stylised Facts

In lab experiments, replication is quite prominent, which is why experiments are frequently used to find patterns in behaviour that may or may not be consistent with theory.

Types of Methods Used to Forecast Demand in Economics

In economics, demand forecasting is anticipated by using experiments. However, there is no specific technique that can be used for forecasting. The techniques are used to protect against uncertainties and risks in the future.

The first method involves predicting demand by gathering data from experts or through surveys about consumers' buying habits. The second approach involves forecasting demand using statistical methods with the help of prior data.

The techniques are divided into two categories based on long-term and short-term forecasting. The survey method is used for short-term forecasting, while statistical methods are used to study the long-term forecasting

Following are a few methodologies used in experimental economics:

Survey Method

Surveys are conducted in this method, In which the future demand of consumers is predicted based on the current demand for goods and services. Survey methods are of three types:

1. Market Experiment Method

Market experiment methods are conducted in an actual market scenario. Future demand is predicted by conducting experiments with the use of varying expenditures and prices and recording the data. However, there are a few limitations to the market experiment method.

The outcome of an experiment might be affected by certain reasons, such as natural calamities and political or National unrest.

Another limitation is that this method of market experiment is quite expensive to conduct.

2. Opinion Poll of Experts

One of the effective methods used is the opinion of experts, which in most cases happens to be the sales manager of an organisation. Since they are aware of consumer behaviour, they are able to predict future behaviour and the demand for products.

3. Delphi Method

Using this technique, a number of experts are individually questioned about the demand for products in the future. To obtain consensus, the questions are repeatedly asked. Additionally, in this strategy, each expert is informed of the estimates made by the other experts in the group so that they can revise their estimates in consideration of the estimates of others.

Statistical Method

With this approach, demand is predicted using cross-sectional and historical data. For long-term forecasting, this method is used.

Market surveys and interviews with people are used to gather cross-sectional data. While historical data is information from the past that has been gathered from a variety of sources, such as market survey reports and balance sheets from previous years. The following are the types of statistical methods used:

1. Barometric Method

In the barometer method, demand forecasts are based on past occurrences or significant current variables. For example, there is a national festival approaching in society, and it is predicted that the demand for sweets will rise significantly in the market. In this way, the current trends of a market are studied.

2. Trend Projection Method

This method is also known as the least square method. This approach uses past data from the books of accounts from the prior year to analyse sales forecasts. Additionally, this approach makes the assumption that the variables like sales and demand that influenced previous trends would remain the same in future as well.

3. Econometric Method

This method is considered the most reliable method than other methods for forecasting economic trends. Statistical tools are combined with Economic theories to predict future trends in this economic experiment method. There are two types of econometric methods:

Simultaneous Equations - There are several independent equations in this set of equations. Due to the fact that they contain a finite number of equations, simultaneous equations are sometimes referred to as systems of equations. There are two variables used in this method.

A variable in a statistical model that is affected by or determined by its relationships with other variables in the model is known as an endogenous variable. In contrast, the variable whose value is determined outside the model is called an exogenous variable.

Regression Method - This method is used to predict the demand function Of a product. Here, the demand is considered the dependent variable, while the variables that predict demand are called independent variables.

Advantages and Disadvantages of the Experimental Method

Experimental methods have a few advantages and disadvantages as well. The advantages are:

Researchers can examine different cause-and-effect relationships that a product, theory, or idea can produce by manipulating factors.

Experimental research can consistently produce results that are precise and relevant since it provides such a high level of control.

Experimental methods help in determining the outcomes that might be achievable for a given product, theory, or idea. Each variable can be controlled alone or in different combinations.

Apart from the above-mentioned advantages, the experimental method has a few disadvantages, such as:

The environment of trial participants may have an impact on them. As a result, they can respond based on what they believe the researcher wants to hear rather than how they actually feel.

Performing experimental research also involves removing certain unnecessary factors. As a result, a rather artificial setting is created.

Experimental methods tend to have human errors, and researchers involved in them can make certain errors while conducting the experiment, which will eventually affect the results of the experiment.

Summary

The term "experiment method" refers to a method in economics that uses scientific experiments to study economic theories and behavioural patterns. The two important methodologies used in experimental economics are survey methods and statistical methods. The advantages of experimental methods are the study of cause and effect relationships, relevant results and control over variables. The disadvantages of experimental methods are human error, the impact of environmental factors on participants and the creation of an artificial setting.

FAQs on Experimental Economics: Behavioral Insights

1. What is experimental economics in simple terms?

Experimental economics is a branch of economics that uses controlled experiments, similar to those in science, to test economic theories and understand how people make decisions. Instead of just relying on historical data, economists create lab or field situations to observe economic behaviour directly.

2. What are the main types of experiments conducted in this field?

Market experiments are typically conducted in two primary ways:

- Experiments in the Actual Market: Researchers collect data by introducing small, controlled changes in a real market environment to see how consumers react.

- Experiments in a Simulated Market: This involves creating an artificial, lab-controlled market where participants are given roles as buyers or sellers to test specific economic models and behaviours.

3. Can you give some real-world examples of experimental economics in action?

Certainly. A classic example is the “Ultimatum Game,” which studies fairness in negotiations. Another is designing new types of auctions, like those used for government contracts or online ad placements. Experiments have also helped understand the “free-rider problem” in public goods by observing if people voluntarily contribute to a shared resource.

4. What role does experimental economics play in creating better economic policies?

It acts like a “wind tunnel” for economic policies. Before implementing a large-scale policy, such as a new tax system or a welfare program, governments can use experiments to test its potential effects on a smaller scale. This helps identify unintended consequences and refine the policy for better outcomes, reducing the risk of failure.

5. How is experimental economics different from behavioral economics?

This is a common point of confusion. Think of it this way: Behavioral Economics is the field that studies how psychological factors influence economic decisions. Experimental Economics is the primary method or toolkit used to test the theories of behavioral economics in a controlled setting. So, one is a field of study, and the other is the method used to conduct that study.

6. Who was Vernon Smith and why is he important in experimental economics?

Vernon Smith is often called the “father of experimental economics” and won a Nobel Prize for his work. His early experiments were revolutionary because they showed that even in a simple lab setting, markets with real human participants could achieve the equilibrium prices predicted by economic theory. This proved that lab experiments were a valid tool for studying complex economies.

7. What are the biggest challenges or criticisms of using experiments in economics?

While powerful, the method has some key limitations. A major one is external validity—whether the behaviour observed in a controlled lab setting accurately predicts how people will act in the complex real world. Another concern is that experiments often use student participants and small monetary stakes, which may not be representative of the general population making high-stakes financial decisions.