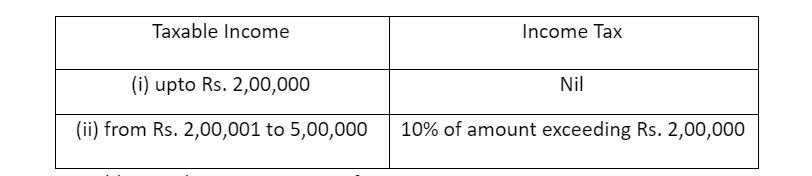

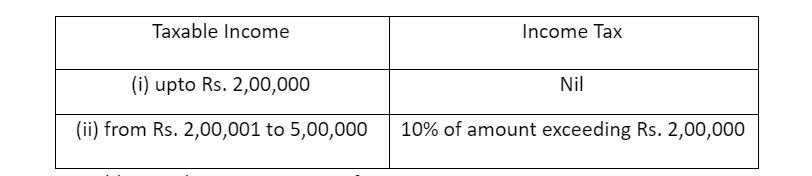

In a financial year the monthly salary of a person is Rs. 50,000. He deposited Rs. 60,000 in the Prime Minister’s relief fund on which income tax rebate is 100%. He donated Rs. 20,000 to a hospital on which income tax rebate is 50%. He invests Rs. 7,000 per month in GPF, Rs. 15,000 annually in LIC and purchases NSC for Rs. 35,000. Find income tax to be paid by him in that financial year. Rate of income tax is as follows:

100% rebate upto total savings of Rs. 1,00,000.

In addition education cess: 3% of income tax.

Answer

613.8k+ views

Hint:From the given date, find the total annual income, amount of rebate on investment/donation and his total savings. Thus get the amount of salary after all the deduction of rebated amount. Total tax is income tax and education cess.

Complete step by step answer:

Given is the monthly salary of a person as Rs. 50,000.

Total annual income \[=12\times \] Rs. 50,000 = Rs. 6,00,000.

The amount on which tax would be rebated on investments on donation = 100% prime minister’s relief fund + 50% of hospital donations

= 100% of 6,00,000 + 50% of Rs. 20,000

\[=100\times \dfrac{60,000}{100}+\dfrac{50\times 20,000}{100}\]\[=60,000+10,000\]= Rs. 70,000.

It is said that he invests Rs. 7,000 per month in GPF, Rs. 15000 annually in LIC and purchases NSC for Rs. 35,000.

\[\therefore \]Total saving = amount in GPF + amount in LIC + amount in NSC

\[=\left( 12\times 7,000 \right)+15,000+35,000\] = Rs. 1,34,000.

100% rebate on savings upto Rs. 1,00,000, which implies that Rs. 34,000 would be taxable.

Therefore the amount of salary after deduction of rebated amount is,

= Total salary – rebate on investment/ donations – rebate on saving

= 6,00,000 – 7,000 – 1,00,000 = Rs. 4,30,000.

It is said that Income Tax upto 2,00,000 is 0% and for amounts exceeding Rs. 2,00,000, income taxis 10%.

\[\therefore \]Income tax = 0% of Rs. 2,00,000 + 10% (4,30,000 – 2,00,000)

10% of Rs. 2,30,000 = \[\dfrac{10}{100}\times \] 2,30,000 = Rs. 23,000.

Given that education cess is 3% of income tax.

\[\therefore \]Education cess = 3% of Rs. 23,000

\[=\dfrac{3}{100}\times \] Rs. 23,000 = Rs. 690.

\[\therefore \]Total tax = Income tax + Education cess = Rs. 23,000 + Rs. 690 = Rs. 23,690.

Thus the income tax to be paid by him in the financial year is Rs. 23,690.

Note:You should remember that income tax uptil Rs. 2,00,000 is nil. So don’t multiply \[4,30,000\times 10%\] as income tax, which is wrong. Remember to calculate education cess, which is 3%of the income tax. Thus total tax is the sum of Income tax and education cess.

Complete step by step answer:

Given is the monthly salary of a person as Rs. 50,000.

Total annual income \[=12\times \] Rs. 50,000 = Rs. 6,00,000.

The amount on which tax would be rebated on investments on donation = 100% prime minister’s relief fund + 50% of hospital donations

= 100% of 6,00,000 + 50% of Rs. 20,000

\[=100\times \dfrac{60,000}{100}+\dfrac{50\times 20,000}{100}\]\[=60,000+10,000\]= Rs. 70,000.

It is said that he invests Rs. 7,000 per month in GPF, Rs. 15000 annually in LIC and purchases NSC for Rs. 35,000.

\[\therefore \]Total saving = amount in GPF + amount in LIC + amount in NSC

\[=\left( 12\times 7,000 \right)+15,000+35,000\] = Rs. 1,34,000.

100% rebate on savings upto Rs. 1,00,000, which implies that Rs. 34,000 would be taxable.

Therefore the amount of salary after deduction of rebated amount is,

= Total salary – rebate on investment/ donations – rebate on saving

= 6,00,000 – 7,000 – 1,00,000 = Rs. 4,30,000.

It is said that Income Tax upto 2,00,000 is 0% and for amounts exceeding Rs. 2,00,000, income taxis 10%.

\[\therefore \]Income tax = 0% of Rs. 2,00,000 + 10% (4,30,000 – 2,00,000)

10% of Rs. 2,30,000 = \[\dfrac{10}{100}\times \] 2,30,000 = Rs. 23,000.

Given that education cess is 3% of income tax.

\[\therefore \]Education cess = 3% of Rs. 23,000

\[=\dfrac{3}{100}\times \] Rs. 23,000 = Rs. 690.

\[\therefore \]Total tax = Income tax + Education cess = Rs. 23,000 + Rs. 690 = Rs. 23,690.

Thus the income tax to be paid by him in the financial year is Rs. 23,690.

Note:You should remember that income tax uptil Rs. 2,00,000 is nil. So don’t multiply \[4,30,000\times 10%\] as income tax, which is wrong. Remember to calculate education cess, which is 3%of the income tax. Thus total tax is the sum of Income tax and education cess.

Recently Updated Pages

Master Class 10 Computer Science: Engaging Questions & Answers for Success

Master Class 10 General Knowledge: Engaging Questions & Answers for Success

Master Class 10 English: Engaging Questions & Answers for Success

Master Class 10 Social Science: Engaging Questions & Answers for Success

Master Class 10 Maths: Engaging Questions & Answers for Success

Master Class 10 Science: Engaging Questions & Answers for Success

Trending doubts

What is the median of the first 10 natural numbers class 10 maths CBSE

Which women's tennis player has 24 Grand Slam singles titles?

Who is the Brand Ambassador of Incredible India?

Why is there a time difference of about 5 hours between class 10 social science CBSE

Write a letter to the principal requesting him to grant class 10 english CBSE

A moving boat is observed from the top of a 150 m high class 10 maths CBSE